Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

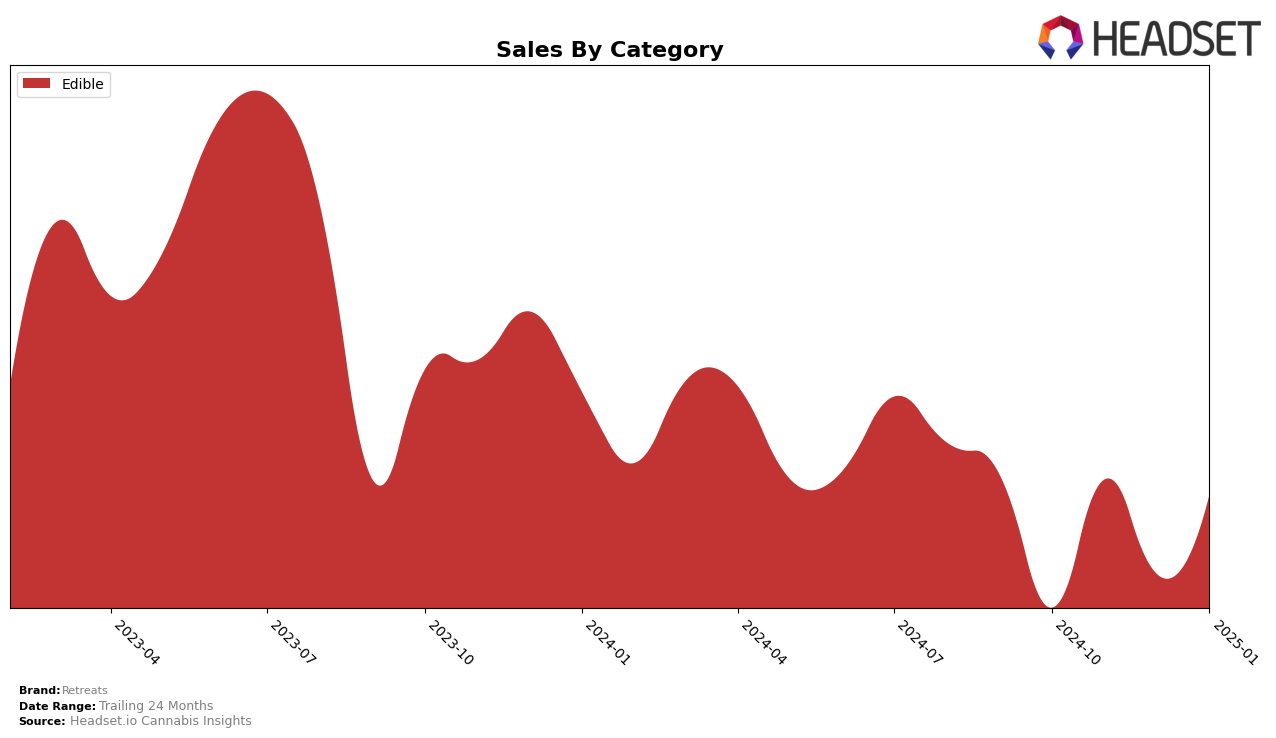

In the state of Oregon, Retreats has shown a noteworthy performance in the Edible category. Over the course of four months, from October 2024 to January 2025, the brand's ranking fluctuated, initially not making it into the top 30 in October, but then climbing to 29th place in November and reaching a peak at 27th in January 2025. This indicates a positive trend in their market presence, suggesting that Retreats is gaining traction among consumers in the region. The sales figures support this upward movement, with a notable increase in November, followed by a slight dip in December, and then a recovery in January. This pattern reflects a growing acceptance and possibly an expanding customer base for Retreats in Oregon's competitive edibles market.

While Retreats has shown progress in Oregon, their absence from the top 30 rankings in October 2024 highlights the challenges they face in maintaining consistent visibility in the market. Despite this initial setback, their ability to break into and improve their standing in the top 30 by January 2025 is a positive indicator of their potential to further strengthen their position. The fluctuations in their monthly sales figures suggest that while there is growing interest, there might be external factors influencing consumer purchasing behavior. Retreats' ability to adapt and respond to these market dynamics will be crucial in determining their long-term success and stability in the competitive cannabis edibles sector.

Competitive Landscape

In the competitive landscape of the Oregon edible market, Retreats has shown a dynamic performance over the past few months, reflecting both challenges and opportunities. Starting from October 2024, Retreats was ranked 31st, gradually improving to 27th by January 2025. This upward trend indicates a positive reception and growing consumer interest, despite facing stiff competition from brands like Junk, which maintained a higher rank, albeit with fluctuating sales. Notably, Concrete Jungle has been climbing steadily, moving from 36th to 28th, suggesting a potential threat if their growth continues. Meanwhile, Tasty's (OR) and Mellow Vibes (formerly Head Trip) have shown varied performances, with ranks hovering around the mid-20s, indicating a stable yet competitive environment. Retreats' sales figures have shown resilience, especially in January 2025, where they surpassed the sales of Junk, highlighting their potential to capture more market share if they continue to leverage their strengths and address market demands effectively.

Notable Products

In January 2025, the top-performing product from Retreats was the Hybrid Gummies 10-Pack (100mg), maintaining its number one rank from the previous months with impressive sales of 822 units. The Sativa Gummies 10-Pack (100mg) moved up to the second position, showing consistent performance with a slight increase from its third-place rank in November 2024. Indica Gummies 10-Pack (100mg) remained steady in third place, although its sales figures were slightly lower compared to the previous months. The CBD/THC 1:1 Island Punch Gummies 2-Pack held its fourth-place rank, while the CBD/THC 1:1 Passion Orange Guava Gummies 10-Pack climbed back to fifth position after not being ranked in November. This data highlights the dominance of the Hybrid Gummies in the edible category and the competitive dynamics among the other gummy products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.