Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

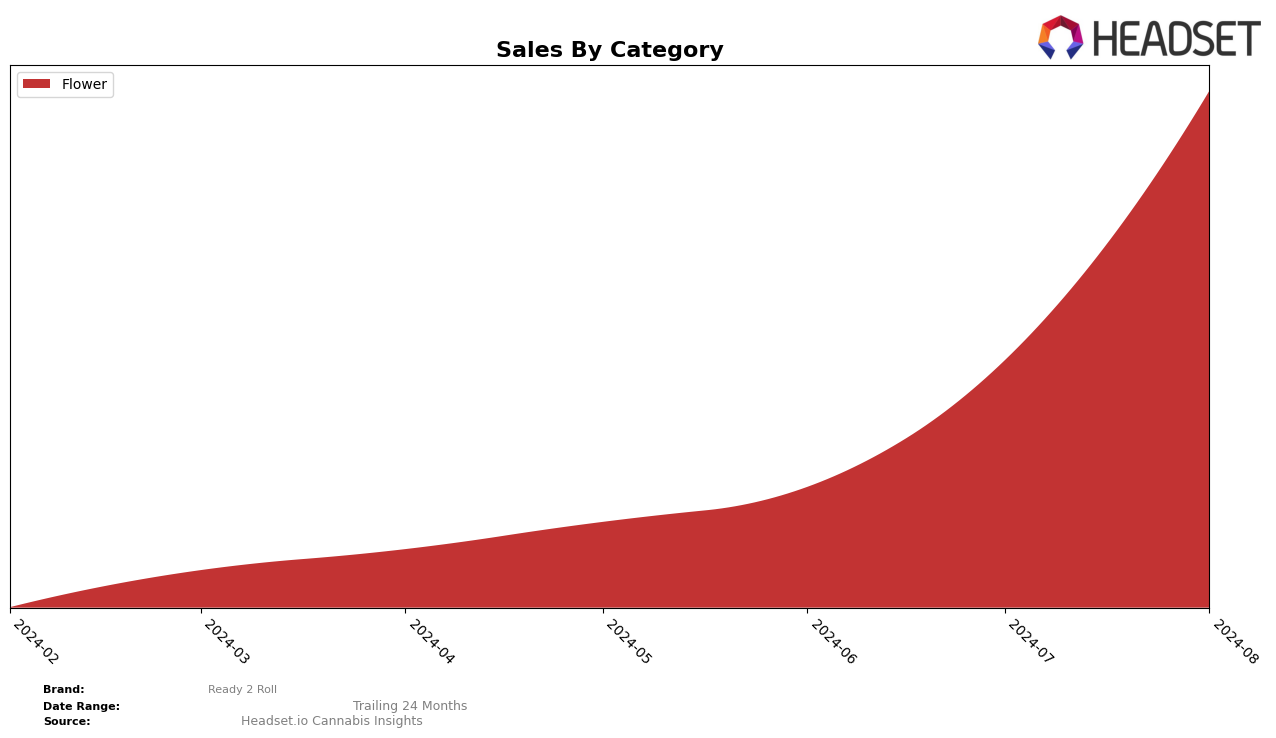

Ready 2 Roll has demonstrated notable improvements in the New York market, particularly within the Flower category. Over the past few months, the brand has seen a significant rise in its ranking, moving from 56th place in May 2024 to 22nd place by August 2024. This upward trajectory indicates a growing consumer preference and a potential increase in market share. The month-over-month sales figures reflect this positive trend, with a marked increase from $45,814 in May to $232,131 in August. This substantial growth in sales volume suggests that Ready 2 Roll is gaining traction and becoming a more prominent player in the New York cannabis market.

While the performance in New York is promising, it is important to note that Ready 2 Roll's presence in other states or categories is not highlighted, indicating that the brand may not be within the top 30 rankings elsewhere. This could be seen as a limitation or an area for growth, depending on the brand's strategic objectives. The absence from the top 30 in other markets might suggest a need for targeted marketing efforts or product adjustments to better meet the preferences of consumers in those regions. Overall, the data points to a strong performance in New York, which could serve as a model for expansion and improvement in other areas.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Ready 2 Roll has shown a significant upward trajectory in recent months. Starting from a rank of 56 in May 2024, Ready 2 Roll climbed to 22 by August 2024. This notable improvement in rank indicates a strong increase in market presence and consumer preference. In comparison, Cheech & Chong's also demonstrated a positive trend, moving from outside the top 20 in May to rank 24 in July, before dropping out again in August. Meanwhile, Florist Farms experienced fluctuations, peaking at rank 14 in May but dropping to 25 by August. High Falls Canna New York showed a steady improvement, reaching rank 21 in August. Gage Farms had a remarkable rise, moving from rank 46 in May to 20 in August. These dynamics suggest that Ready 2 Roll's strategic efforts are paying off, positioning it favorably against competitors and indicating potential for continued growth in the New York Flower market.

Notable Products

In August 2024, Venom OG Ground (7g) from Ready 2 Roll secured the top spot in product sales, maintaining its number one ranking from May and July, with a notable sales figure of 2235 units. Terp Town Ground (7g) followed closely in second place, showing a consistent performance by climbing up from third in May and securing the top spot in June, then settling into second in July and August. Amnesia Haze Ground (7g) held the third position for August, demonstrating steady demand as it consistently ranked in the top three across all months from May to August. Notably, Venom OG Ground showed a significant sales surge in August compared to previous months, indicating a strong market preference. Overall, these rankings highlight the consistent popularity and strong sales performance of Ready 2 Roll's flower category products over the summer months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.