Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

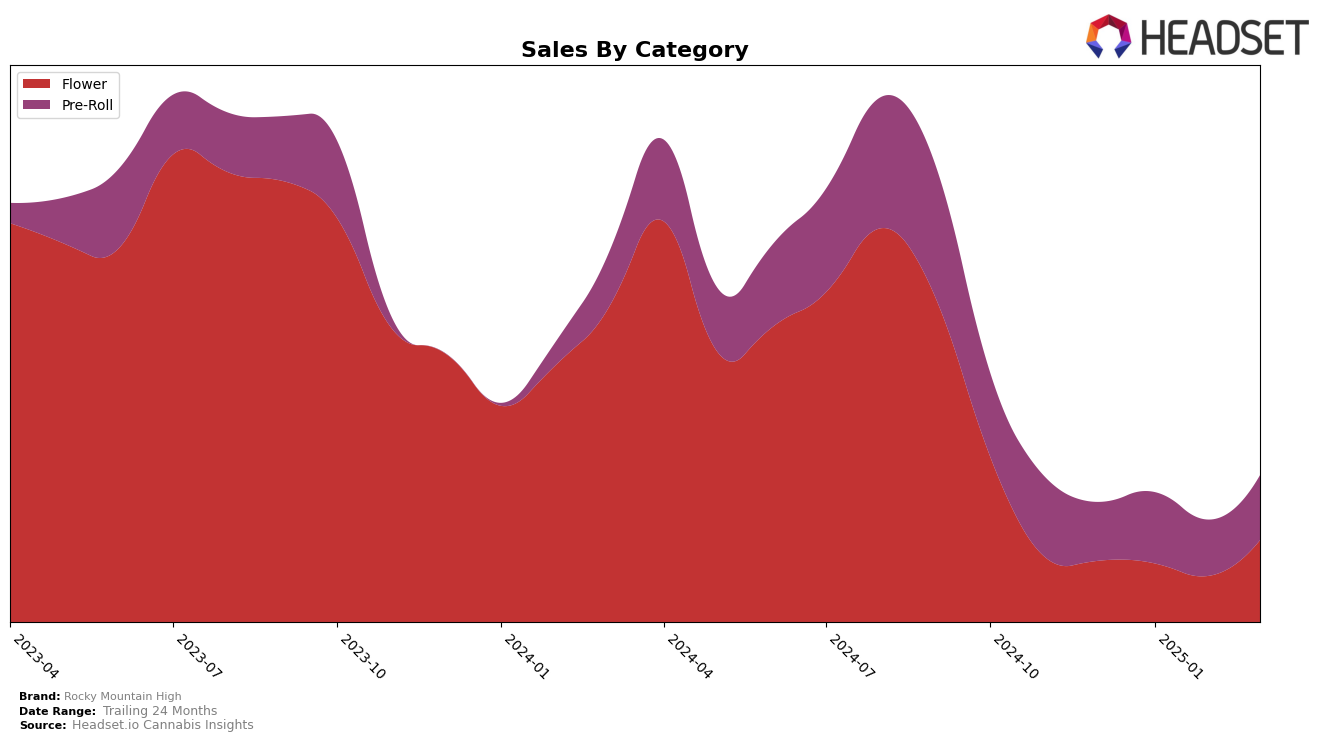

Rocky Mountain High has demonstrated interesting dynamics in its performance across different categories and states. In the Colorado market, the brand's Flower category showed a significant improvement in its ranking from December 2024 to March 2025, moving from 60th to 52nd position. This upward trend is particularly noteworthy considering the brand did not make it into the top 30 rankings, indicating a competitive landscape in the Flower category. Despite this, the sales figures suggest a positive trajectory, with a marked increase in March 2025 compared to the previous months.

In contrast, the Pre-Roll category for Rocky Mountain High in Colorado has consistently performed better, maintaining a spot within the top 30 brands. Starting at 30th in December 2024 and advancing to 23rd by March 2025, this category shows a steady upward movement. This consistent performance in the Pre-Roll category could be indicative of a stronger market presence or consumer preference in this segment. The sales data supports this trend, with fluctuations but overall positive movement in the early months of 2025, suggesting a strategic area of growth for the brand in this category.

Competitive Landscape

In the competitive landscape of the Flower category in Colorado, Rocky Mountain High has demonstrated a noteworthy upward trend in its rankings, moving from 60th place in December 2024 to 52nd by March 2025. This improvement is indicative of a strategic gain in market presence, especially when compared to brands like Viola, which also showed a positive trajectory but started from a much lower rank, climbing from 92nd to 54th. Meanwhile, The Colorado Cannabis Co. experienced a decline, dropping from 29th in February to 48th in March, potentially opening opportunities for Rocky Mountain High to capture some of their market share. Additionally, NOBO has shown a strong comeback, jumping from 50th to 45th, which could pose a competitive threat if their momentum continues. Overall, Rocky Mountain High's consistent sales growth, culminating in a peak in March, suggests a robust market strategy that is effectively positioning it against its competitors in the Colorado Flower market.

Notable Products

In March 2025, the top-performing product for Rocky Mountain High was Animal Face x Kush Mints #11 Pre-Roll (0.5g) in the Pre-Roll category, maintaining its first-place ranking from previous months with sales reaching 2982 units. Chem De La Chem Pre-Roll (0.5g) emerged as a strong contender, ranking second, marking its debut in the top rankings this month. Tina's Cookies Pre-Roll (1g) secured the third spot, also making its first appearance in the rankings. Taffie Pre-Roll (1g) followed closely in fourth place, while Double Rainbow Pre-Roll (1g) rounded out the top five. Notably, the rankings saw significant changes with new entries, indicating a shift in consumer preferences for March 2025.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.