Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

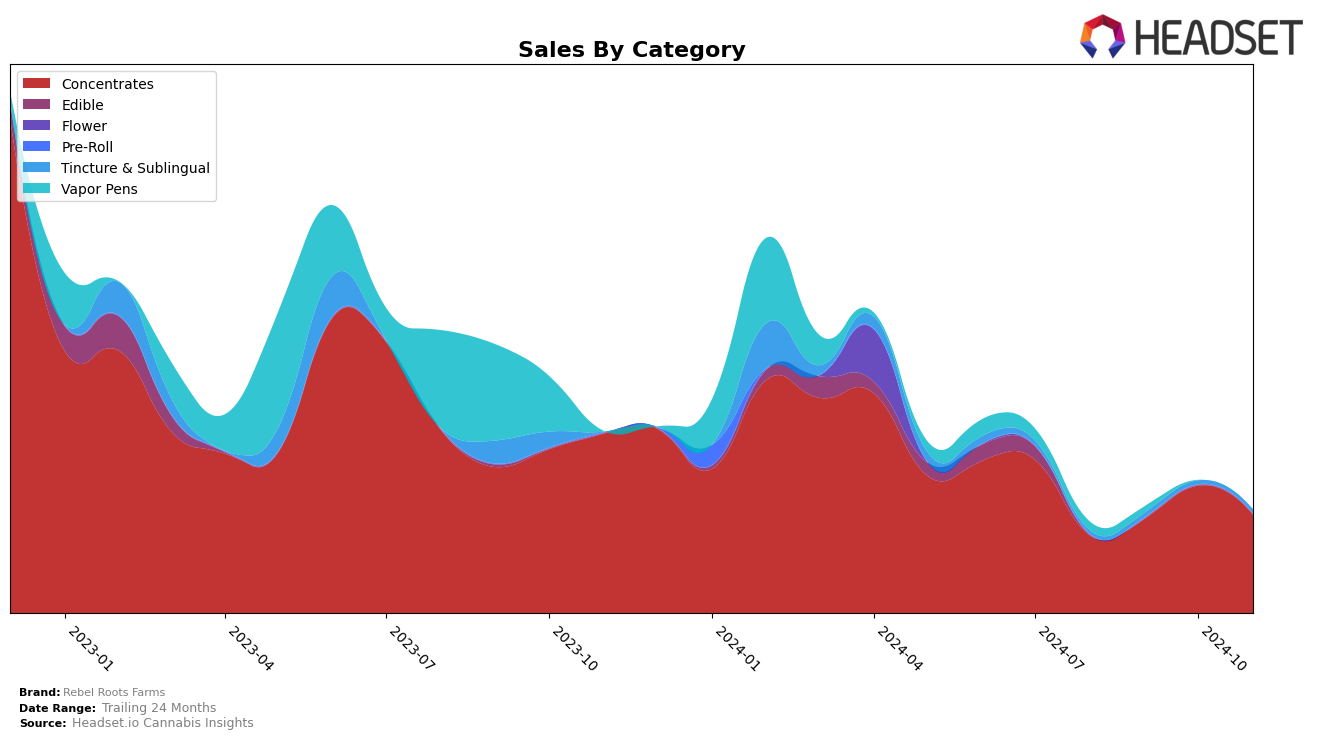

Rebel Roots Farms has shown a fluctuating presence in the cannabis market, particularly in the Oregon concentrates category. Despite not securing a spot in the top 30 rankings from August through October 2024, the brand managed to make a notable appearance in November 2024, ranking at 68. This suggests a resurgence or strategic push in their market efforts, although they still have room to grow to reach the top tier. The absence from the top 30 in the preceding months indicates either a competitive market landscape or a need for a more aggressive marketing strategy to improve their standings.

The sales figures, while not fully disclosed, hint at a potential upward trend for Rebel Roots Farms in the Oregon concentrates market. The November 2024 sales figure, although not specified, was significant enough to place them back on the rankings. This could be indicative of a successful product launch or promotional campaign during that period. However, the brand's performance in other states and categories remains unclear, as there is no available data suggesting their presence outside Oregon. This limited geographic footprint might suggest a focused regional strategy or a challenge in scaling operations beyond their current market.

Competitive Landscape

In the Oregon concentrates market, Rebel Roots Farms has experienced a fluctuating presence, notably re-entering the top 20 brands in November 2024 at rank 68. This marks a significant comeback after missing the top 20 in the preceding months of August, September, and October. During this period, Decibel Farms demonstrated a strong performance, consistently improving its rank from 73 in August to 67 in November, indicating a competitive edge with higher sales figures. Meanwhile, Viola and Mama Lou's saw a decline in rankings, with Viola dropping out of the top 20 by October and Mama Lou's not ranking past August. The competitive landscape suggests that while Rebel Roots Farms has regained some ground, maintaining and improving its position will require strategic efforts to outperform brands like Decibel Farms, which are showing upward trends.

Notable Products

In November 2024, the top-performing product from Rebel Roots Farms was Indica RSO (1g), which achieved the number one rank in the Concentrates category. Mac #1 RSO (1g) followed closely, securing the second position with notable sales of 212 units, showing a significant rise from its third-place ranking in October 2024. Cherry Chem RSO (1g) dropped from its consistent second-place position in previous months to third in November. Tropicanna Cookies RSO Syringe (1g) made its debut in the rankings at the fourth position, while Charlotte's Web RSO (1g) rounded out the top five. This shift in rankings highlights the dynamic nature of consumer preferences within the Concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.