Aug-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

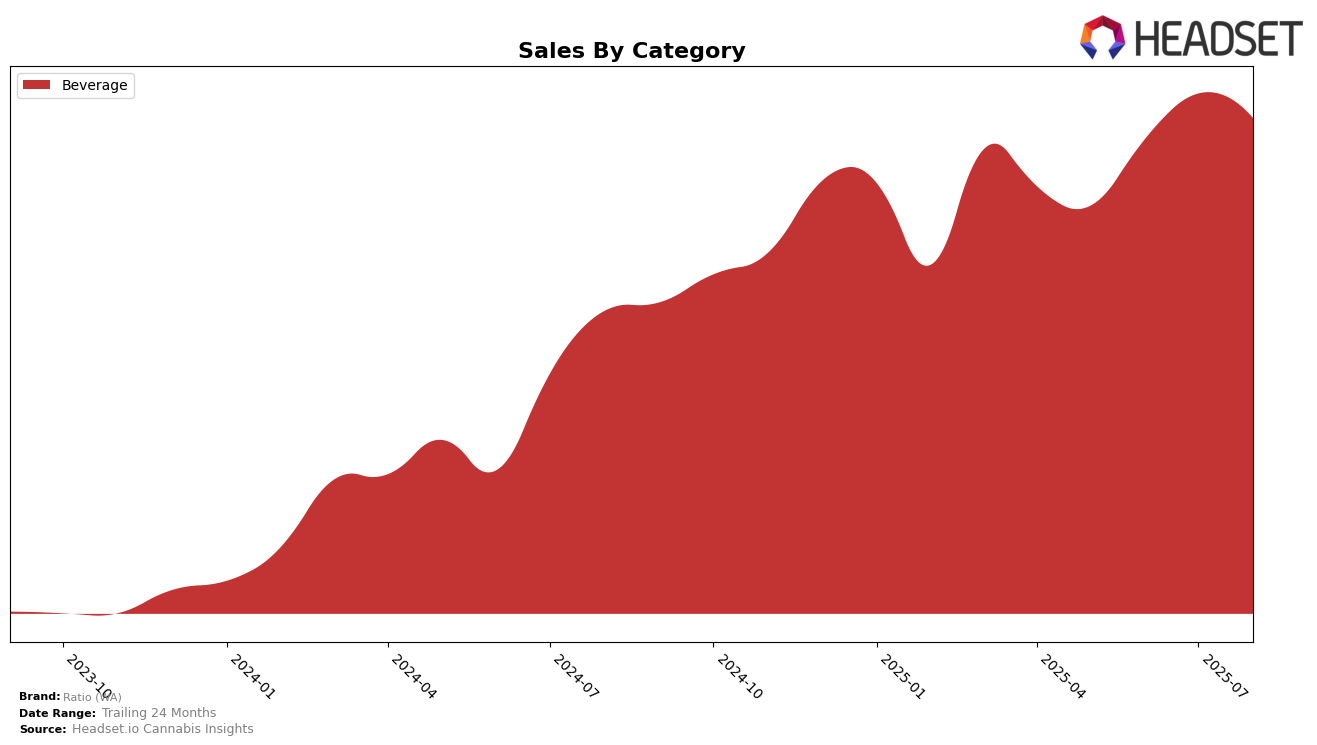

In the state of Washington, Ratio (WA) has demonstrated a consistent and commendable performance in the Beverage category. Starting from a rank of 10 in May 2025, the brand improved its position to 7 by June and maintained this rank through July and August. This steady ranking indicates a strong foothold in the market, reflecting consumer loyalty and consistent demand for their products. The upward trend in sales from May to July, peaking at over $111,000, further underscores the brand's growing popularity and effective market strategies.

While Ratio (WA) shows robust performance in Washington, it is noteworthy that the brand does not appear in the top 30 rankings in any other state or category for the given months. This absence could be seen as a limitation in their market reach or a strategic focus on dominating the Washington market before expanding elsewhere. Such a concentrated presence might suggest that Ratio (WA) is prioritizing depth over breadth, focusing on strengthening its brand identity and customer base in its home state before considering broader market penetration.

Competitive Landscape

In the Washington beverage category, Ratio (WA) has demonstrated a notable upward trajectory in its market position from May to August 2025. Initially ranked 10th in May, Ratio (WA) climbed to 7th place by June and maintained this rank through August. This improvement in rank is indicative of a positive trend in sales performance, as Ratio (WA) experienced a consistent increase in sales from May to July, peaking in July before a slight dip in August. In contrast, competitors such as Agro Couture and Mary Jones maintained stable ranks at 6th and 5th respectively, but both saw a decline in sales over the same period. Blaze Soda and Constellation Cannabis also held steady ranks at 8th and 9th, yet their sales figures remained lower than Ratio (WA)'s by August. This suggests that Ratio (WA) is gaining competitive ground, potentially due to effective marketing strategies or product offerings that resonate well with consumers in this market.

Notable Products

In August 2025, the top-performing product from Ratio (WA) was the Island Coconut Shot (100mg THC, 2.5oz) in the Beverage category, securing the first rank with sales reaching 4667 units. The Island Punch Shot (100mg THC, 2.5oz) followed closely in second place, showing a significant rise from its previous fourth position in July, with sales of 4639 units. The Orange Breeze Shot (100mg THC, 2.5oz) maintained a steady performance, ranking third, although it experienced a slight drop in sales compared to July. The Strawberry Burst Shot (100mg THC, 2.5oz), which had consistently held the top spot in prior months, slipped to fourth place, indicating a shift in consumer preference. The CBN/CBD/THC 1:1:2 Grape Dream Shot (25mg CBN, 25mg CBD, 50mg THC, 2.5oz) remained in fifth place, reflecting stable but modest sales throughout the observed months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.