Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

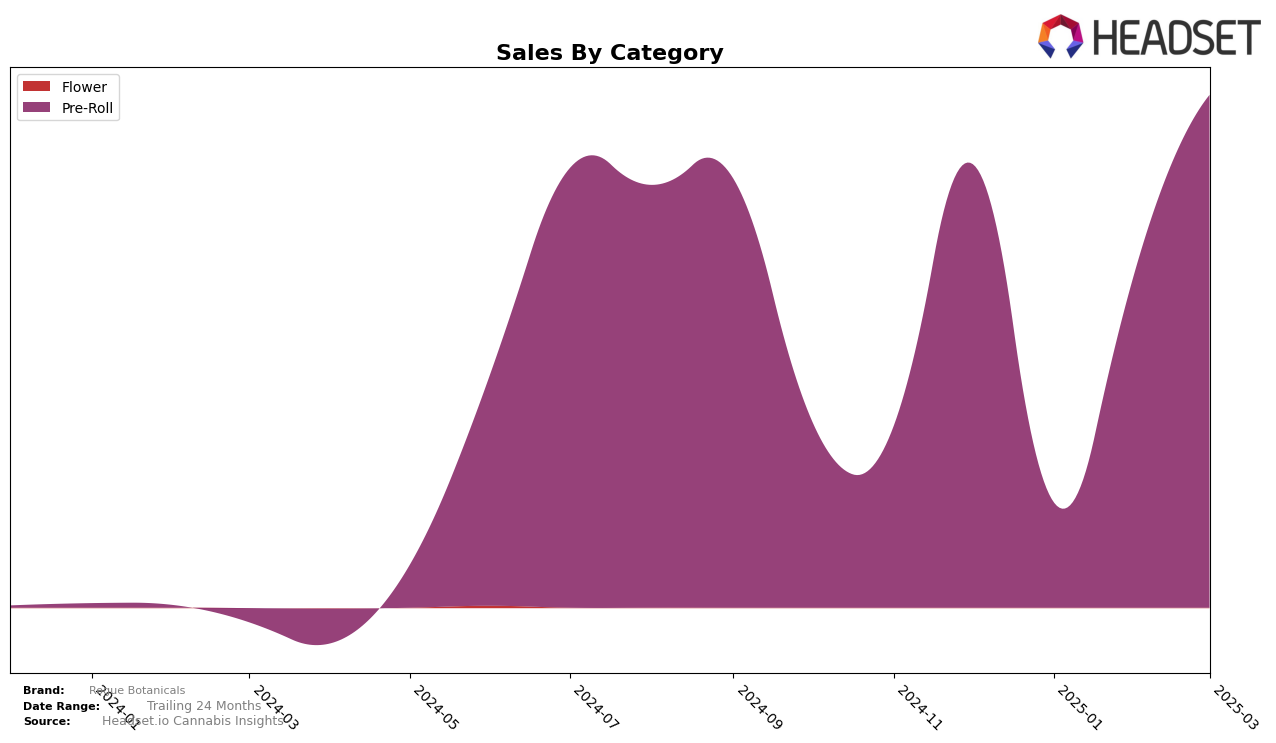

Rogue Botanicals has shown a dynamic performance across various categories and states, with notable fluctuations in their rankings. In the Pre-Roll category in Saskatchewan, the brand experienced significant movements over the months. Starting at the 22nd position in December 2024, they slipped out of the top 30 in January 2025, indicating a challenging period. However, they made a remarkable recovery in February, climbing to the 15th position, and further improved to 11th in March 2025. This upward trajectory suggests a strong comeback, reflecting strategic adjustments or market conditions favoring Rogue Botanicals in recent months.

The absence of Rogue Botanicals in the top 30 rankings in January 2025 for the Saskatchewan Pre-Roll category could be seen as a setback, potentially indicating increased competition or a temporary dip in consumer interest. However, their ability to rebound strongly in the following months is noteworthy. While the specific sales figures for each month reveal some fluctuations, the overall trend suggests a positive movement. This resilience and adaptability in a competitive market like Saskatchewan highlight the brand's potential for growth and sustained presence in the industry. For a deeper dive into their performance and strategic maneuvers, further analysis would be required, especially in comparison to other categories and states where they operate.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Saskatchewan, Rogue Botanicals has demonstrated a notable shift in its market position from December 2024 to March 2025. Initially ranked 22nd in December, Rogue Botanicals experienced a significant drop to 49th in January, indicating a challenging start to the year. However, the brand made a remarkable recovery, climbing to 15th in February and further improving to 11th by March. This upward trajectory suggests a positive response to market dynamics or strategic adjustments. In contrast, Kingsway maintained a relatively stable presence, fluctuating between 12th and 18th place, while MTL Cannabis showed some volatility, peaking at 6th but dropping to 10th by March. Space Race Cannabis and Rizzlers also demonstrated competitive performances, with Space Race Cannabis achieving a notable 9th place in March. These dynamics highlight the competitive pressures and opportunities within the Saskatchewan Pre-Roll market, with Rogue Botanicals' recent gains suggesting potential for continued growth and increased market share.

Notable Products

In March 2025, the top-performing product for Rogue Botanicals was the Cambodian Pre-Roll 4-Pack (2g) in the Pre-Roll category, maintaining its position as the number one ranked product for four consecutive months. This product achieved notable sales of 4,615 units, reflecting a significant increase from previous months. The consistent top ranking underscores its popularity and strong market presence. Comparatively, its sales figures have shown a remarkable upward trend since December 2024. Such performance highlights the product's dominance and potential customer preference in the market.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.