Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

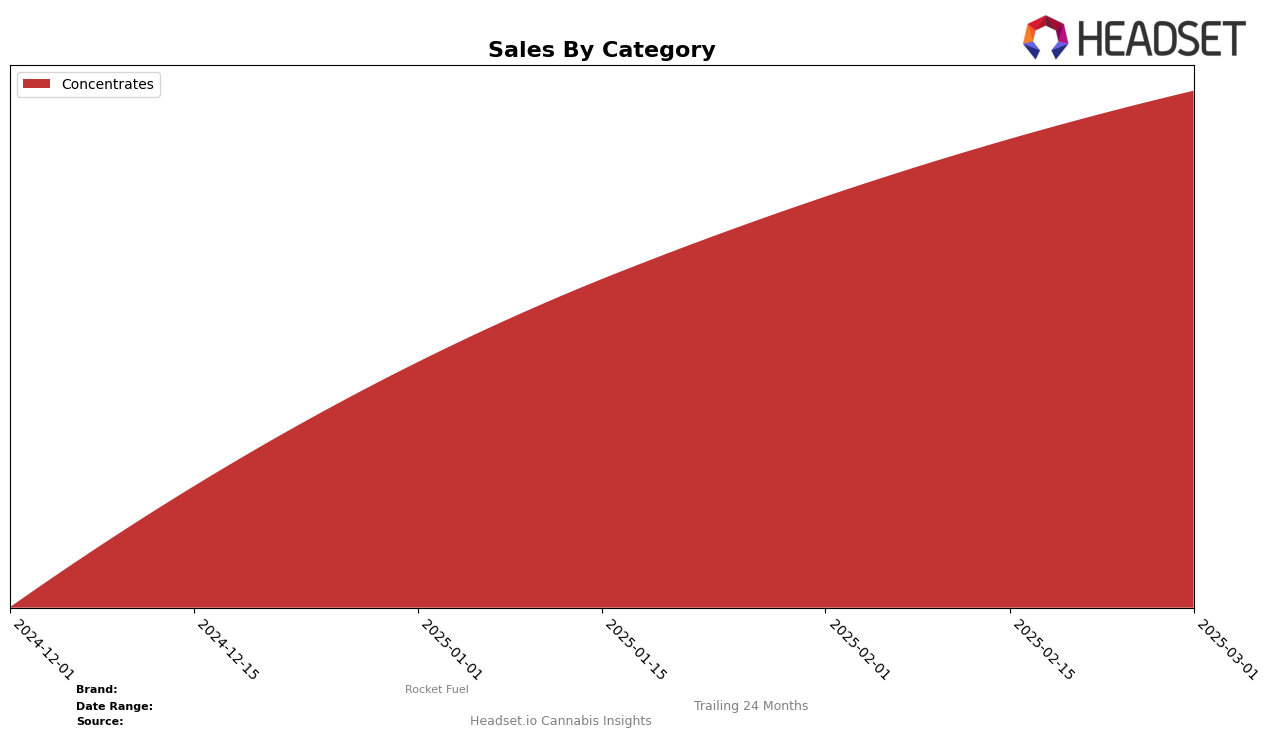

Rocket Fuel has demonstrated a remarkable performance in the Concentrates category in Michigan. Starting from a position outside the top 30 in December 2024, the brand quickly climbed to the 6th spot by January 2025. By February, Rocket Fuel had ascended to the 2nd position, maintaining this rank in March 2025. This rapid ascent highlights a significant increase in market presence and consumer preference within a short period. The brand's growth trajectory in Michigan's Concentrates category is indicative of a strong competitive strategy and effective market penetration.

While Rocket Fuel's performance in Michigan is noteworthy, it is also important to consider how the brand is faring in other states and categories. The absence of rankings in categories or states beyond Michigan suggests that Rocket Fuel may not have a significant footprint outside this region or category. This could present both a challenge and an opportunity for the brand to explore expansion strategies in other markets. Such strategic moves could potentially replicate the success seen in Michigan, further solidifying Rocket Fuel's position in the broader cannabis industry.

Competitive Landscape

In the Michigan concentrates category, Rocket Fuel has demonstrated a remarkable upward trajectory in brand ranking and sales performance over the recent months. Starting from a position outside the top 20 in December 2024, Rocket Fuel catapulted to the 6th rank by January 2025 and further climbed to the 2nd position by February and March 2025. This rapid ascent in ranking is indicative of a significant increase in consumer preference and market penetration, as evidenced by the substantial growth in sales from December 2024 to March 2025. In contrast, Common Citizen maintained a steady but less dramatic rise, moving from 9th to 4th place over the same period, while The Limit consistently held the top spot, albeit with a slight decline in sales. Meanwhile, Wojo Co remained stable at the 3rd rank. Rocket Fuel's impressive performance suggests a strong competitive edge and growing brand loyalty, positioning it as a formidable contender in the Michigan concentrates market.

Notable Products

In March 2025, Rocket Fuel's top-performing product was Runtz Live Resin (1g) in the Concentrates category, which ascended to the number 1 rank with sales reaching $22,027. Banana Daddy Live Resin (1g) maintained its strong performance, holding steady at rank 2, showing consistent demand over the past few months. Melonade Live Resin (1g) climbed back into the rankings at position 3, showing a significant improvement from its absence in the previous months. Cherrylicious Live Resin (1g) slightly dropped to rank 4 but still showed robust sales figures. Permanent Marker Live Resin (1g) rounded out the top 5, indicating a gradual decline from its top spot in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.