Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

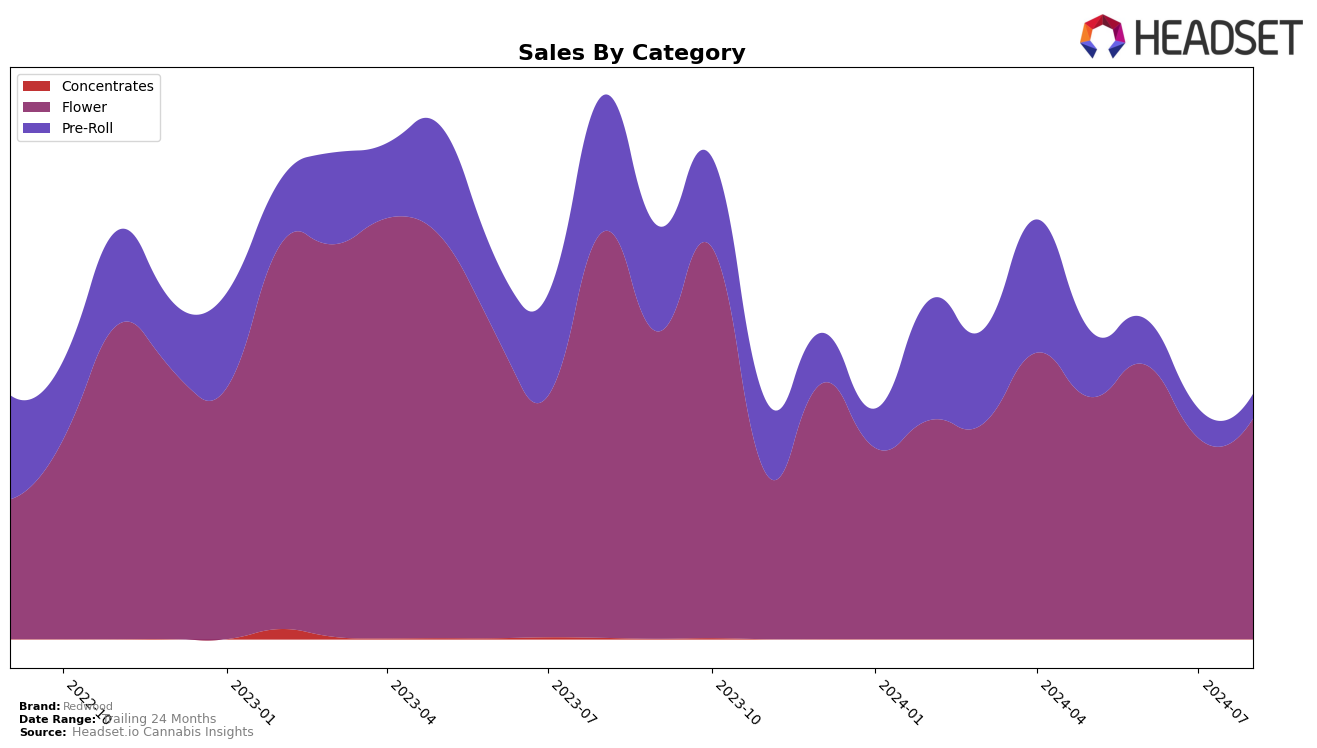

Redwood's performance in the Nevada market has shown some notable fluctuations across different categories. In the Flower category, Redwood has seen a generally positive trend, moving from a rank of 27 in May 2024 to 19 in June 2024, before experiencing a slight drop to 28 in July 2024 and then recovering to 26 in August 2024. This indicates that while there is some volatility, the brand is maintaining a presence in the top 30, suggesting a resilient demand. The sales figures also reflect this trend, with a peak in June 2024 at $307,775 and a subsequent dip, highlighting potential market dynamics or seasonal variations impacting consumer preferences.

In contrast, Redwood's performance in the Pre-Roll category in Nevada has been less consistent and more concerning. The brand started at rank 29 in May 2024 but fell out of the top 30 by June 2024, continuing to decline to ranks 42 and 47 in the following months. This downward trend suggests a significant challenge in maintaining market share in this category. The corresponding sales figures mirror this decline, with a substantial drop from $74,747 in May 2024 to just $27,362 in August 2024. This indicates that Redwood may need to reassess its strategy in the Pre-Roll category to regain its competitive edge.

Competitive Landscape

In the competitive landscape of the Flower category in Nevada, Redwood has experienced notable fluctuations in its ranking and sales over the past few months. Redwood's rank improved from 27th in May 2024 to 19th in June 2024, but then dropped to 28th in July 2024 before recovering slightly to 26th in August 2024. This volatility contrasts with the more stable performance of competitors such as Virtue Las Vegas, which maintained a rank around the low 20s, and The Grower Circle, which showed a steady climb from 42nd to 28th over the same period. Meanwhile, Good Green experienced a significant drop from 24th to 42nd in June before rebounding to 25th in August. These dynamics suggest that while Redwood faces stiff competition, particularly from brands like Superior (NV) which also saw a notable rise, there are opportunities for Redwood to capitalize on market shifts and improve its standing with strategic adjustments.

Notable Products

In August 2024, Redwood's top-performing product was Sweet Tea (3.5g) in the Flower category, maintaining its number one rank from the previous three months with sales of 1,056 units. Platinum Strawberries (3.5g) ranked second in its debut month, followed by Flat White (3.5g) in third place. Coco Chanel (3.5g) secured the fourth position, and Tangerine Skunk (3.5g) rounded out the top five. Notably, Sweet Tea (3.5g) has consistently dominated the rankings since May 2024, indicating strong and stable consumer demand. The introduction of new products like Platinum Strawberries and Flat White suggests an expanding and competitive product lineup for Redwood.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.