Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

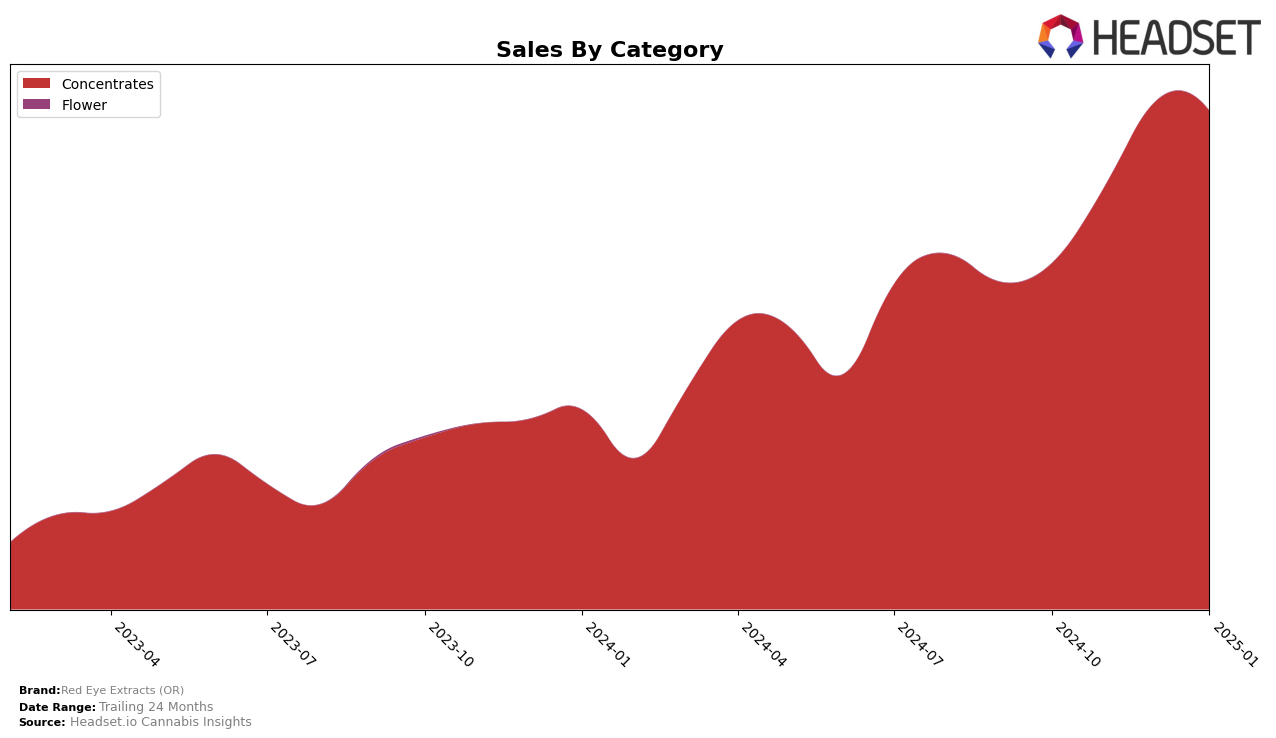

Red Eye Extracts (OR) has shown notable performance in the Concentrates category within the state of Oregon. Over the last few months, the brand has consistently maintained a strong presence, climbing from a fourth-place rank in October 2024 to securing the second spot from November 2024 through January 2025. This upward trend is indicative of a robust product lineup and effective market strategies that resonate well with consumers in the state. The brand's ability to sustain its position in the top three highlights its competitive edge in the Oregon market, particularly in the Concentrates category where competition is typically fierce.

However, outside of Oregon, Red Eye Extracts (OR) does not appear in the top 30 rankings for any other states or categories, suggesting a more localized focus or perhaps untapped potential in broader markets. This

Competitive Landscape

In the Oregon concentrates market, Red Eye Extracts (OR) has shown impressive growth, climbing from the 4th position in October 2024 to securing the 2nd spot consistently from November 2024 through January 2025. This upward trajectory highlights a significant increase in consumer preference and market penetration, as evidenced by their sales surge during this period. Despite this progress, Red Eye Extracts (OR) faces stiff competition from Altered Alchemy, which maintains a firm grip on the top position with consistently higher sales figures. Meanwhile, White Label Extracts (OR) has remained a close competitor, holding the 3rd rank throughout the same period. The competitive landscape is further intensified by Entourage Cannabis / CBDiscovery, which fluctuates between the 4th and 5th positions, indicating a dynamic market environment where Red Eye Extracts (OR) must continue to innovate and expand its market share to maintain its current ranking.

Notable Products

In January 2025, Starsplosion Cured Resin (1g) emerged as the top-performing product for Red Eye Extracts (OR) with sales reaching 2387 units. Zen Bubble Cured Resin (1g) secured the second spot, maintaining a strong position as it climbed from fourth in December 2024. Berry Mentats Cured Resin (1g) followed closely in third, experiencing a slight drop from its second-place rank in the previous month. Tropical Honeycomb Cured Resin (1g) slipped to fourth from its leading position in December 2024. Berry Good Vibes Cured Resin (1g) rounded out the top five, showing a consistent presence despite a slight drop in rank from third in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.