Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

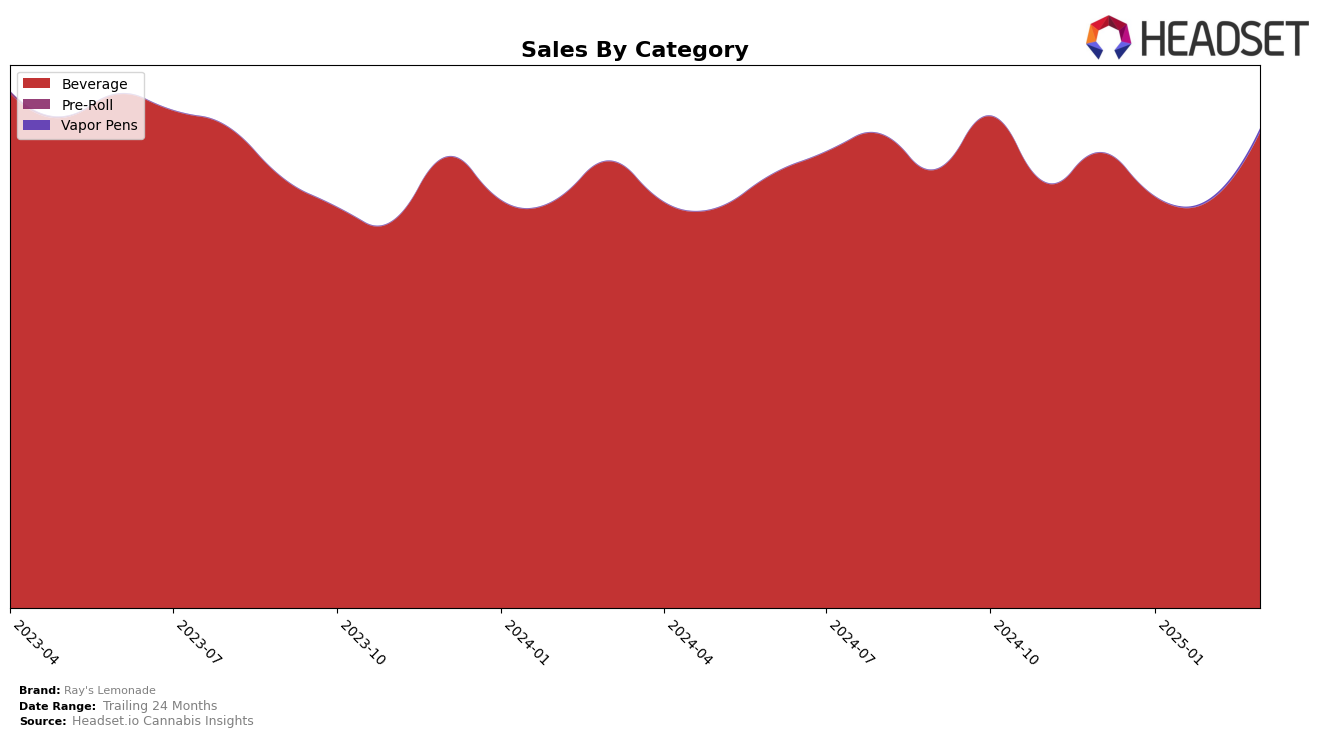

Ray's Lemonade has shown a strong performance across several markets, particularly in the beverage category. In Washington, Ray's Lemonade maintained its top position consistently from December 2024 through March 2025. This steady ranking at number one highlights their dominant presence in the state. Meanwhile, in British Columbia, the brand improved its ranking from seventh in December 2024 to fifth by February 2025, maintaining this position in March. This upward trend suggests a growing acceptance and popularity of their products in the region. However, in Michigan, Ray's Lemonade held the eighth position consistently until February 2025, after which it dropped out of the top 30 in March, indicating potential challenges in maintaining market share there.

In Ontario, Ray's Lemonade showed a stable performance, ranking seventh from December 2024 through February 2025, and then climbing to fifth in March 2025. This positive movement in Ontario is indicative of a strengthening foothold in the market. The sales figures in British Columbia also reflect a positive trajectory, with a notable increase from December 2024 to March 2025, suggesting effective strategies in capturing consumer interest. Meanwhile, the absence of Ray's Lemonade in the top 30 in Michigan's March rankings could be a signal for the brand to reassess its strategies in that market to regain its competitive edge. Overall, Ray's Lemonade's performance across these regions demonstrates both strongholds and areas for potential growth, making it a brand to watch in the beverage category.

Competitive Landscape

In the competitive landscape of the beverage category in Washington, Ray's Lemonade consistently holds the top rank from December 2024 through March 2025, demonstrating its strong market presence and consumer preference. Despite a slight dip in sales in January and February, Ray's Lemonade maintains its lead, indicating robust brand loyalty. Meanwhile, Journeyman and Major are its closest competitors, frequently swapping the second and third positions. Journeyman briefly overtakes Major in January and February, but Major regains the second spot by March, showcasing a dynamic rivalry. This competitive positioning suggests that while Ray's Lemonade remains the preferred choice, it must continue to innovate and engage with consumers to fend off the persistent challenge from these rising competitors.

Notable Products

In March 2025, the top-performing product from Ray's Lemonade was Strawberry Lemonade (10mg THC, 355ml) which reclaimed its number one ranking after previously ranking second in February. Lil Ray's - Strawberry Lemonade (100mg THC, 1.75oz) dropped to second place, despite having held the top rank in both January and February. The newly introduced CBD/THC 1:1 Tiger's Blood Lemonade (10mg CBD, 10mg THC, 355ml) secured the third position with notable sales of 12,101 units. Lil Ray's - Huckleberry Lemonade Drink (100mg THC, 1.75oz) improved its rank to fourth place, up from fifth in previous months. Meanwhile, Lil' Ray's - Pineapple Lemonade (100mg THC, 1.75oz) fell to fifth place, showing a decline from its third-place ranking in February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.