Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

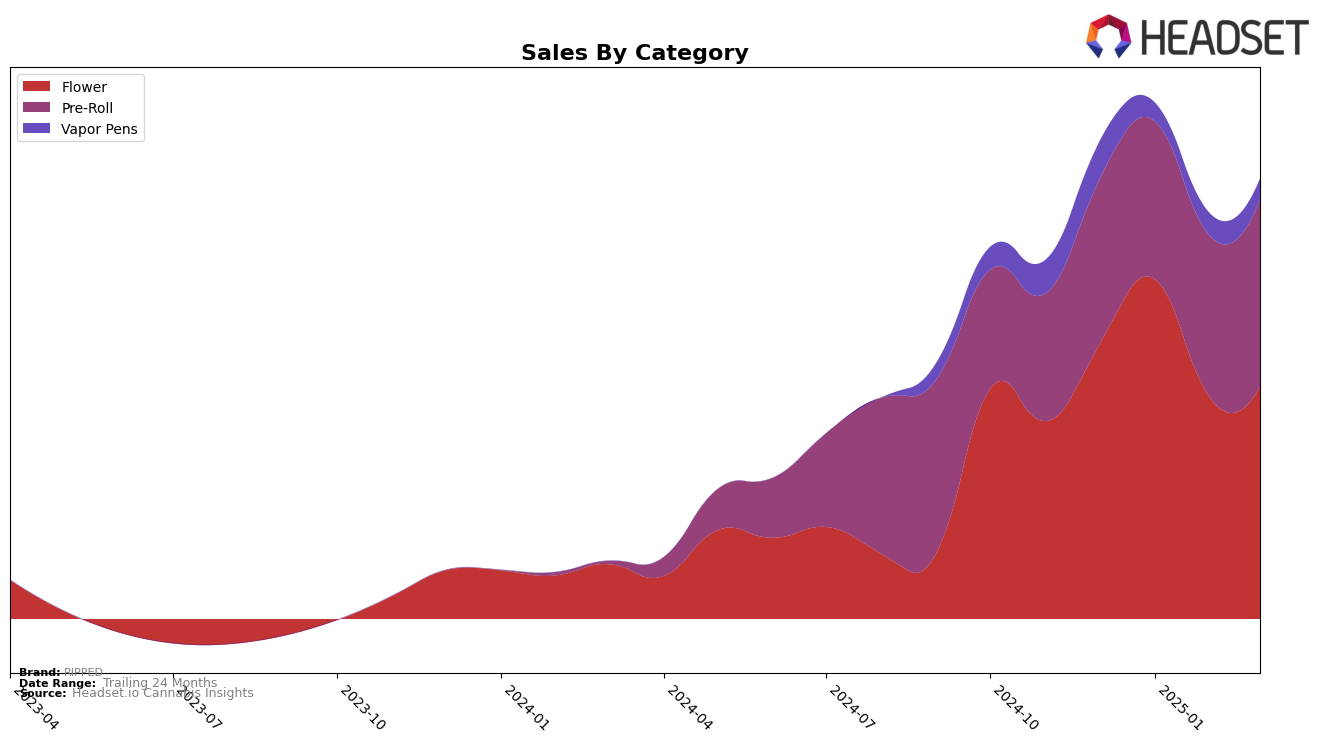

RIPPED has shown varied performance across different product categories and regions. In Alberta, their Flower category saw a subtle improvement in the rankings from December 2024 to March 2025, moving from 36th to 33rd position. Despite this slight upward trend, the sales figures indicate a fluctuating performance with a notable dip in February 2025. In contrast, their presence in the Flower category in Saskatchewan showed more volatility, peaking at 18th position in January 2025 but then dropping to 32nd by March. Such movements suggest that RIPPED might need to address specific market dynamics or consumer preferences unique to each region to maintain or enhance their market position.

In Ontario, RIPPED's participation in the Pre-Roll category has been more promising. Starting from an unranked position in December 2024, they climbed to 88th in January 2025 and further improved to 72nd in February before slightly slipping to 73rd in March. This indicates a growing acceptance or increased market activity in this category, although they still remain outside the top 30. Notably, their Vapor Pens category, also in Ontario, did not maintain a consistent ranking after December 2024, suggesting either a niche market presence or competitive pressures. Overall, RIPPED's performance across these provinces highlights the importance of strategic focus and adaptability to regional market conditions.

Competitive Landscape

In the competitive landscape of the Flower category in Alberta, RIPPED has shown a moderate but steady improvement in rank from December 2024 to March 2025. Starting at 36th place in December, RIPPED climbed to 33rd by March, indicating a positive trend despite fierce competition. Notably, Twd. experienced a significant decline, dropping from 14th to 34th, which may have opened up opportunities for RIPPED to capture some market share. Meanwhile, The Drop surged from 53rd to 30th, showcasing a remarkable rise that could pose a future threat to RIPPED's upward trajectory. Boaz and 3Saints remained relatively stable, with minor fluctuations in their rankings. This dynamic environment suggests that while RIPPED is on an upward trend, it must strategize effectively to maintain and improve its position amidst both declining and rising competitors.

Notable Products

In March 2025, Rolls Pre-Roll 3-Pack (1.5g) maintained its top position as RIPPED's best-selling product, with impressive sales reaching 19,550 units. Indica Pre-Roll (1g) consistently held the second rank throughout the months, showing steady performance. Hybrid Blend Pre-Roll (1g) improved its ranking from fourth to third, demonstrating a significant increase in sales compared to previous months. Sour x Papaya Milled (7g) dropped to fourth place, despite a slight increase in sales figures. Zooted (28g) remained in fifth place, maintaining its position without any rank changes since January 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.