Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

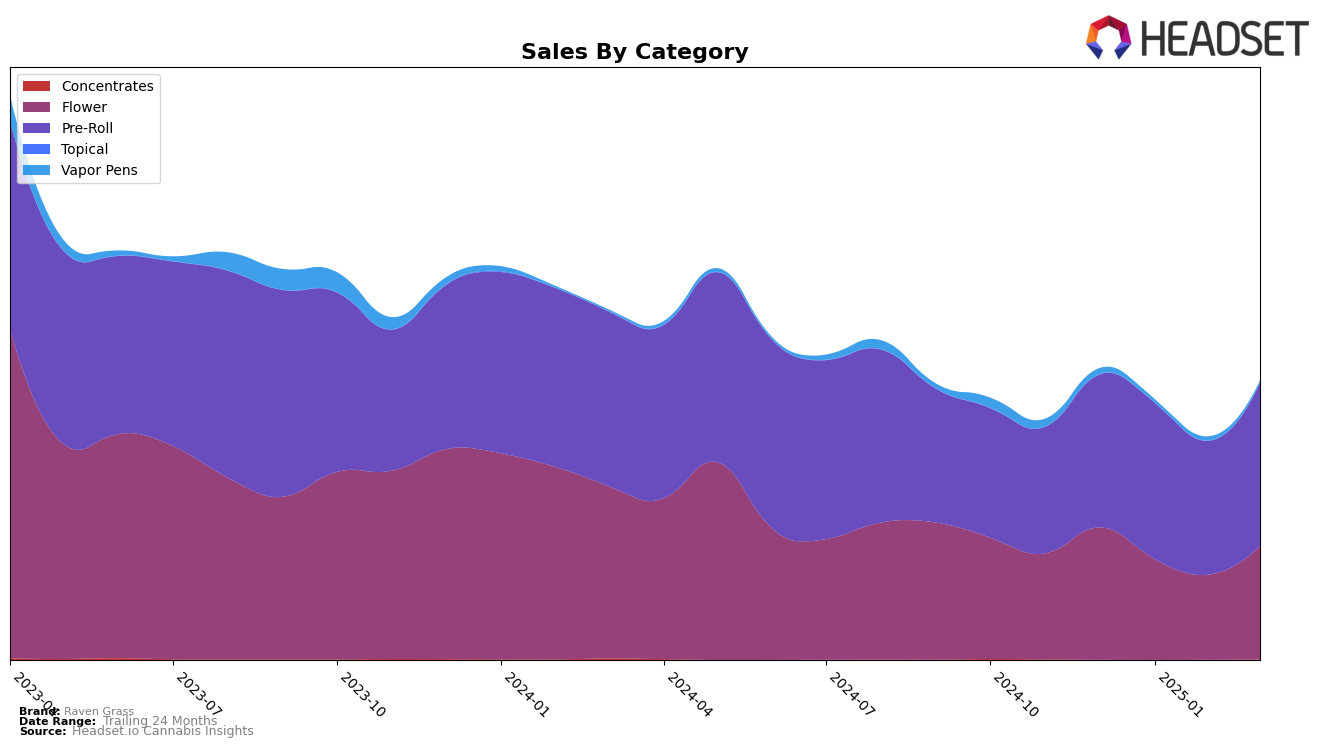

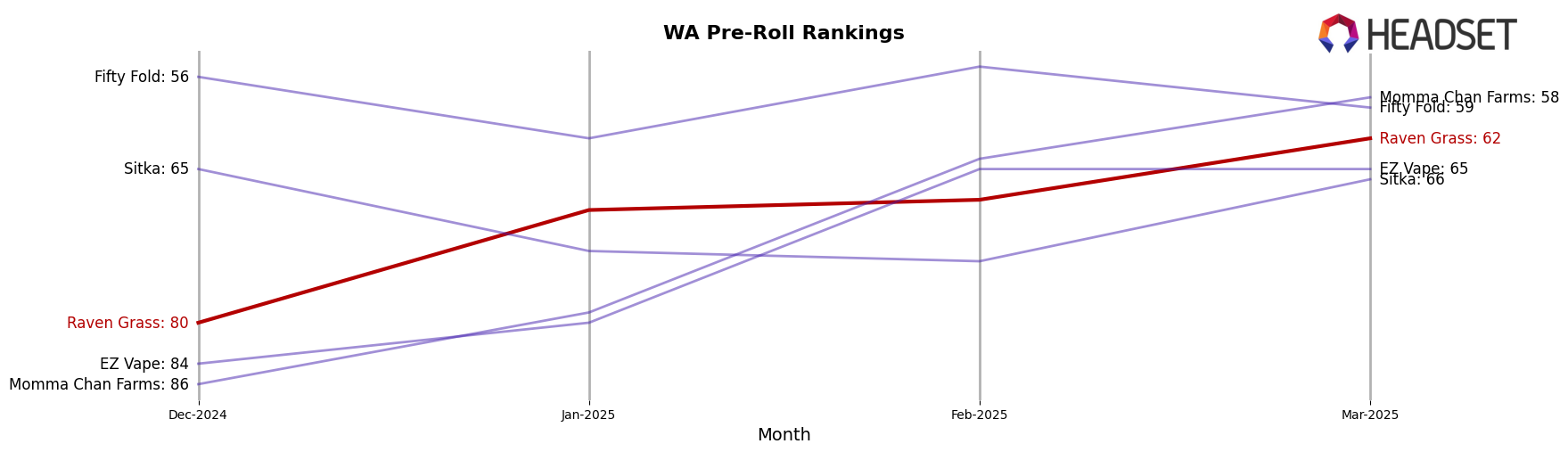

Raven Grass has shown notable progress in the Pre-Roll category within Washington. Although the brand did not rank within the top 30 in December 2024, it has demonstrated a consistent upward trajectory, moving from 69th place in January 2025 to 62nd by March 2025. This improvement suggests a strengthening presence and growing consumer interest in their offerings. Despite the fluctuations in sales figures, the general trend indicates a positive momentum, which could be attributed to strategic adjustments or increased market engagement.

However, it is important to note that Raven Grass's absence from the top 30 rankings could imply challenges in market penetration or competition with more established brands. The lack of top-tier placement might suggest areas for potential growth or the need for enhanced marketing strategies to boost visibility and consumer preference. Nevertheless, the brand's ability to improve its ranking over a short period underscores potential resilience and adaptability in a competitive landscape. Observers might find it interesting to track whether this upward trend continues in the coming months, as it could be indicative of broader market strategies coming to fruition.

Competitive Landscape

In the competitive landscape of the Washington Pre-Roll category, Raven Grass has shown a consistent upward trajectory in terms of rank from December 2024 to March 2025, moving from 80th to 62nd position. This improvement is notable, especially when compared to competitors like Fifty Fold, which fluctuated between 56th and 62nd, and Sitka, which saw a more volatile movement, dropping to 74th in February before recovering to 66th in March. Despite a dip in sales in February, Raven Grass managed to rebound in March, indicating a positive trend in consumer preference. Meanwhile, EZ Vape and Momma Chan Farms both experienced rank improvements, with Momma Chan Farms making a significant leap from 86th to 58th, surpassing Raven Grass in March. This competitive dynamic suggests that while Raven Grass is gaining traction, it faces stiff competition from brands that are also improving their market positions, highlighting the importance of strategic marketing and product differentiation to maintain and enhance its growth trajectory.

Notable Products

In March 2025, the top-performing product for Raven Grass was Dutch Haze Pre-Roll 3-Pack (1.8g) in the Pre-Roll category, climbing from fourth place in February to first place, with sales reaching 645 units. Jack Herer Preroll 3-Pack (1.8g) maintained its strong position, holding steady at second place with a notable increase in sales from the previous month. Stargazer Myrtle Pre-Roll 3-Pack (1.8g) entered the rankings for the first time, securing the third spot. Dutch Haze (3.5g) debuted in fourth place within the Flower category. Purple Trainwreck Pre-Roll 3-Pack (1.8g) rounded out the top five, marking its first appearance in the rankings.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.