May-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

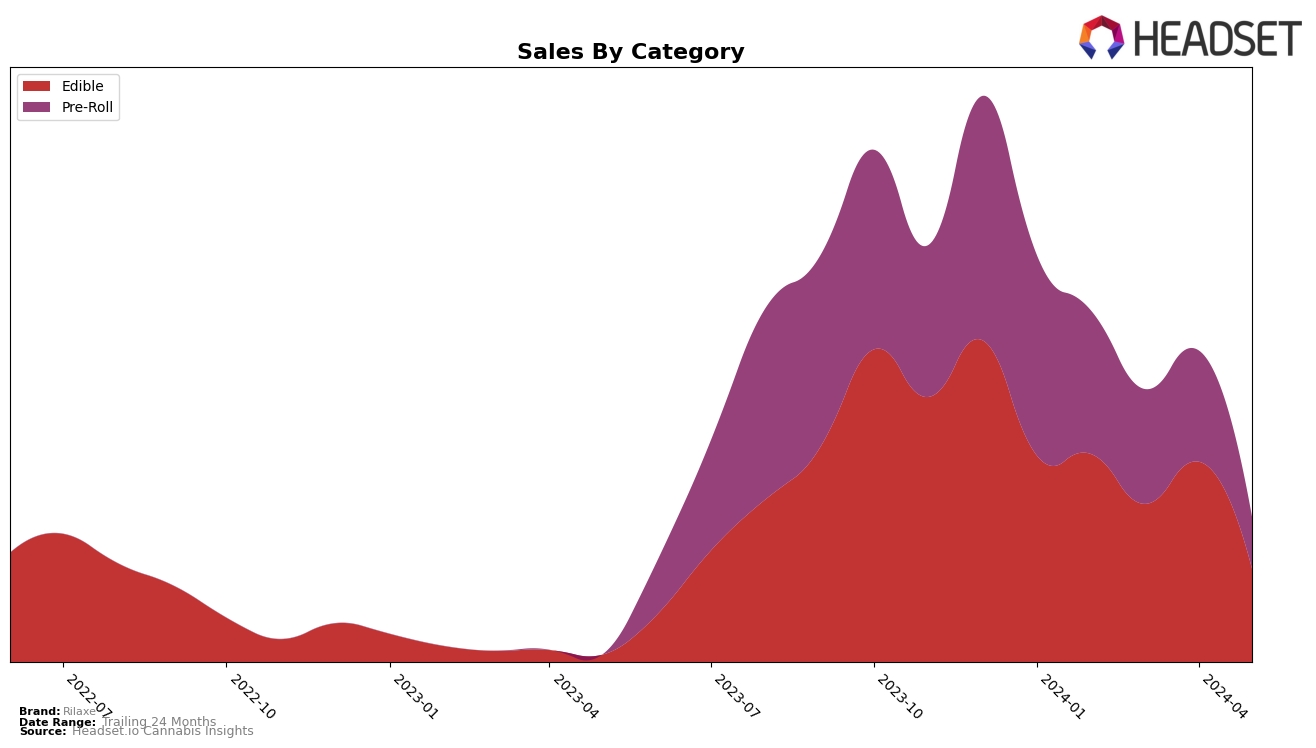

Rilaxe has shown notable fluctuations in its performance across various states and categories in recent months. In Alberta, the brand made a significant entry into the Edible category in May 2024, securing the 25th rank after not being in the top 30 in the preceding months. This upward movement could indicate a growing acceptance and popularity of Rilaxe's edible products in the market. However, the absence of Rilaxe from the top 30 rankings in Alberta during February, March, and April highlights the brand’s struggle to maintain a consistent presence in the competitive landscape earlier in the year.

Across other states, Rilaxe's performance has been mixed, reflecting varying levels of market penetration and consumer interest. The brand's absence from the top 30 rankings in multiple states and categories suggests that while Rilaxe has found some success in specific niches like Alberta's Edible market, it faces challenges in achieving broader market dominance. The data indicates potential areas for growth and improvement, particularly in states where Rilaxe has yet to make a significant impact. The trend of entering the top 30 in May is promising and could be a precursor to further advancements if the brand continues to leverage its strengths and address market demands effectively.

Competitive Landscape

In the competitive landscape of the edible cannabis market in Alberta, Rilaxe has faced notable challenges in maintaining its rank and sales. Despite a promising start, Rilaxe did not appear in the top 20 brands from February to May 2024, indicating a significant drop in visibility and market presence. In contrast, Canna Squarz consistently ranked within the top 20, although it experienced a dip from 18th to 22nd place in April 2024. This brand's sales, however, remained robust, peaking at 21,206 CAD in March before a slight decline. Meanwhile, Being and Vacay hovered around the 22nd and 23rd positions, respectively, with sales showing a positive trend. The competitive pressure from these brands, especially those maintaining or improving their rankings, suggests that Rilaxe needs to strategize effectively to regain its market share and visibility in Alberta's edible category.

Notable Products

For May-2024, the top-performing product from Rilaxe is the CBD:THC 1:1 Sour Cherry Gummies 5-Pack (10mg CBD, 10mg THC) in the Edible category, maintaining its number one rank from April-2024 with sales of 734 units. Following closely is the CBD:THC 1:1 Sour Peach Gummies 5-Pack (10mg CBD, 10mg THC), which held its second-place position consistently since March-2024. Berri Blunts 3-Pack (2.1g) in the Pre-Roll category remained steady at the third rank for four consecutive months. The CBD:THC 2:1 Spicy Firecrackerz Crackers 5-Pack (20mg CBD, 10mg THC) also showed stability, holding the fourth rank for both April and May-2024. New to the top five in May-2024 is Mango Tango Dried Fruit (10mg), which entered the rankings at the fifth position in April-2024 and maintained it in May-2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.