Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

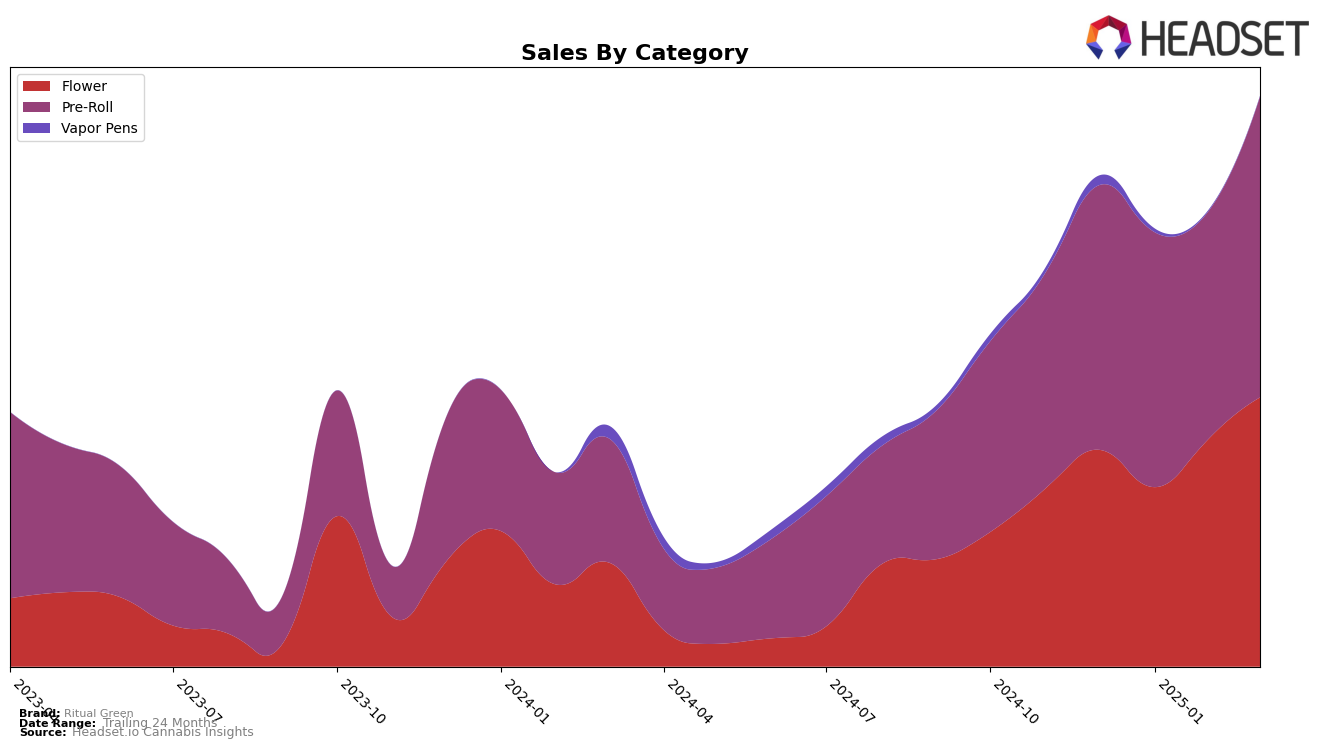

Ritual Green has shown a dynamic performance across different categories and regions. In Alberta, the brand's Pre-Roll category has seen a steady climb, moving from a rank of 59 in December 2024 to 44 by March 2025. This upward trend is supported by a consistent increase in sales, indicating growing consumer interest and possibly successful marketing strategies. However, it's worth noting that despite this improvement, the brand has not yet made it into the top 30 in this category, suggesting room for growth and potential strategies to enhance market penetration.

In contrast, Saskatchewan presents a more favorable picture for Ritual Green, especially in the Flower category. The brand has climbed from a rank of 13 in December 2024 to an impressive 4 by March 2025, reflecting a significant boost in consumer preference or market strategy. Similarly, the Pre-Roll category in Saskatchewan shows fluctuating yet promising progress, with ranks improving from 11 in December 2024 to 6 in March 2025. These movements suggest that Ritual Green is establishing a strong foothold in Saskatchewan, particularly in the Flower category, which could serve as a strategic advantage in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Ritual Green has shown a promising upward trajectory in terms of rank and sales. Starting from a rank of 13 in December 2024, Ritual Green climbed to the 4th position by March 2025, indicating a significant improvement in market presence. This upward trend is notable, especially when compared to competitors such as FIGR, which fluctuated in rank but ended March 2025 at the 6th position, and Bake Sale, which experienced a slight decline from 2nd in January 2025 to 5th in March 2025. Meanwhile, The Loud Plug maintained a strong presence, although it slipped from the top spot to 3rd by March 2025. Elevator showed a consistent performance, slightly improving to 2nd place by March 2025. Ritual Green's consistent rise in rank and sales suggests a growing consumer preference and effective market strategies, positioning it as a formidable competitor in the Saskatchewan Flower market.

Notable Products

In March 2025, the top-performing product from Ritual Green was French Cookies Pre-Roll 3-Pack (1.5g), maintaining its first-place ranking from previous months with a notable sales figure of 8252 units. Blue Pave Pre-Roll 3-Pack (1.5g) also held steady in second place, showing consistent performance across the months. Strawberry Rizz Pre-Roll 3-Pack (1.5g) made its debut in the rankings at third place, indicating a positive reception in the market. Purple Honey (3.5g) experienced a slight drop, moving from third in February to fourth in March. Blue Pave (7g) re-entered the rankings at fifth place, showcasing a resurgence in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.