Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

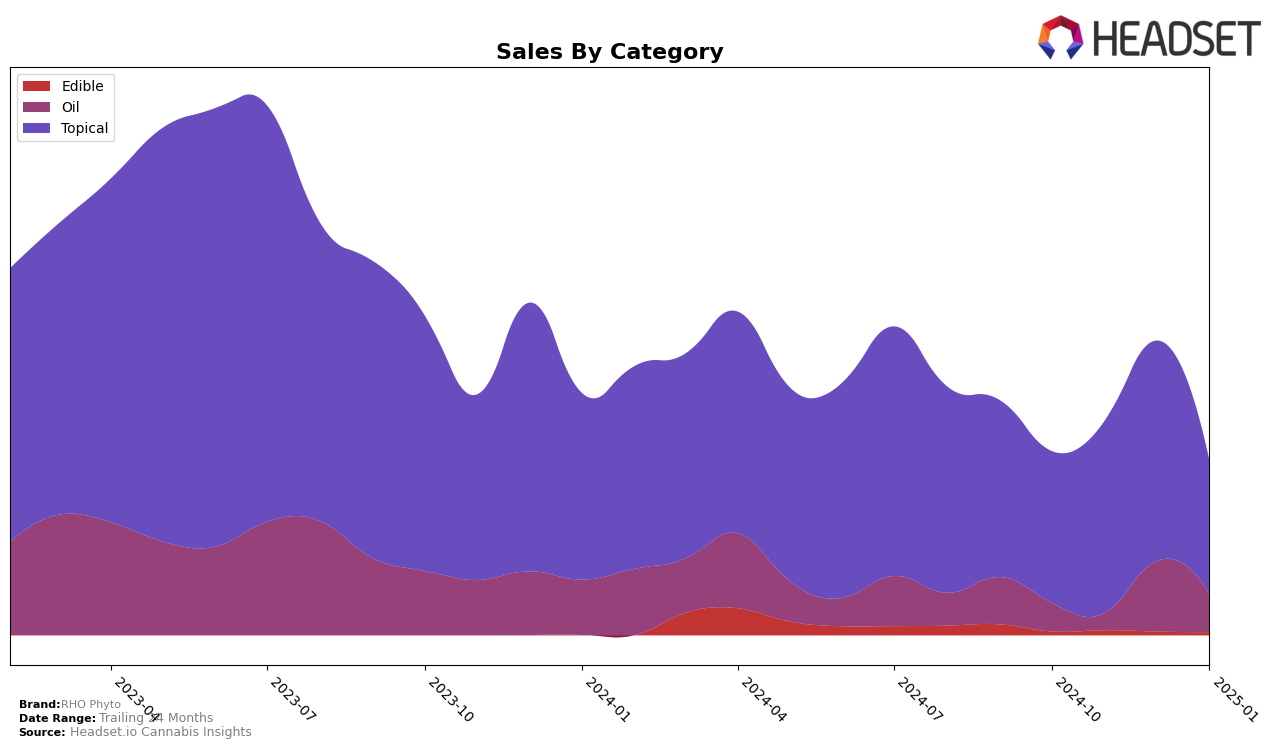

RHO Phyto has shown a consistent performance in the Ontario market, particularly in the Topical category. The brand maintained a steady rank of 7th from October 2024 through January 2025. This consistency in ranking suggests a stable consumer base and effective market penetration within the province. However, the brand's sales figures fluctuated, peaking in December 2024 before experiencing a decline in January 2025. Such variations might indicate seasonal demand or promotional activities affecting consumer purchasing behavior during the holiday season.

Interestingly, RHO Phyto's absence from the top 30 brands in other states and categories might be a point of concern or an opportunity for growth, depending on the strategic goals of the brand. The lack of presence beyond Ontario's Topical category could suggest a niche focus or limited distribution channels. This presents a potential area for expansion if the brand aims to diversify its market reach. Understanding the dynamics of other markets and consumer preferences could be crucial for RHO Phyto to capitalize on untapped opportunities and enhance its competitive positioning across different regions.

Competitive Landscape

In the Ontario topical cannabis market, RHO Phyto consistently maintained its position at rank 7 from October 2024 through January 2025, indicating stable performance amidst fluctuating sales figures. Despite this consistency, RHO Phyto faces stiff competition from brands like Solei and LivRelief, which held ranks 5 and 6, respectively, throughout the same period. Notably, Noon & Night appeared in the rankings only intermittently, suggesting variability in its market presence. While RHO Phyto's sales peaked in December 2024, it still trails behind Solei and LivRelief, whose sales figures were consistently higher. This competitive landscape highlights the need for RHO Phyto to innovate and enhance its market strategies to potentially climb the rankings and increase its market share.

Notable Products

In January 2025, the top-performing product for RHO Phyto was the CBD/THC 25:1 Deep Tissue Extra Strength Gel (250mg CBD, 10mg THC, 50ml) in the Topical category, maintaining its number one rank from the previous months despite a decrease in sales to 530 units. The THC:CBG Rapid Act Oral Spray (15ml), categorized as Oil, consistently held the second position across the months. The CBD:THC 10:1 Daily Dose Gummies 10-Pack (100mg CBD, 10mg THC) moved up from fourth to third place, showing a slight improvement in its ranking. Meanwhile, the CBG Transdermal Relief Gel (500mg CBG, 30ml) dropped to fourth place, reflecting a decline in sales. The CBD Rapid Act 10:20 Oil Spray (15ml) was not ranked in January, indicating a potential discontinuation or a significant drop in its performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.