Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

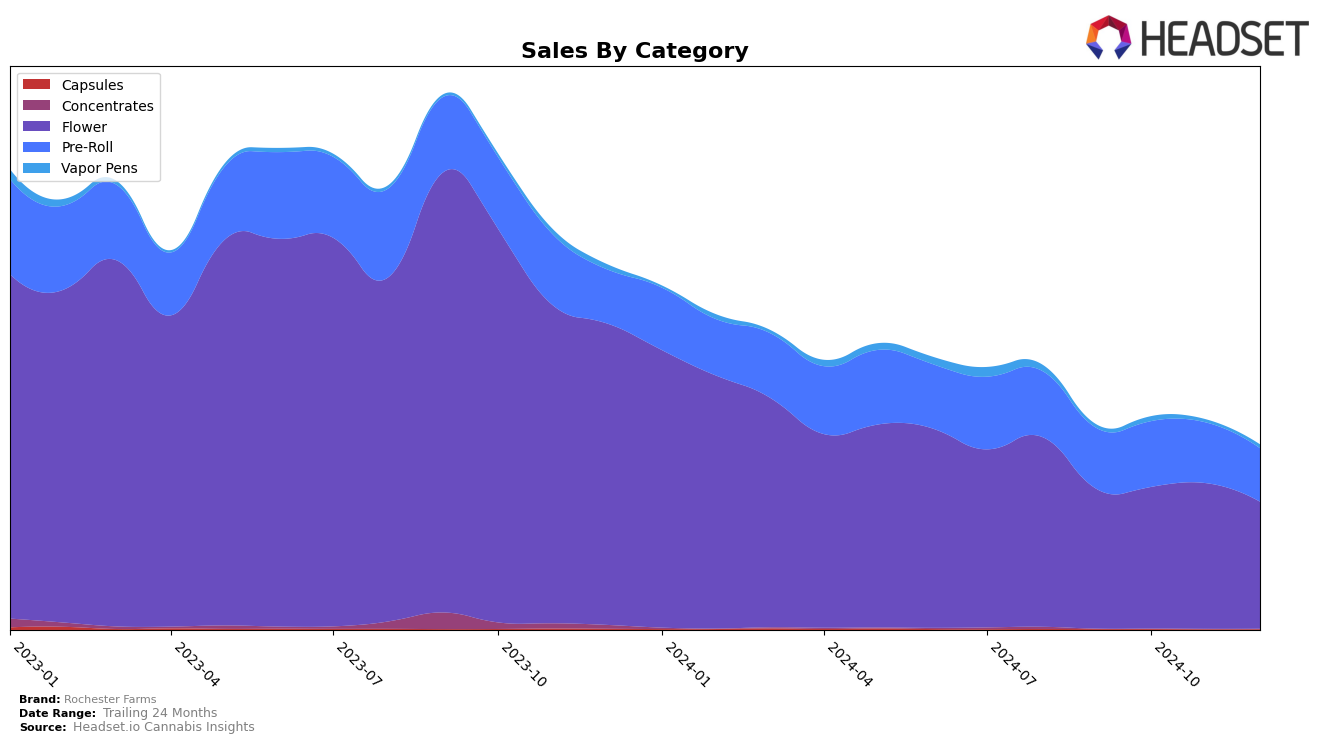

Rochester Farms has shown a consistent presence in the Washington market, particularly in the Flower and Pre-Roll categories. In the Flower category, the brand has maintained a ranking just outside the top 70, fluctuating between 70th and 77th place from September to December 2024. Although the brand did not break into the top 30, this steady performance indicates a stable customer base. Interestingly, despite a slight decline in sales from November to December, Rochester Farms has managed to keep its position relatively stable, suggesting resilience in a competitive market.

In the Pre-Roll category within Washington, Rochester Farms has experienced a similar trend, with rankings hovering in the low 70s throughout the last quarter of 2024. The brand's position ranged from 73rd to 76th, indicating consistent demand for their products. Despite not entering the top 30, the brand's ability to maintain its ranking amidst fluctuating sales figures suggests a loyal consumer base. Although the sales figures dipped in December, the brand's steady ranking reflects a potential to capitalize on future growth opportunities in this category.

Competitive Landscape

In the competitive landscape of the Washington Flower category, Rochester Farms has experienced fluctuating rankings from September to December 2024, starting at 70th and ending at 77th. Despite a slight increase in sales from October to November, Rochester Farms faced a decline in December, which contributed to its drop in rank. Notably, Toasted Cannabis (WA) maintained a stronger position, peaking at 42nd in October, although it also saw a decline by December. Meanwhile, Dog House showed a notable improvement in October, surpassing Rochester Farms, but eventually fell back to a similar rank by December. From the Soil demonstrated a significant upward trend, ending December ahead of Rochester Farms, while Equinox Gardens remained consistently competitive, albeit with some fluctuations. These dynamics indicate a highly competitive market where Rochester Farms needs to strategize to regain and improve its standing.

Notable Products

In December 2024, Blueberry Muffin Pre-Roll 2-Pack (1.5g) emerged as the top-performing product for Rochester Farms, reclaiming its number one rank from September with a notable sales figure of 881 units. Emergen-C Pre-Roll 2-Pack (1.5g) secured the second position, showing a consistent performance improvement since September when it was ranked fourth. Grandmaster Sexy Pre-Roll 2-Pack (1.5g) moved to third place, up from its fifth position in October. Runtz S1 #2 Pre-Roll 2-Pack (1.5g) made its debut in the rankings at fourth place. Meanwhile, Pink Lemonaid (3.5g), which held the top spot in October and November, dropped to fifth place in December.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.