Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

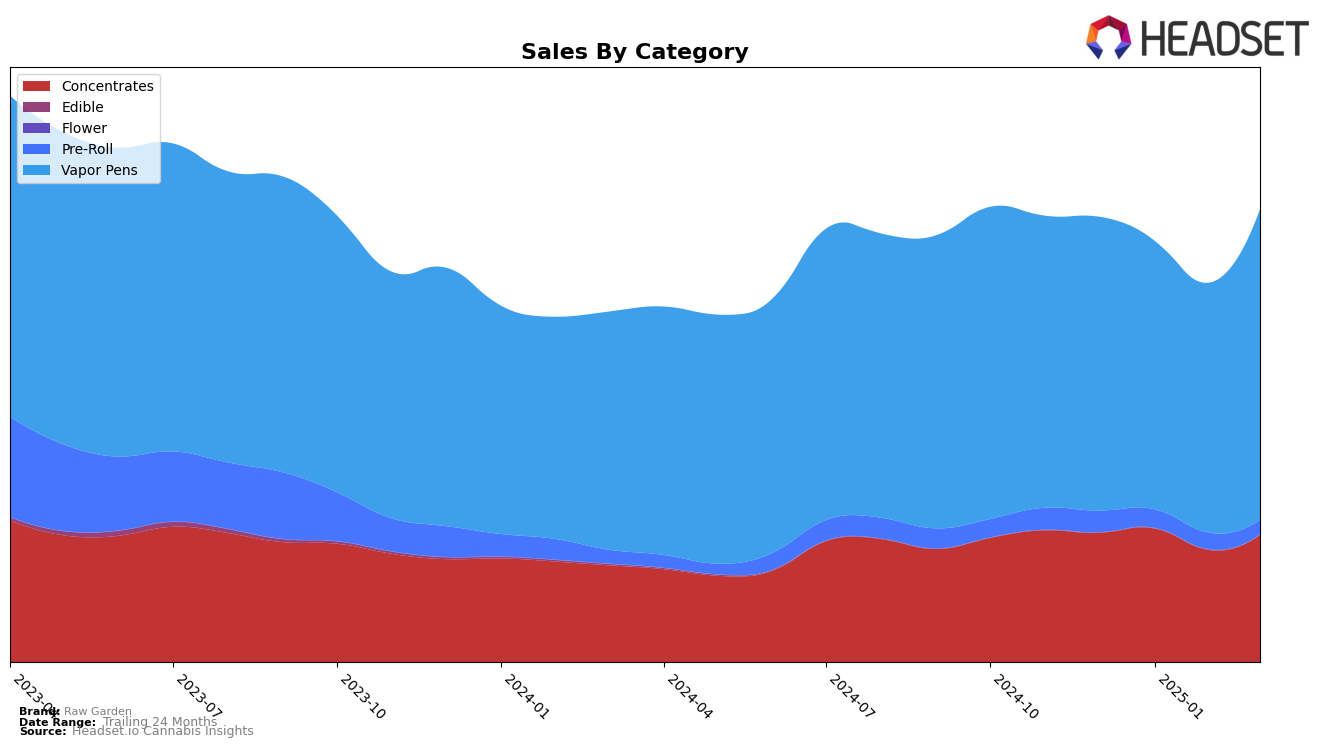

Raw Garden has demonstrated a strong performance in the California market, particularly in the Concentrates category where it consistently held the top spot from December 2024 through March 2025. This unwavering position highlights the brand's dominance and appeal in this category, despite a slight dip in sales during February. In the Vapor Pens category, Raw Garden has maintained a steady third-place ranking over the same period, indicating a solid presence and consumer trust in their products. The consistency in ranking suggests that Raw Garden is a well-established brand within these segments in California.

However, Raw Garden's performance in the Pre-Roll category in California tells a different story. The brand's ranking fluctuated and dropped out of the top 30 in January and March 2025, indicating challenges in maintaining a competitive edge in this segment. This volatility suggests that while Raw Garden excels in Concentrates and Vapor Pens, there is room for improvement in their Pre-Roll offerings. The decline in sales from December to March further underscores the need for strategic adjustments to regain traction in this category.

Competitive Landscape

In the competitive landscape of vapor pens in California, Raw Garden consistently held the third rank from December 2024 to March 2025, showcasing its stable market position. Despite a slight decline in sales from December 2024 to February 2025, Raw Garden experienced a notable rebound in March 2025, indicating resilience and potential for growth. The brand faces stiff competition from STIIIZY and Plug Play, which maintained the first and second ranks, respectively, throughout the same period. Notably, STIIIZY consistently outperformed Raw Garden with significantly higher sales, while Plug Play also maintained a sales edge, albeit with a narrower margin. Meanwhile, CAKE she hits different and Gramlin showed dynamic rank changes, with Gramlin notably climbing from eighth to fourth place by March 2025, indicating a competitive pressure that Raw Garden must navigate to maintain its position.

Notable Products

In March 2025, Blue Dream Refined Live Resin Cartridge (1g) maintained its position as the top-selling product for Raw Garden, with sales reaching 7,717 units. PB Souffle Live Sauce Cartridge (1g) consistently held the second spot, showing a decline from previous months but still performing strongly. Lemon Gas Live Resin Cartridge (1g) emerged as a new contender, ranking third, while Blueberry Cookies Refined Live Resin Cartridge (1g) secured the fourth position, having improved from its fifth rank in January. Strawberry Jack #13 Live Resin Sauce Cartridge (1g) entered the rankings at fifth place, indicating a new interest among consumers. These shifts highlight the dynamic nature of consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.