Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

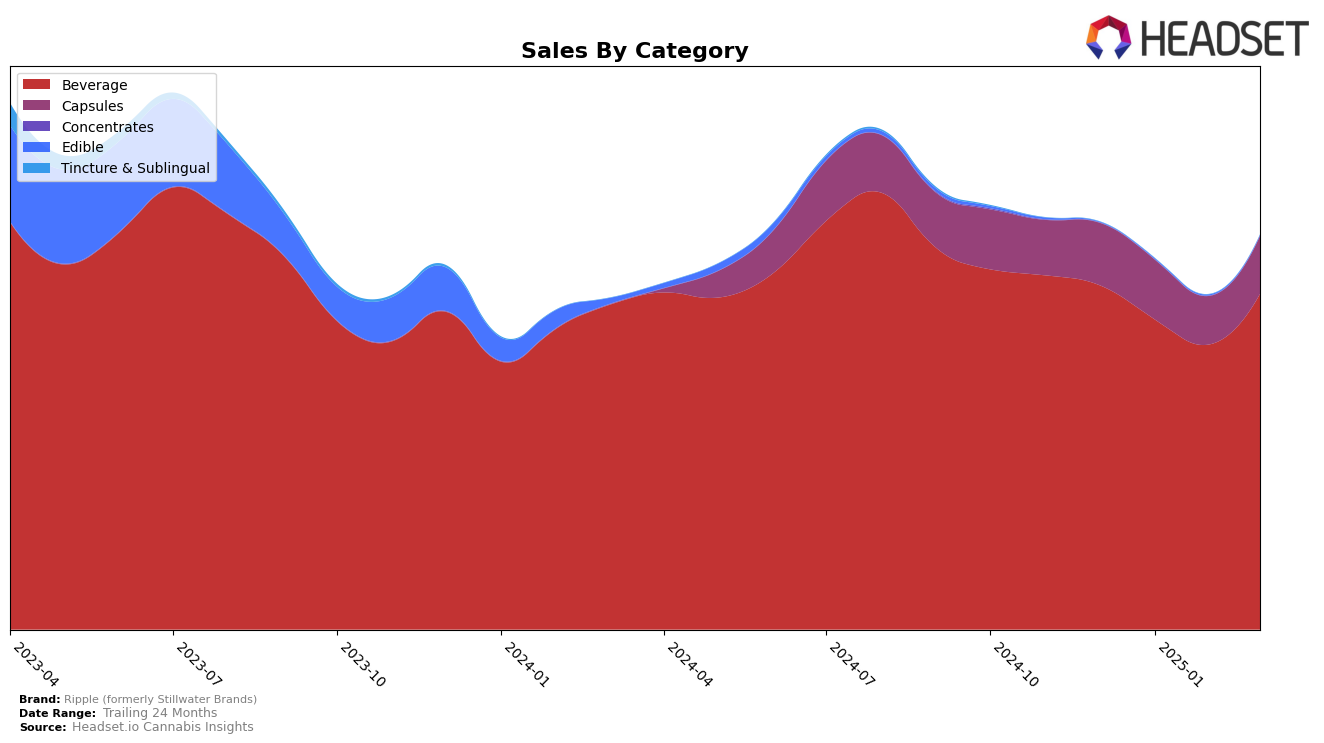

Ripple (formerly Stillwater Brands) has shown a consistent performance in the Colorado market, particularly in the Beverage category. Over the first quarter of 2025, Ripple maintained a steady second-place ranking, demonstrating a strong foothold in this segment. Notably, there was a significant increase in sales from February to March, indicating a positive trend and possibly reflecting successful marketing strategies or increased consumer demand. In the Capsules category, Ripple holds the top position, showcasing its dominance and consumer preference in this product line. Despite a dip in sales in February, the brand recovered in March, which could suggest effective adjustments in their strategy or a seasonal demand fluctuation.

In Missouri, Ripple's performance in the Beverage category has been more volatile. The brand started strong in December 2024, ranking third, but experienced a decline in the following months, dropping to sixth and then seventh by February 2025. The absence of Ripple in the top 30 rankings for March could be concerning, as it suggests a significant loss in competitive positioning within the state. This drop in ranking may indicate challenges such as increased competition or shifting consumer preferences. Further analysis would be required to understand the underlying factors contributing to this decline and to assess whether this trend will continue or if Ripple can regain its market position in Missouri.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, Ripple (formerly Stillwater Brands) has consistently maintained its position as the second-ranked brand from December 2024 through March 2025. Despite a slight decrease in sales from December to February, Ripple saw a notable rebound in March 2025, indicating a positive trend. The brand's primary competitor, Keef Cola, has consistently held the top rank, with sales figures significantly higher than Ripple's, showcasing a strong market presence. Meanwhile, Dixie Elixirs has maintained the third position, with sales figures that are substantially lower than Ripple's, suggesting a comfortable buffer for Ripple in its current ranking. Additionally, Ript has shown some upward momentum, moving from the fifth to the fourth position in March 2025, though its sales remain far below those of Ripple. This competitive analysis highlights Ripple's stable market position amidst fluctuating sales trends and underscores the importance of strategic initiatives to potentially close the gap with the leading brand, Keef Cola.

Notable Products

In March 2025, Ripple (formerly Stillwater Brands) saw the Pure Fast-Acting Dissolvable Powder 10-Pack (100mg) maintaining its top position in the Beverage category, with sales reaching 11,674 units. The RipStick - Blue Raspberry Dissolvable Powder 10-Pack (100mg) climbed to the second spot, showing a consistent upward trend from fourth place in December 2024. Revive - CBG/THC 1:1 Dissolvable Powder 10-Pack (100mg CBG, 100mg THC) slipped to third place, marking a decline in its ranking since December 2024. The Sleep - CBN/THC 1:2 Unflavored Dissolvable Powder 10-Pack (50mg CBN, 100mg THC) remained stable at fourth, while the RipStick - Watermelon Dissolvable Powder 10-Pack (100mg) held steady in fifth place. This ranking stability and upward movement for certain products indicate a strong consumer preference for the fast-acting and flavored options offered by Ripple.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.