Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

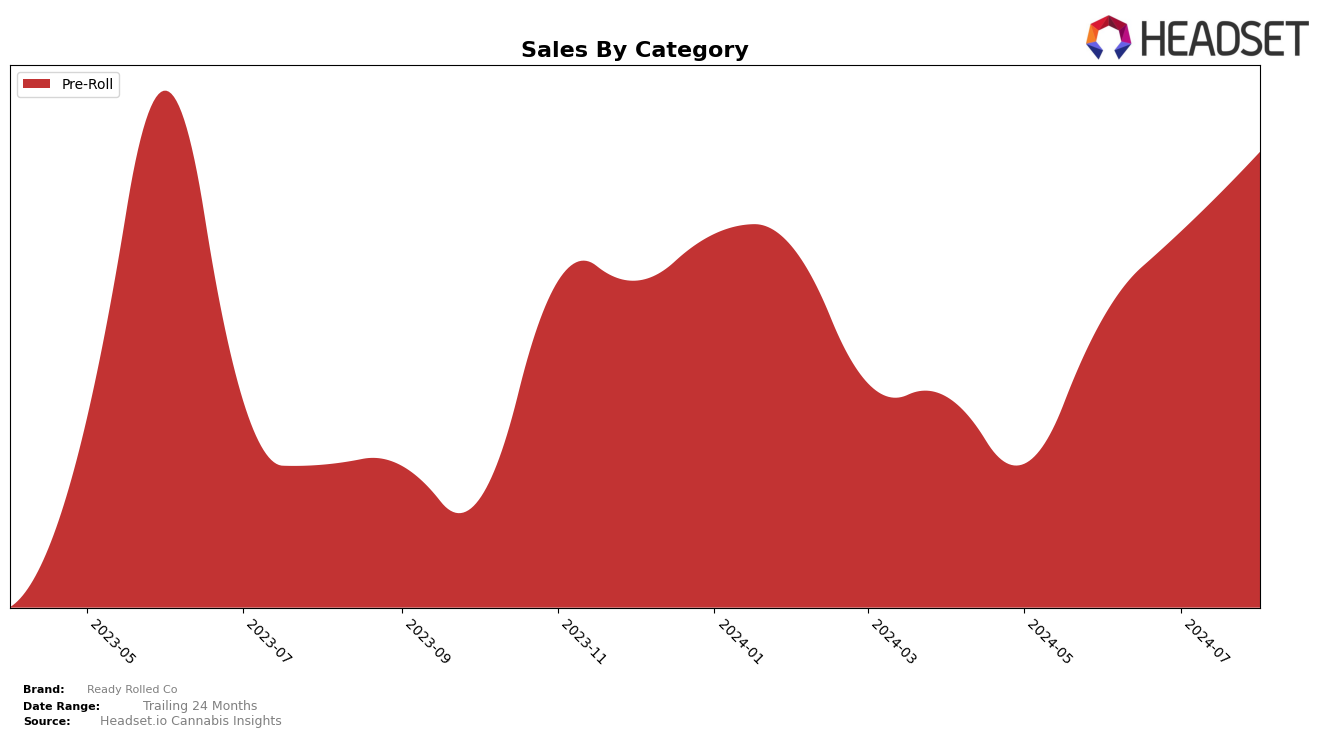

Ready Rolled Co has shown significant improvement in the Pre-Roll category within Michigan over the past few months. Starting from a rank of 48 in May 2024, the brand climbed to rank 27 in June, then to 22 in July, and finally to 19 in August. This upward trajectory indicates a strong and consistent performance, reflecting a growing consumer preference for their products. The notable increase in sales from $196,945 in May to $568,867 in August underscores the brand's successful efforts in capturing market share and increasing its visibility among consumers.

However, it is important to note that Ready Rolled Co has not yet made it into the top 30 brands in other states or categories besides Pre-Roll in Michigan. This could be viewed as a potential area for growth or a point of concern depending on the company's strategic goals. The absence from top rankings in other regions or categories might suggest either a focused market strategy or a need for broader expansion efforts. Observing these trends provides valuable insights into the brand's current market positioning and potential areas for future development.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Ready Rolled Co has demonstrated a significant upward trajectory in rankings over the past few months, moving from 48th place in May 2024 to 19th place by August 2024. This rapid ascent highlights a strong market performance and growing consumer preference. In comparison, Redemption has shown more stability, fluctuating within the top 20 but not experiencing the same dramatic rise, ranking 18th in May and 17th in August. Meanwhile, Sapphire Farms has seen a more modest improvement, moving from 19th to 20th place over the same period. HY-R has had a volatile performance, dropping out of the top 20 in June and July but recovering to 21st place in August. Notably, Fawn River has also made significant gains, climbing from 37th place in May to 18th in August. These shifts indicate a dynamic market where Ready Rolled Co's rapid rise could be attributed to effective marketing strategies or product innovations, positioning it as a brand to watch in the Michigan pre-roll market.

Notable Products

In August 2024, the top-performing product for Ready Rolled Co was Kosher Kush Pre-Roll 28-Pack (28g), which achieved the number one rank with notable sales of 1855 units. Lion's Mane Pre-Roll 28-Pack (28g) secured the second position, showing a significant increase from its third-place ranking in July. Mendo Breath Pre-Roll 28-Pack (28g) entered the rankings for the first time, taking the third spot. Pancakes Pre-Roll 28-Pack (28g) maintained a consistent performance, ranking fourth, up from fifth in July. Candy Jams Pre-Roll 28-Pack (28g) dropped to the fifth position from second in July, indicating a slight decrease in its sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.