Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

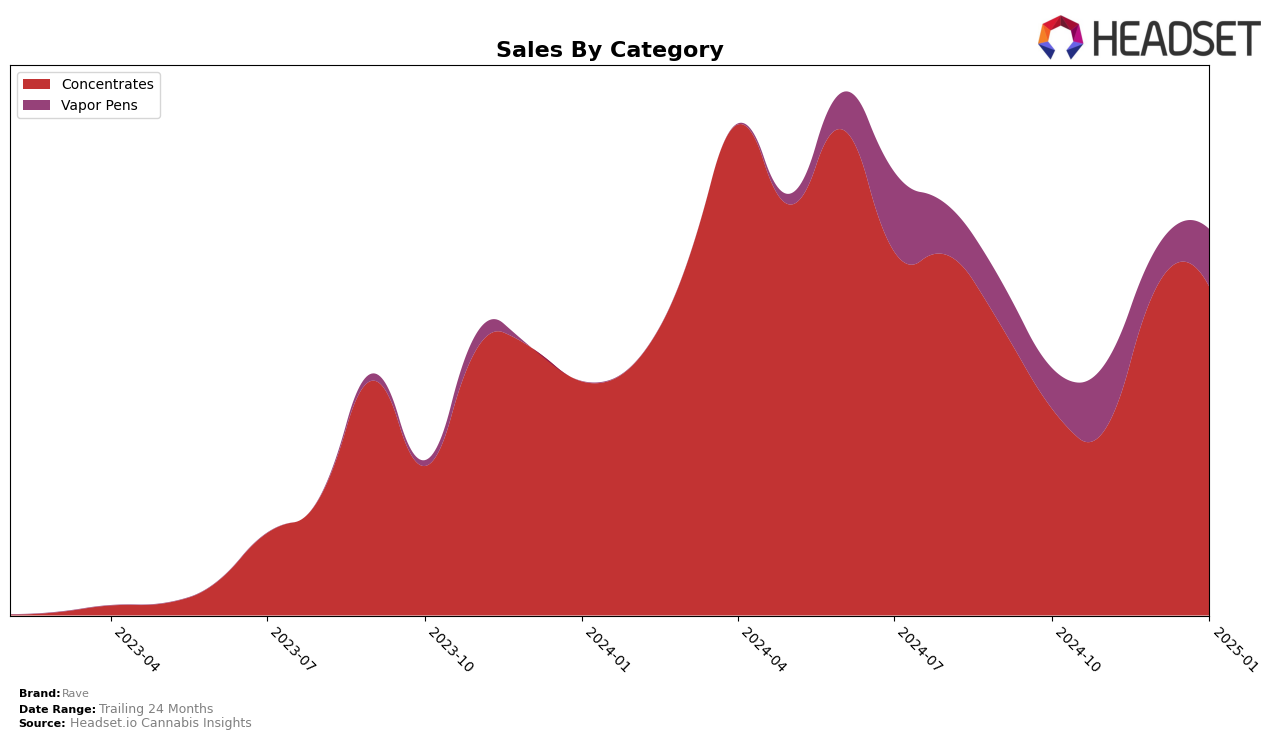

In the state of Massachusetts, Rave has shown notable performance in the Concentrates category. Over the past months, Rave's rank in this category has moved from 10th in October 2024 to 7th by January 2025, indicating a strong upward trend. This improvement is supported by a significant increase in sales from $102,003 in October to $162,022 in January. Such a positive trajectory suggests that Rave's products are gaining popularity in Massachusetts, potentially due to effective marketing strategies or product quality enhancements. However, it's essential to consider that Rave's performance in the Vapor Pens category did not make the top 30 for some months, reflecting a potential area for growth or strategic reevaluation.

While Rave's position in the Vapor Pens category in Massachusetts saw some fluctuations, it improved from a rank of 100 in October 2024 to 78 by January 2025. Despite not being among the top 30 brands in this category, the upward movement in rankings suggests a gradual increase in market presence. The sales figures also reflect this trend, with a notable increase from $19,853 in October to $28,325 in January. This indicates that while Rave may not yet be a dominant player in the Vapor Pens category, there is a growing interest that could be capitalized on with further strategic efforts. These insights highlight the dynamic nature of Rave's market performance across different categories within Massachusetts.

Competitive Landscape

In the Massachusetts concentrates market, Rave has experienced notable fluctuations in its rank over the past few months, reflecting a dynamic competitive landscape. In October 2024, Rave was ranked 10th, but it slipped to 13th in November, before making a recovery to 7th place in December and maintaining that position in January 2025. This recovery coincides with a significant increase in sales from November to December, suggesting a successful strategic adjustment or product launch. Meanwhile, Bountiful Farms consistently held a top-five position, indicating strong brand loyalty or superior product offerings. Haze Extracts also showed a strong upward trend, moving from 12th in October to 6th by January, potentially posing a growing threat to Rave's market share. On the other hand, Cloud Cover (C3) demonstrated volatility, with ranks fluctuating between 6th and 11th, which might suggest inconsistent performance or market challenges. Rave's ability to regain its position in December and maintain it into January highlights its resilience and potential for growth amidst fierce competition.

Notable Products

In January 2025, Rave's top-performing product was Citrus Rush Badder (1g) in the Concentrates category, achieving the number 1 rank with a notable sales figure of 1382 units. This product experienced an impressive rise from the 2nd position in December 2024. So F'n Gassy Badder (1g) followed closely, taking the 2nd spot, although it dropped from the 1st position in the previous month. Blue Dream Wax (1g) entered the rankings at 3rd place, showcasing its growing popularity. Meanwhile, Mac 1 Shatter (1g) maintained its 4th position from December, indicating steady performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.