Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

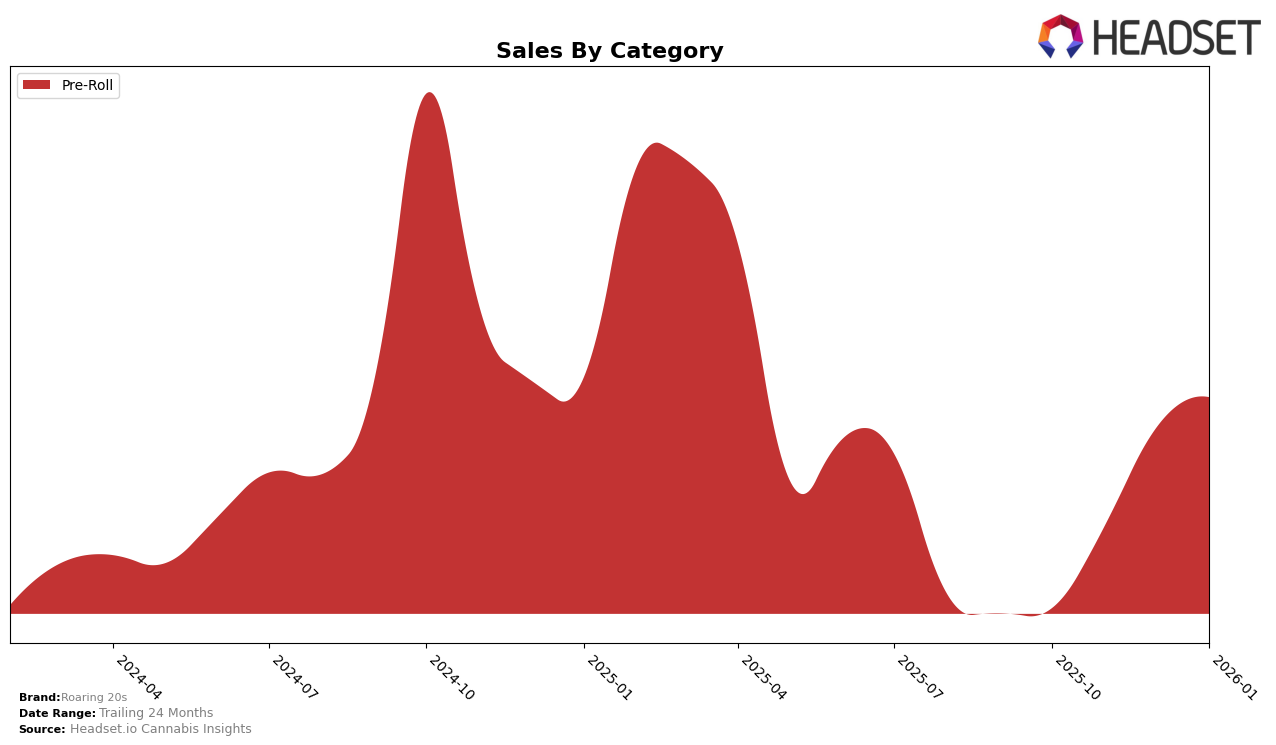

Roaring 20s has demonstrated notable growth in the Pre-Roll category within Arizona. Over the span from October 2025 to January 2026, the brand improved its ranking from 27th to 20th. This upward trend indicates a strengthening presence in the market, likely driven by strategic initiatives or consumer preference shifts. The consistent climb in rankings suggests that Roaring 20s is effectively capturing market share from competitors, which is a positive indicator of brand performance. The increase in sales from $105,376 in October 2025 to $143,963 in January 2026 further supports this upward trajectory.

However, it's important to note that Roaring 20s did not appear in the top 30 brands for any other category or state during this period. This absence could imply either a strategic focus on the Pre-Roll category in Arizona or challenges in gaining traction in other markets. The lack of presence in additional states or categories may highlight areas for potential expansion or improvement. Understanding the dynamics behind their performance in Arizona could provide insights into replicating success in other regions or categories.

Competitive Landscape

In the competitive landscape of the Arizona pre-roll category, Roaring 20s has shown a promising upward trajectory in rankings from October 2025 to January 2026. Initially outside the top 20 in October 2025, Roaring 20s climbed to the 20th position by January 2026, indicating a positive momentum in market presence. This ascent is noteworthy when compared to competitors like Presidential, which experienced a decline from 16th to 19th place, and Fade Co., which fluctuated outside the top 20 for two months before slightly recovering to 22nd place. Meanwhile, WTF Extracts maintained a relatively stable position, ending at 18th, while Charlies saw a slight dip to 21st. The consistent improvement in Roaring 20s' rank suggests a strengthening brand appeal and potential for increased sales, positioning it as a rising contender in the market.

Notable Products

In January 2026, the top-performing product from Roaring 20s was the Rest - Kosher Kush Pre-Roll 6-Pack (3g), which achieved the number one rank with sales of 1285 units. This product saw a significant leap from its fifth position in November 2025. Following closely, the Rest - Fatso Pre-Roll 6-Pack maintained its second position from December 2025, showcasing steady demand. The Rest - Wedding Cake Pre-Roll 6-Pack debuted in the rankings at third place, indicating a strong market entry. Meanwhile, the Rebalance - Gelato Pre-Roll 6-Pack improved its rank from fifth in December to fourth in January, reflecting a positive upward trend.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.