Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

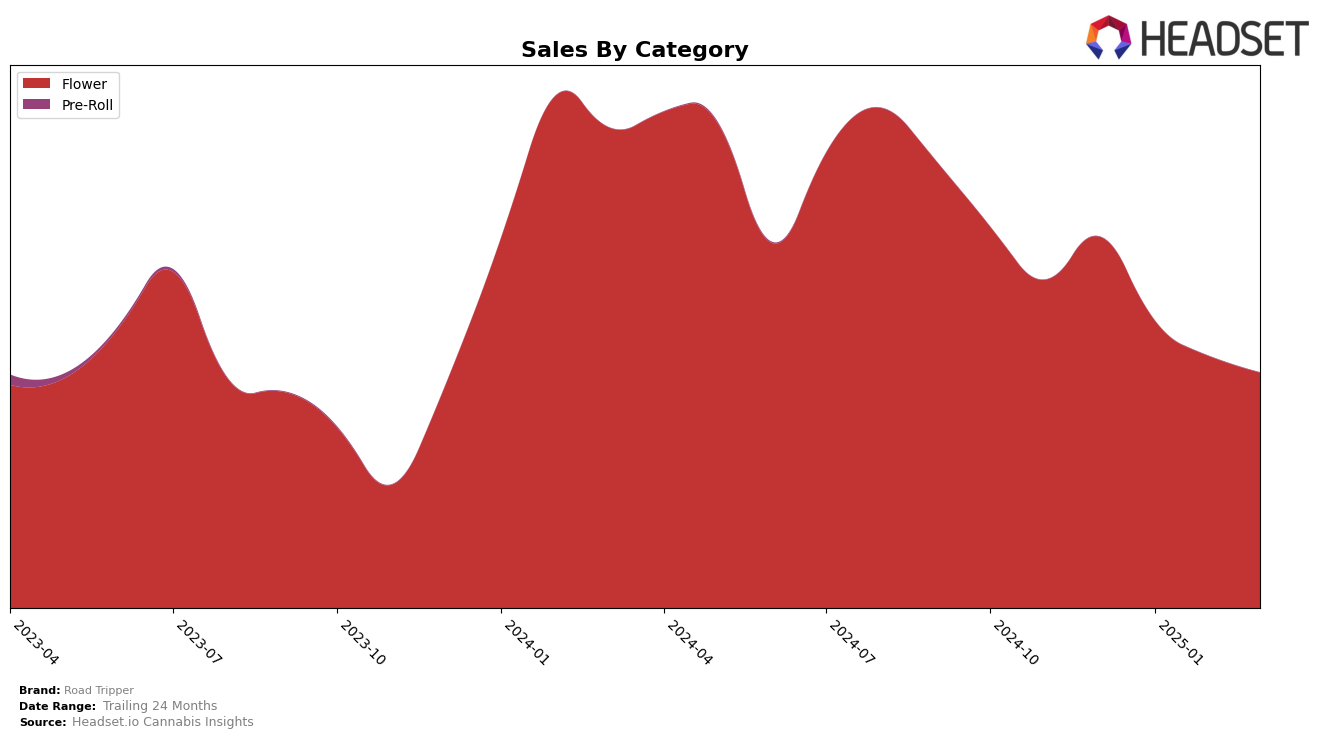

Road Tripper has shown varied performance across different states and categories. In the Flower category in Massachusetts, the brand has maintained a strong presence, though there is a slight downward trend in its rankings. Starting from a solid 5th place in December 2024, it slipped to 7th by March 2025. This movement is accompanied by a gradual decrease in sales, indicating potential challenges in maintaining its market position or increased competition in the state. Despite this decline, Road Tripper remains within the top ten, suggesting a resilient brand presence and perhaps a loyal customer base in Massachusetts.

Meanwhile, in New Jersey, Road Tripper's situation is more concerning. The brand fell out of the top 30 rankings in January 2025 and continued to drop, reaching 49th place by March 2025. The declining sales figures mirror this downward trajectory, which may indicate a need for strategic adjustments or increased marketing efforts to regain traction in this market. The lack of a top 30 presence highlights significant challenges or shifts in consumer preferences that Road Tripper needs to address to improve its standing in New Jersey's competitive landscape.

Competitive Landscape

In the competitive landscape of the Flower category in Massachusetts, Road Tripper has experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked 5th in December 2024 and January 2025, Road Tripper saw a decline to 6th place in February and further to 7th in March. This downward trend contrasts with the performance of Good Chemistry Nurseries, which improved its rank from 7th in December to 5th in February, before settling at 6th in March. Meanwhile, Ozone maintained a strong presence, fluctuating between 4th and 7th place, but ultimately ranking higher than Road Tripper in March. Glorious Cannabis Co. consistently trailed behind Road Tripper, maintaining a rank of 8th or 9th throughout the period. The sales figures reflect these rankings, with Road Tripper's sales decreasing steadily, while competitors like Good Chemistry Nurseries experienced a more stable sales trajectory. This competitive analysis highlights the dynamic shifts in brand rankings and sales, underscoring the importance for Road Tripper to strategize effectively to regain its competitive edge in the Massachusetts Flower market.

Notable Products

In March 2025, Jet Fuel (3.5g) emerged as the top-performing product for Road Tripper, moving up from the second position in January and February to first place, with notable sales of 5,030 units. Lemon Cherry Gelato #1 (3.5g) climbed to the second rank, showing a significant improvement from being unranked in February. Purple Haze (3.5g) dropped to third place after leading in February, indicating a slight decline in its dominance. Velvet Pie (3.5g) debuted in the rankings at the fourth position, while Peanut Butter Pie (3.5g) followed closely in fifth. Overall, March saw a reshuffling in the rankings, with new entries and shifts highlighting dynamic market trends within the Flower category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.