Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

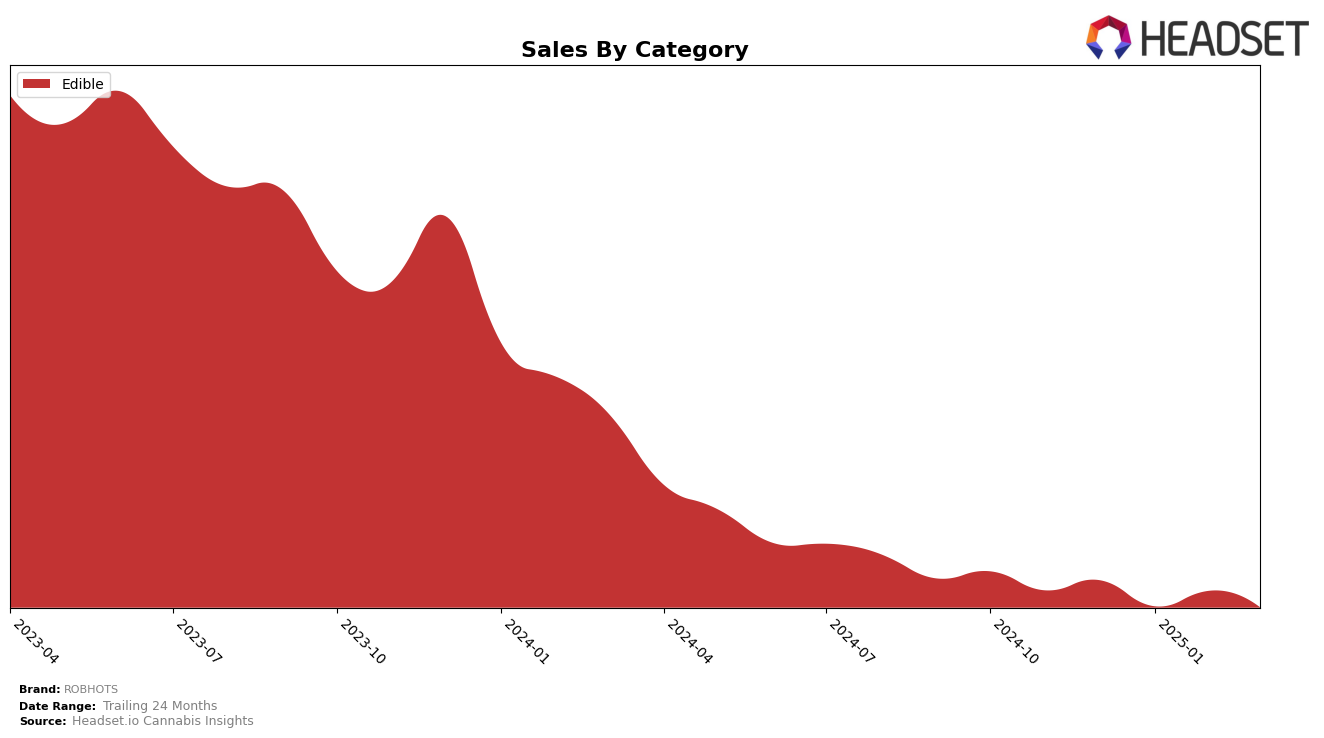

ROBHOTS has demonstrated varied performance across different states and categories, with notable trends in the edible market. In Colorado, the brand has consistently ranked 35th in the edible category from December 2024 to March 2025, indicating a stable yet unremarkable presence in the state's competitive market. The absence of ROBHOTS from the top 30 brands in Colorado suggests that while they maintain a foothold, there is significant room for growth. In contrast, Maryland shows a slightly more optimistic picture, with ROBHOTS improving its rank from 27th in December 2024 to 25th in February 2025, before settling back to 27th by March 2025. This indicates a potential for upward mobility, albeit with some fluctuations.

In Missouri, ROBHOTS has shown a stronger performance, consistently ranking within the top 20 edible brands. The brand achieved its highest rank of 16th in February 2025, though it experienced a slight dip to 18th by March 2025. This suggests that while ROBHOTS is a significant player in Missouri's edible market, maintaining and improving its position will require strategic efforts. The sales figures reflect these rankings, with Missouri consistently showing robust sales numbers compared to the other states. This performance disparity across states highlights the importance of regional strategies tailored to market dynamics and consumer preferences.

Competitive Landscape

In the competitive landscape of the edible cannabis category in Missouri, ROBHOTS has experienced fluctuations in its market position, indicating a dynamic and competitive environment. As of March 2025, ROBHOTS ranks 18th, showing a slight improvement from its 20th position in January 2025 but a decline from its peak at 16th in February 2025. This suggests a volatile market presence, potentially impacted by the performance of competitors such as Curio Wellness, which despite a drop to 20th in March, had a stronger start in January at 12th. Meanwhile, Kosmik Brands showed a similar trend to ROBHOTS, peaking at 14th in January before falling out of the top 20 in March. Missouri's Own Edibles maintained a more stable ranking, hovering around 17th and 18th, while Smokey River Cannabis demonstrated significant growth, climbing to 16th in March from 19th in January. These shifts highlight the competitive pressures ROBHOTS faces, emphasizing the need for strategic adjustments to improve its market standing amidst fluctuating sales and rankings.

Notable Products

In March 2025, the top-performing product from ROBHOTS was the CBN/THC 2:1 Night Time Gummies 10-Pack, maintaining its first-place rank consistently since December 2024, with sales reaching 6052 units. The Sour Blue Raspberry Gummies 2-Pack held steady in second place for the third consecutive month. The Plus- CBD/THC 10:1 Sour Assorted Gummies 10-Pack climbed to third place from fifth in February, indicating a positive trend in consumer preference. Greens Gummies 2-Pack remained in fourth place, showing stable performance. Meanwhile, the Pineapple Tangerine Gummies 2-Pack dropped from third to fifth place, marking a notable decline in its rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.