Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

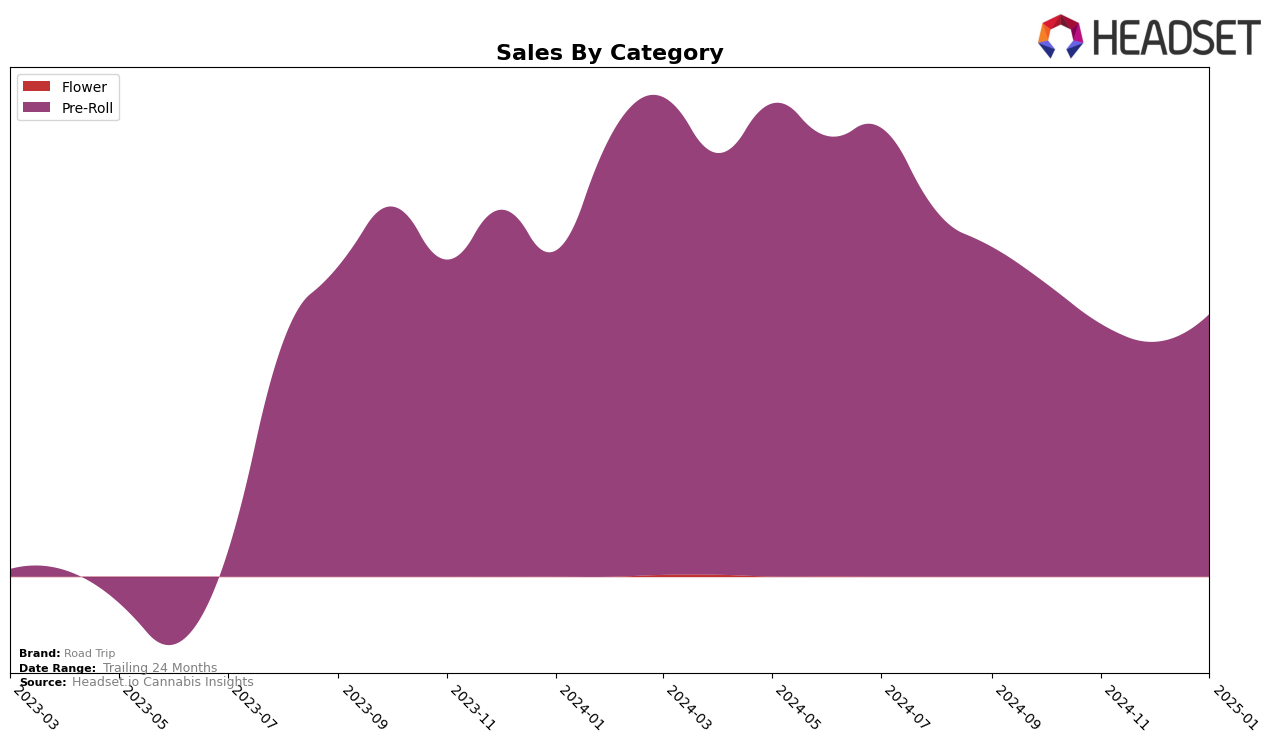

Road Trip's performance in the Pre-Roll category in Michigan shows a mix of stability and slight improvement over the observed months. Beginning at rank 20 in October 2024, the brand experienced a minor decline to rank 23 in both November and December, before bouncing back to its initial rank of 20 by January 2025. This fluctuation suggests that while Road Trip faces competition, it maintains a strong presence within the top 30 brands in Michigan's Pre-Roll category. The brand's sales figures reflect a similar pattern, with a noticeable dip in November and December, followed by a recovery in January, indicating potential seasonal influences or market dynamics affecting consumer demand.

Interestingly, the absence of Road Trip from the top 30 rankings in other states or categories could be interpreted as a strategic focus or a challenge in expanding its market presence. The brand's consistent ranking within Michigan's Pre-Roll category highlights its relative strength and consumer preference in this specific market, but it also raises questions about its performance in other regions or product lines. For stakeholders and potential investors, understanding the reasons behind this geographic and categorical concentration could provide valuable insights into Road Trip's market strategy and potential growth areas.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Michigan, Road Trip has experienced notable fluctuations in its rank and sales performance. Over the four-month period from October 2024 to January 2025, Road Trip's rank varied, starting at 20th in October, dropping to 23rd in both November and December, and then recovering to 20th in January. This indicates a resilience in maintaining a position within the top 20 despite competitive pressures. In comparison, Peninsula Cannabis showed a significant upward trend, improving its rank from 31st in October to 19th in January, suggesting a strong increase in market presence. Meanwhile, Pro Gro experienced a slight decline, moving from 17th in October to 21st in January, which could imply a decrease in consumer preference or market share. Magic and LOCO also demonstrated varying performances, with Magic showing a recovery in January after a dip in November, and LOCO maintaining a stable presence around the 18th rank. These dynamics highlight the competitive challenges and opportunities for Road Trip to strategize for improved market positioning and sales growth.

Notable Products

In January 2025, Sherblato Pre-Roll (1g) emerged as the top-performing product for Road Trip, climbing from the second position in December 2024 to secure the number one spot. This product achieved notable sales figures, generating $15,362. Blueberry Cookies Pre-Roll (1g), which was the leader in December, moved down to the second position with sales of 11,002. BrrBerry Pre-Roll (1g) made its debut in the rankings, securing the third spot, while Triple OG Pre-Roll (1g) experienced a decline, dropping to fourth place from its previous top rank in November. Lastly, Pure Michigan Pre-Roll (1g) entered the rankings for the first time, capturing the fifth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.