Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

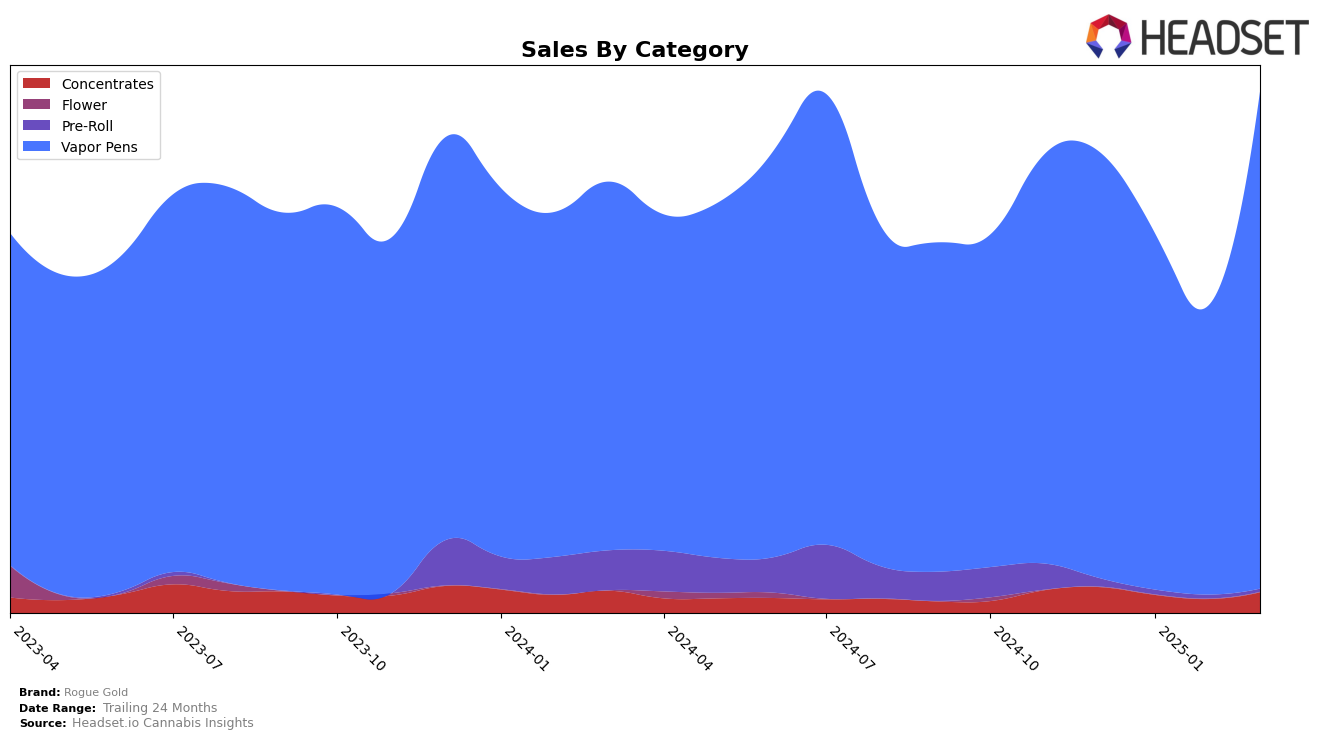

Rogue Gold's performance in the state of Oregon shows a mixed trajectory across different product categories. In the Concentrates category, the brand has struggled to break into the top 30, with rankings hovering around the mid-40s to low-50s from December 2024 to March 2025. This indicates a challenging market position in Concentrates, as they were unable to secure a top spot. However, there was a notable increase in sales in March 2025 compared to February 2025, suggesting some positive movement despite the overall lower rankings.

Conversely, Rogue Gold has shown a strong presence in the Vapor Pens category in Oregon. The brand maintained a top-20 position throughout the observed months and made a significant leap to 11th place in March 2025. This upward trend in rankings corresponds with a substantial increase in sales, indicating a solid consumer base and effective market strategies in this category. The brand's ability to climb the ranks in Vapor Pens suggests potential for further growth and market penetration, contrasting with their performance in Concentrates.

Competitive Landscape

In the Oregon Vapor Pens category, Rogue Gold has demonstrated a significant fluctuation in its market position over the past few months. Starting from a rank of 13 in December 2024, Rogue Gold saw a decline to 16 and 18 in January and February 2025, respectively, before making a notable recovery to rank 11 in March 2025. This recovery is particularly impressive given the competitive landscape, where brands like Farmer's Friend Extracts consistently maintained higher ranks, ranging from 7 to 10, and Gem Carts also showed stable performance with ranks between 9 and 13. Despite the initial decline in sales, Rogue Gold's March sales figures indicate a strong rebound, surpassing competitors such as Echo Electuary, which also experienced fluctuations but ended with a lower rank. This suggests that Rogue Gold's strategic adjustments may have effectively addressed earlier challenges, positioning it for potential growth in the coming months.

Notable Products

In March 2025, the top-performing product for Rogue Gold was the Tigers Blood Flavored Oil Cartridge (1g) in the Vapor Pens category, maintaining its first-place ranking from February with sales reaching 3351 units. The Blueberry Flavored Oil Cartridge (1g) held steady in second place, showing an increase in sales from February to March. The Grandi Guava Distillate Cartridge (1g) debuted impressively in the third position with 2537 units sold. Sweet Strawberry Flavored Oil Cartridge (1g) improved its ranking from fifth in February to fourth in March. Meanwhile, the Orange Cream Flavored Oil Cartridge (1g) slipped from third in February to fifth in March, despite an increase in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.