Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

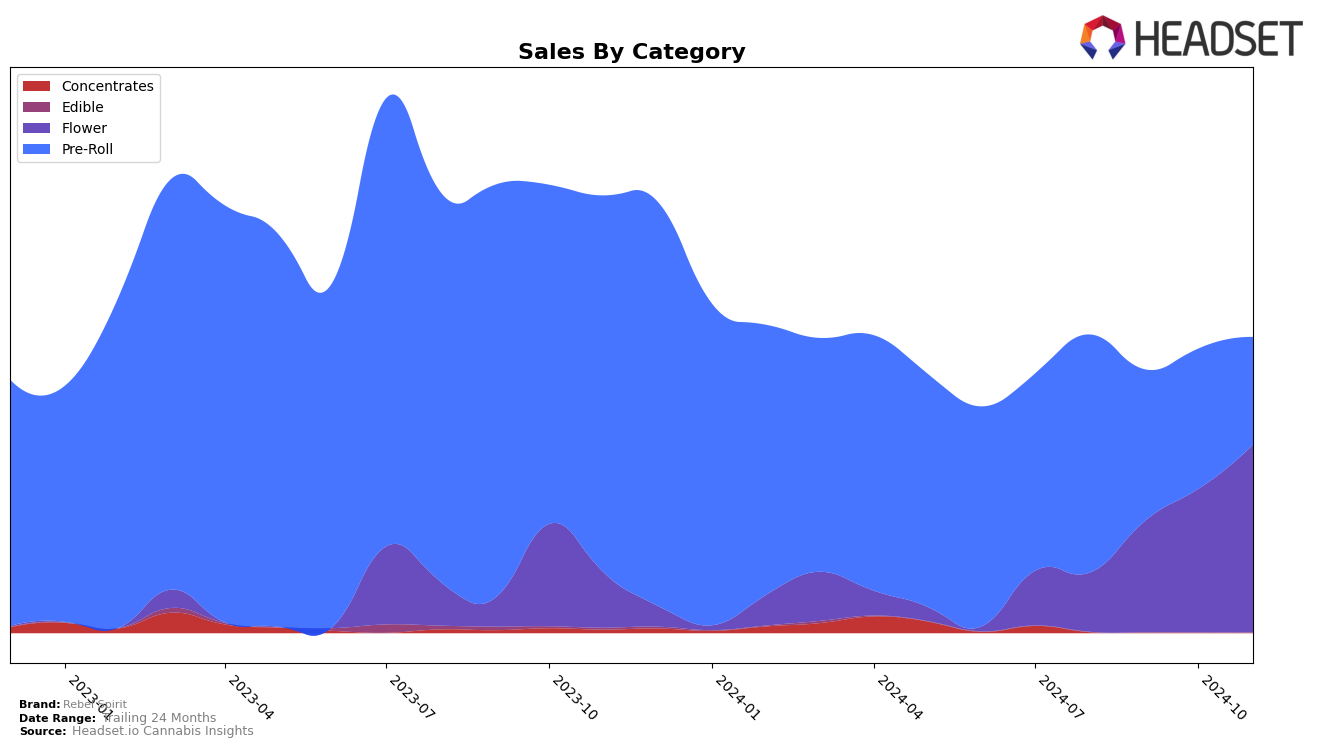

Rebel Spirit has demonstrated a noteworthy trajectory in the Oregon market, particularly in the Flower category. The brand has made significant strides, moving from outside the top 30 to securing the 35th position by November 2024. This upward movement is indicative of a strong performance and growing market presence, as evidenced by the increase in sales from September to November. While not in the top 30 in August, Rebel Spirit's ascent suggests a positive reception and increasing consumer demand within the state.

In the Pre-Roll category, Rebel Spirit has maintained a presence within the top 30 in Oregon throughout the observed months. Starting at the 12th position in August, the brand experienced fluctuations, settling at the 28th spot by November. Despite this slight decline, Rebel Spirit's ability to remain in the rankings highlights its competitive standing in the market. The decrease in sales from August to November could point to challenges in maintaining market share or shifts in consumer preferences, which might require strategic adjustments to regain higher rankings.

Competitive Landscape

In the Oregon Flower category, Rebel Spirit has shown a promising upward trajectory in its rankings over the past few months, moving from not being in the top 20 in August 2024 to securing the 35th position by November 2024. This improvement in rank is accompanied by a significant increase in sales, indicating growing consumer interest and market penetration. In contrast, competitors like Garden First and Earl Baker have experienced a decline in their rankings, with Garden First dropping from 21st in August to 29th in November, and Earl Baker slipping from 22nd to 30th in the same period. Meanwhile, Verdant Leaf Farms and Drewby Doobie / Epic Flower have shown more stability, although they remain behind Rebel Spirit in terms of sales growth. This competitive landscape suggests that Rebel Spirit's strategic initiatives are effectively resonating with consumers, positioning the brand for continued success in the Oregon market.

Notable Products

In November 2024, the top-performing product for Rebel Spirit was Mac N Rose (Bulk) in the Flower category, securing the number one rank with sales of 2969 units. Frosty Jesus (Bulk) followed closely in second place, marking a strong entry into the rankings. Gary Payton (3.5g) dropped from second place in October to third place in November, despite an increase in sales from 1417 to 1965 units. Georgia Pie (3.5g) and Beach Wedding (Bulk) rounded out the top five, with Georgia Pie making a notable debut at fourth place. Overall, the rankings in November reflect a reshuffling from October, with Mac N Rose and Frosty Jesus showing significant sales momentum.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.