Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

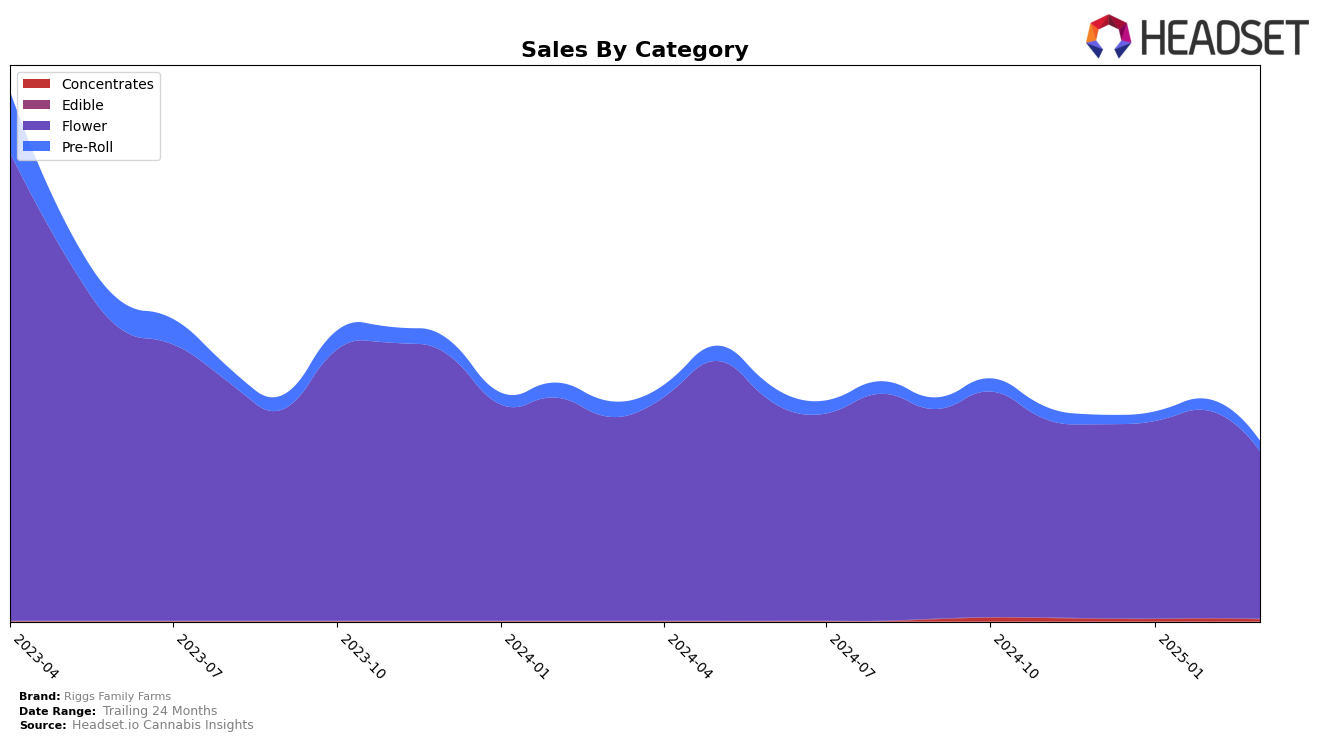

Riggs Family Farms has demonstrated a notable presence in the Arizona market, particularly in the Flower category. In December 2024, they held the 11th position, but by March 2025, their rank shifted to 14th. This movement indicates some fluctuation in their market performance, despite a peak at 8th place in February 2025. Interestingly, their sales saw a significant increase in February, reaching $786,003, before dropping in March. This suggests that while Riggs Family Farms is capable of climbing the ranks, maintaining consistency remains a challenge. Their absence from the top 30 in other states highlights a potential area for growth and expansion.

In the Pre-Roll category, Riggs Family Farms has not yet broken into the top 30 in Arizona, indicating that this segment might not be their strongest suit. However, they have shown some positive movement, improving their rank from 42nd in December 2024 to 39th in March 2025. This upward trend, albeit slow, could be indicative of strategic adjustments or increasing consumer interest in their pre-roll products. The modest sales growth in this category further supports the notion of gradual improvement, suggesting that with continued effort, Riggs Family Farms might enhance its standing in the pre-roll market over time.

Competitive Landscape

In the competitive landscape of the Arizona flower category, Riggs Family Farms experienced notable fluctuations in its ranking and sales performance from December 2024 to March 2025. Starting at rank 11 in December 2024, Riggs Family Farms improved to 8th place by February 2025, reflecting a positive momentum in sales. However, by March 2025, the brand dropped to 14th place, indicating a potential challenge in maintaining its upward trajectory. Competitors such as Fade Co. and DTF - Downtown Flower showed more stable rankings, with DTF - Downtown Flower consistently staying within the top 15. Meanwhile, Abundant Organics demonstrated a steady climb, reaching 13th place by March 2025, potentially posing a threat to Riggs Family Farms' market share. Interestingly, Aeriz made a significant leap from being outside the top 20 in December 2024 to securing the 11th spot by February 2025, showcasing a rapid growth trajectory that could further impact Riggs Family Farms' positioning if the trend continues.

Notable Products

In March 2025, Ice Cream RTZ Pre-Roll (1g) maintained its position as the top-selling product for Riggs Family Farms, with sales reaching an impressive 4048 units. SFV OG Pre-Roll (1g) climbed to the second spot, improving from its third-place position in February. Sunset Sherbet Pre-Roll (1g) dropped to third place after being ranked second in both January and February. Rolls Choice (14g) emerged in the rankings for the first time, securing the fourth position. Famous Cookies Pre-Roll (1g) re-entered the top five, coming in at fifth place after not being ranked in the previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.