Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

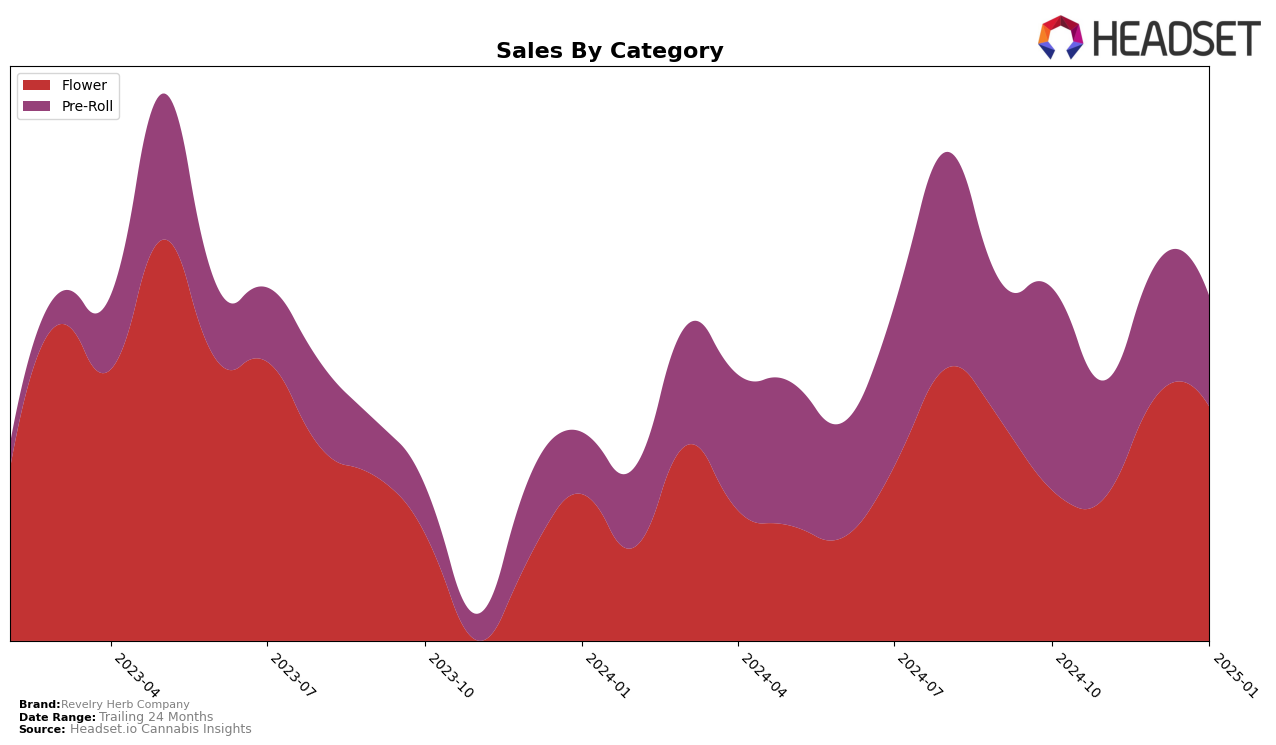

Revelry Herb Company's performance in the California market shows notable fluctuations across categories. In the Flower category, the company did not rank in the top 30 in October 2024, but made significant progress by moving up to the 78th position in December 2024 before slightly dropping to 80th in January 2025. This indicates a recovery in their market presence, although not yet strong enough to break into the top 30. Meanwhile, in the Pre-Roll category, Revelry Herb Company maintained a consistent presence, fluctuating between 40th and 48th positions over the same period. The Pre-Roll sales in January 2025 were notably lower than in October 2024, indicating a potential area for strategic improvement.

In Maryland, Revelry Herb Company demonstrated more stable performance with its Flower products consistently ranking within the 30s and 40s. The Pre-Roll category, however, saw a decline from the 19th position in October 2024 to 21st in January 2025, despite an increase in sales during the same period. This suggests a potential opportunity to leverage sales growth into improved ranking. In New York, the company did not rank in the top 30 for Flower until December 2024, when it entered at 80th and improved slightly to 77th in January 2025. This entry into the market could indicate an emerging presence that may be worth monitoring for future developments.

Competitive Landscape

In the competitive landscape of California's Flower category, Revelry Herb Company has shown notable fluctuations in its market position over recent months. Starting from a non-ranking position in October 2024, Revelry Herb Company climbed to 90th in November, reaching a peak at 78th in December, before slightly declining to 80th in January 2025. This upward trend in the latter months suggests a positive reception and growing consumer interest, despite not breaking into the top 20. In comparison, Seed Junky Genetics experienced a consistent decline from 55th to 79th, indicating potential challenges in maintaining consumer interest. Meanwhile, Halfpipe Cannabis maintained a relatively stable position, fluctuating slightly but staying around the 85th rank. Roll Bleezy and 5G (530 Grower) also showed variability, with Roll Bleezy peaking at 55th in November before dropping, and 5G (530 Grower) showing a similar pattern of rise and fall. These dynamics highlight Revelry Herb Company's potential to capitalize on its upward momentum, especially as some competitors face ranking challenges, which could translate into increased sales opportunities if the trend continues.

Notable Products

In January 2025, the top-performing product for Revelry Herb Company was Peanut Butter Cups (3.5g) in the Flower category, maintaining its number one rank from December 2024 with sales of $2,724. Mai Tai OG (3.5g), also in the Flower category, held steady at the second position, showing slight consistency in its ranking since November 2024. Blackberry Lemonade (3.5g) remained in third place, indicating stable demand for this flavor variant. Oasis Mints (3.5g) climbed back into the rankings at fourth place, showing a resurgence from its previous absence. Baked Alaska Pre-Roll 2-Pack (1g) experienced a drop in popularity, moving from second place in November to fifth place in January, despite being a consistent top performer in earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.