Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

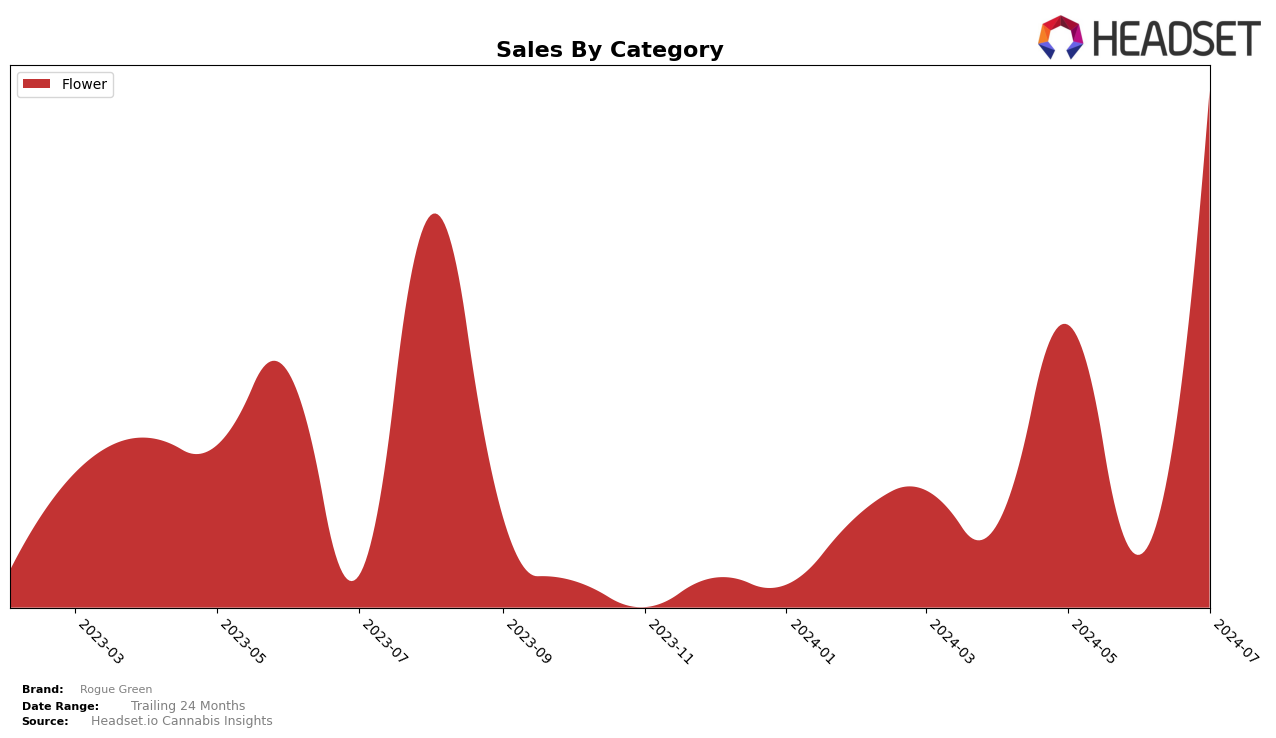

Rogue Green has demonstrated a notable performance in the Missouri market, particularly within the Flower category. In April 2024, the brand was ranked 43rd, which indicated a relatively low presence. However, by July 2024, Rogue Green had ascended to the 18th position, showcasing a significant upward trajectory. This substantial improvement suggests effective strategies or market conditions favoring their products. The brand's sales figures also reflect this positive trend, with a remarkable increase from $141,007 in April to $740,850 in July. The data highlights Rogue Green's ability to capitalize on market opportunities and improve its competitive stance within a short span.

Despite the promising performance in Missouri, Rogue Green's absence from the top 30 rankings in other states and categories could be seen as a point of concern. Without a presence in the top 30 for the Flower category in other states, the brand may be missing out on potential market shares elsewhere. This absence underscores the need for Rogue Green to explore and possibly expand its reach beyond Missouri to build a more diversified and resilient market presence. The brand's current focus on Missouri could be a strategic move, but the lack of ranking in other regions suggests there is room for growth and opportunities that are yet to be tapped.

Competitive Landscape

In the competitive landscape of the Flower category in Missouri, Rogue Green has shown a remarkable upward trajectory in recent months. After struggling to break into the top 20 earlier in the year, Rogue Green made a significant leap from rank 40 in June 2024 to rank 18 in July 2024. This surge is notable when compared to competitors like Cloud Cover (C3), who experienced a more stable but less dramatic climb, reaching rank 19 in July 2024. Similarly, C4 / Carroll County Cannabis Co. and Nuthera Labs have shown fluctuating ranks, with C4 / Carroll County Cannabis Co. dropping to rank 20 in July 2024 and Nuthera Labs maintaining a relatively steady position around rank 16. Meanwhile, Daybreak Cannabis saw a decline from rank 13 in June 2024 to rank 17 in July 2024. Rogue Green's rapid ascent suggests a strong market response to their offerings, positioning them as a rising star in the Missouri Flower market.

Notable Products

For Jul-2024, the top product from Rogue Green was Goombas (3.5g) in the Flower category, which saw a significant increase in sales to 10,021 units, rising from 3rd place in Jun-2024. WD 40 (3.5g) maintained its 2nd place ranking with steady sales. Lemon Barz (3.5g), previously the top seller, dropped to 3rd place. Mendo Breath (3.5g) remained consistent in 4th place, while Gary Peyton (3.5g) re-entered the rankings at 5th place. Notably, Goombas (3.5g) experienced a remarkable sales surge compared to earlier months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.