Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

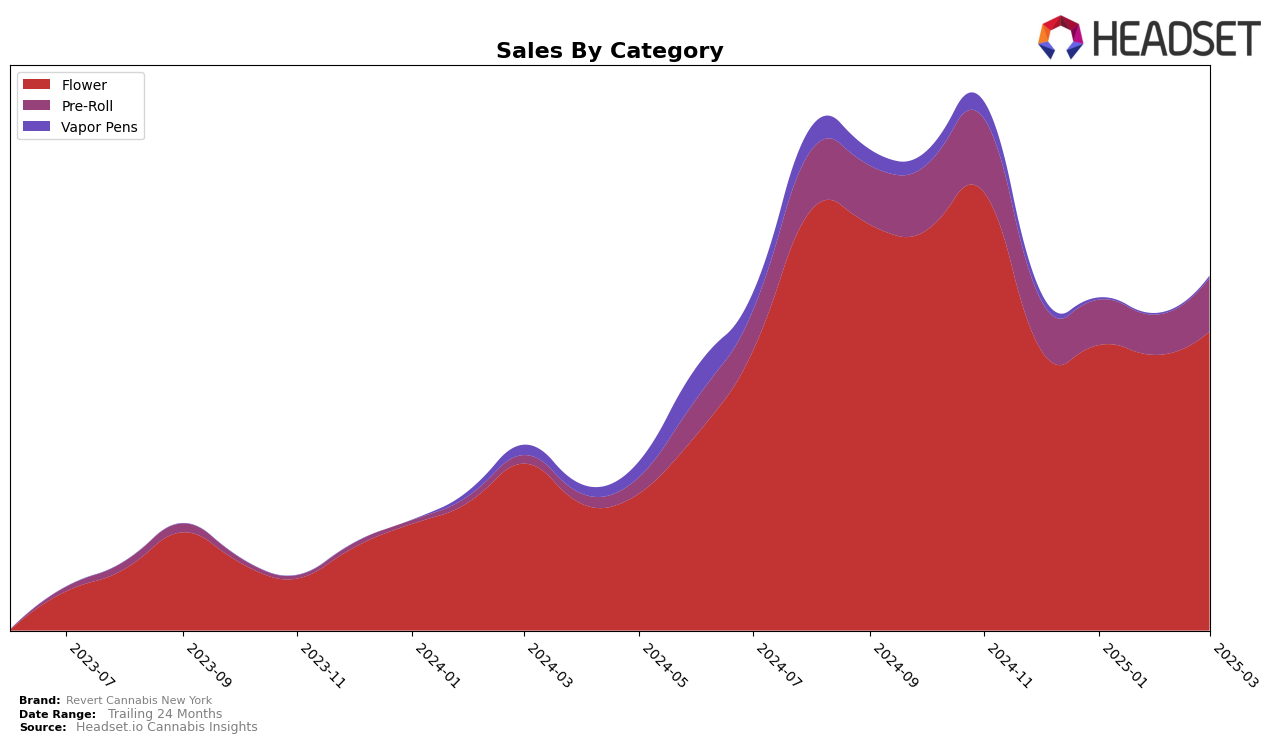

Revert Cannabis New York has shown a consistent performance in the New York market, particularly in the Flower category. Ranking 6th in December 2024 through February 2025, the brand experienced a slight dip to 8th place in March 2025. Despite this, sales in the Flower category increased from approximately $1.26 million in December 2024 to over $1.34 million by March 2025, indicating a positive trajectory in consumer demand. This trend suggests that while the competition in the top ranks intensified, Revert Cannabis New York managed to maintain a strong foothold, reflecting robust brand loyalty or effective marketing strategies within the state.

In contrast, the brand's performance in the Pre-Roll category in New York showed more volatility. Starting at 22nd place in December 2024 and January 2025, the brand slipped to 26th in February before recovering to 20th in March 2025. This fluctuation could highlight challenges in maintaining market share or possibly the impact of new entrants in the category. Notably absent from the top 30 in the Vapor Pens category after December 2024, Revert Cannabis New York may need to reassess its strategy in this segment to regain visibility and competitiveness. The absence from the rankings could either indicate a strategic withdrawal from the category or a need for innovation to capture consumer interest.

Competitive Landscape

In the competitive landscape of the Flower category in New York, Revert Cannabis New York has experienced notable fluctuations in its market position from December 2024 to March 2025. Initially ranked 6th, Revert managed to maintain this position through February 2025, before slipping to 8th in March. This decline coincides with the rise of Untitled, which climbed from 15th to 7th, showcasing a significant upward trend. Meanwhile, Matter., despite a drop in rank from 3rd to 6th, still maintains a strong presence with higher sales figures compared to Revert. Rythm also presents a challenge, consistently ranking just below Revert but showing a sales increase in March. As Revert navigates these competitive dynamics, understanding these shifts and the strategies of rising competitors like Untitled could be crucial for maintaining and improving its market position.

Notable Products

In March 2025, Pineapple Haze Pre-Roll (0.5g) maintained its top position in sales for Revert Cannabis New York, with a notable sales figure of 3968 units. Pink Starburst Pre-Roll (0.5g) emerged as the second best-selling product, marking its debut in the rankings with strong performance. Strawberry Amnesia Pre-Roll (0.5g) experienced a slight decline, moving from second place in February to third place in March. Godfather OG Pre-Roll (0.5g) entered the rankings at fourth place, showcasing its growing popularity. Hawaiian Haze Kief Infused Ground (14g) dropped from third in February to fifth in March, indicating a shift in consumer preferences.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.