Dec-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

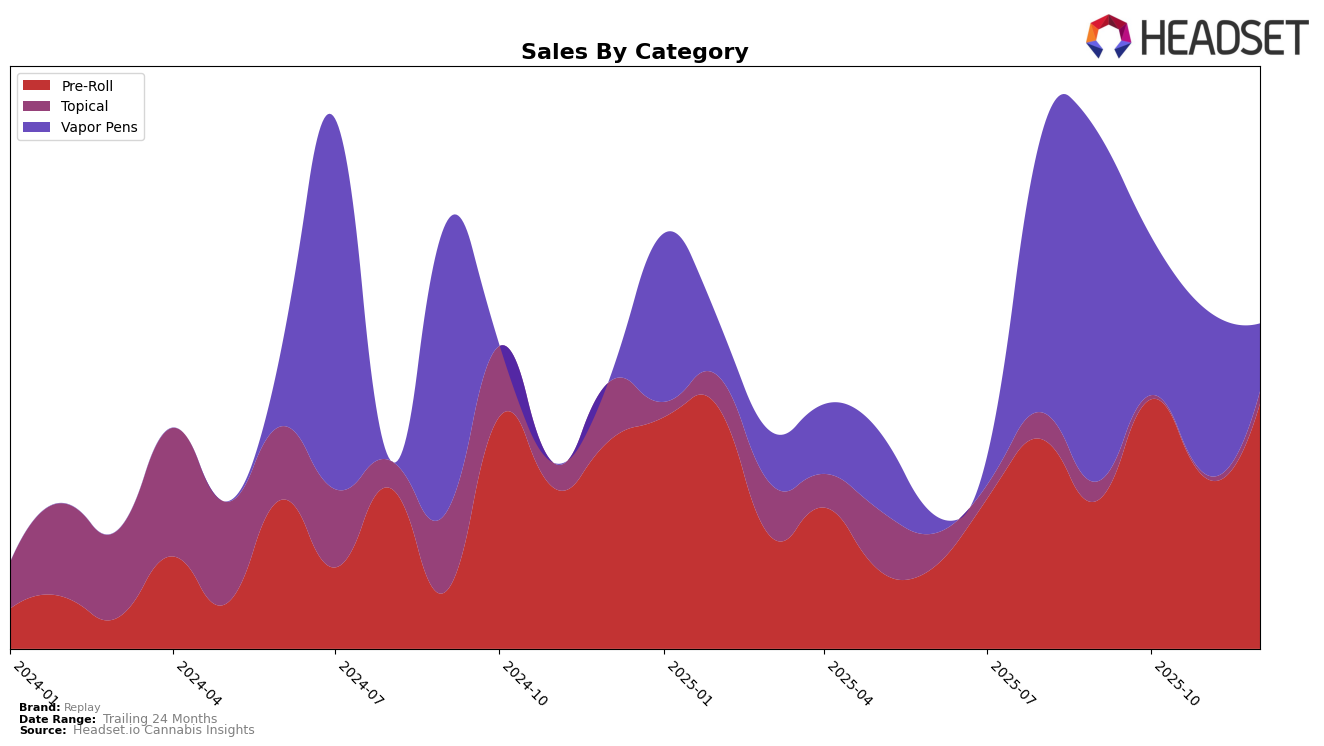

Replay has shown a notable presence in the Massachusetts market, specifically within the Vapor Pens category. In September 2025, Replay ranked 94th, indicating a position outside the top 30 brands, which suggests there is significant room for growth in this category. Despite not appearing in the top rankings for the following months, the initial entry into the rankings could be seen as a stepping stone for future efforts to climb higher in Massachusetts. This performance might be an indicator of Replay's initial foray into the market, and it will be interesting to monitor if they can leverage this positioning to gain traction in the coming months.

While Replay's ranking in Massachusetts highlights a challenge in breaking into the top tier, the brand's sales figures in September 2025 provide a glimpse into their potential. With sales reaching $25,448 in that month, Replay has a tangible foundation to build upon. However, the absence of rankings for the subsequent months suggests that Replay did not maintain or improve its market position during this period. This could be attributed to various factors, such as increased competition or shifts in consumer preferences. Observing Replay's strategies and adjustments in the future will be crucial to understanding their trajectory in the Massachusetts Vapor Pens market.

Competitive Landscape

In the Massachusetts vapor pens category, Replay has experienced notable fluctuations in its market position, with its rank in September 2025 being 94th, but then disappearing from the top 100 in subsequent months. This suggests a competitive landscape where brands like &Shine and Smyth Cannabis Co. are outperforming Replay significantly. &Shine, for instance, held a strong 29th position in October 2025, indicating a robust market presence. Meanwhile, Local Roots improved its rank from 97th in September to 93rd in October, showing a positive trend in sales performance. Replay's absence from the top ranks in the last quarter of 2025 highlights the need for strategic adjustments to regain competitive ground and enhance sales performance in this dynamic market.

Notable Products

In December 2025, Replay's top-performing product was the Mana Infused Pre-Roll (1g), maintaining its number one rank for four consecutive months with sales reaching 612 units. The Respawn Infused Pre-Roll (1g) debuted strongly in December, securing the second position with notable sales figures. Speed Run Infused Pre-Roll (1g) also entered the rankings at third place, indicating a growing demand for pre-rolls. The Mana Distillate Cartridge (1g) experienced a slight drop to fourth place from its previous third place in October, while the Respawn Distillate Cartridge (1g) emerged in fifth place for the first time. These shifts suggest a dynamic market with new products gaining traction quickly.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.