May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

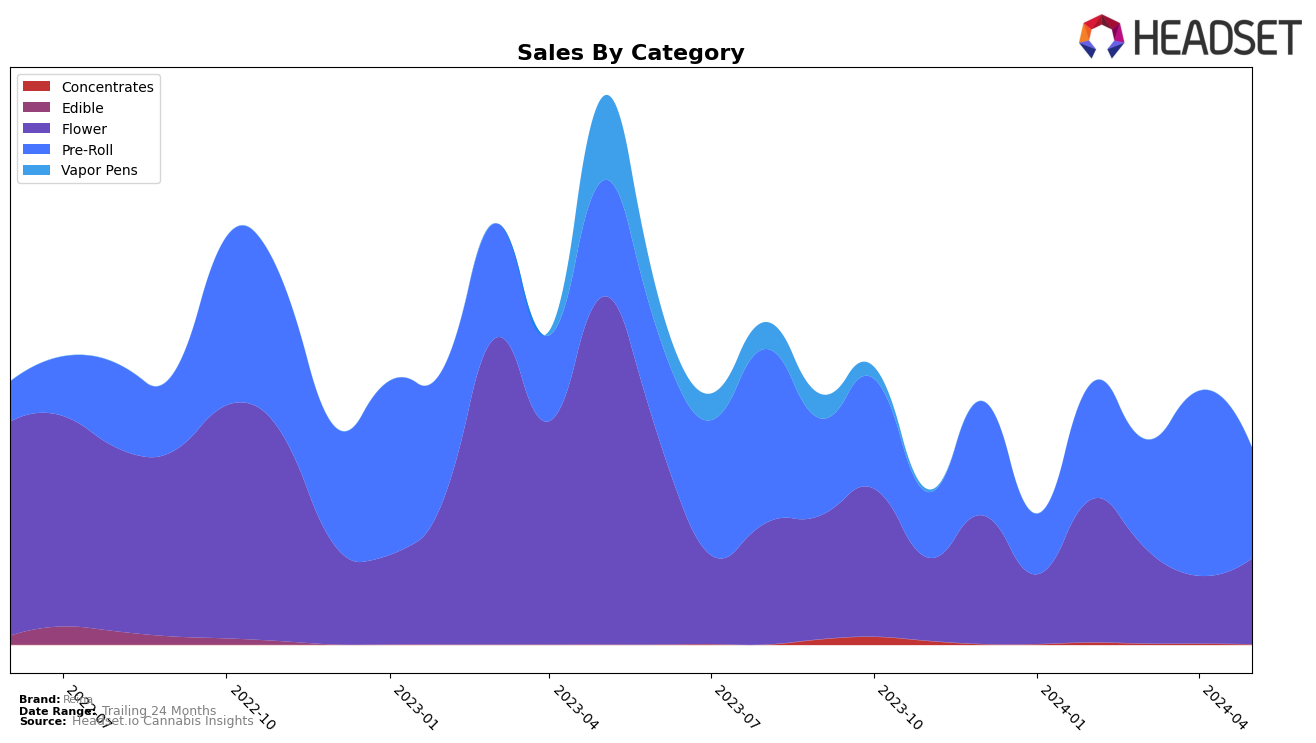

Reina's performance in the Nevada market has shown significant fluctuations across different categories. In the Flower category, Reina struggled to break into the top 30, with rankings hovering around the mid-60s to 70s. While there was a slight improvement from April to May, moving from 78th to 66th place, the brand still didn't manage to secure a strong foothold. The sales figures reflect this inconsistency, with a noticeable dip in March followed by a modest recovery in May. This indicates that while there may be some traction, the Flower category remains a challenging segment for Reina in Nevada.

Conversely, Reina's performance in the Pre-Roll category in Nevada has been more promising. The brand consistently remained within the top 30, with rankings fluctuating but showing a strong presence overall. Notably, Reina achieved its highest rank in April, reaching 21st place, which suggests a peak in consumer interest or successful marketing efforts during that period. Although there was a slight drop in May, the Pre-Roll category still appears to be a more stable and potentially lucrative segment for Reina compared to Flower. This trend highlights the brand's stronger positioning and potential for growth in the Pre-Roll market.

Competitive Landscape

In the competitive landscape of the Nevada Pre-Roll category, Reina has experienced notable fluctuations in its rank and sales over recent months. Reina's rank improved significantly in April 2024, climbing to 21st place, but then dropped to 29th in May 2024. This volatility contrasts with the more stable performance of competitors such as Medizin, which consistently improved its rank from 32nd in February 2024 to 27th in May 2024. Similarly, Matrix NV and Curaleaf have shown steady upward trends, with both brands improving their ranks over the same period. Notably, LP Exotics experienced a decline, dropping from 15th in February 2024 to 28th in May 2024, which might have created a temporary opportunity for Reina to capture market share. These dynamics suggest that while Reina has the potential for significant gains, maintaining consistent performance is crucial to leveraging opportunities created by the fluctuating ranks of its competitors.

Notable Products

In May-2024, the top-performing product for Reina was Toad Red Pre-Roll 5-Pack (2.5g), achieving the highest sales at $490. Miracle Glue Pre-Roll 5-Pack (2.5g) followed closely in second place. Hot Monts (3.5g) ranked third, showing a consistent presence in the top five from previous months, with sales increasing from 314 in April to 456 in May. Slurricane (3.5g) secured the fourth position, while Candy Chrome Pre-Roll 5-Pack (2.5g) rounded out the top five. Notably, Hot Monts (3.5g) has shown improvement in its ranking from fifth in February to third in May.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.