Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

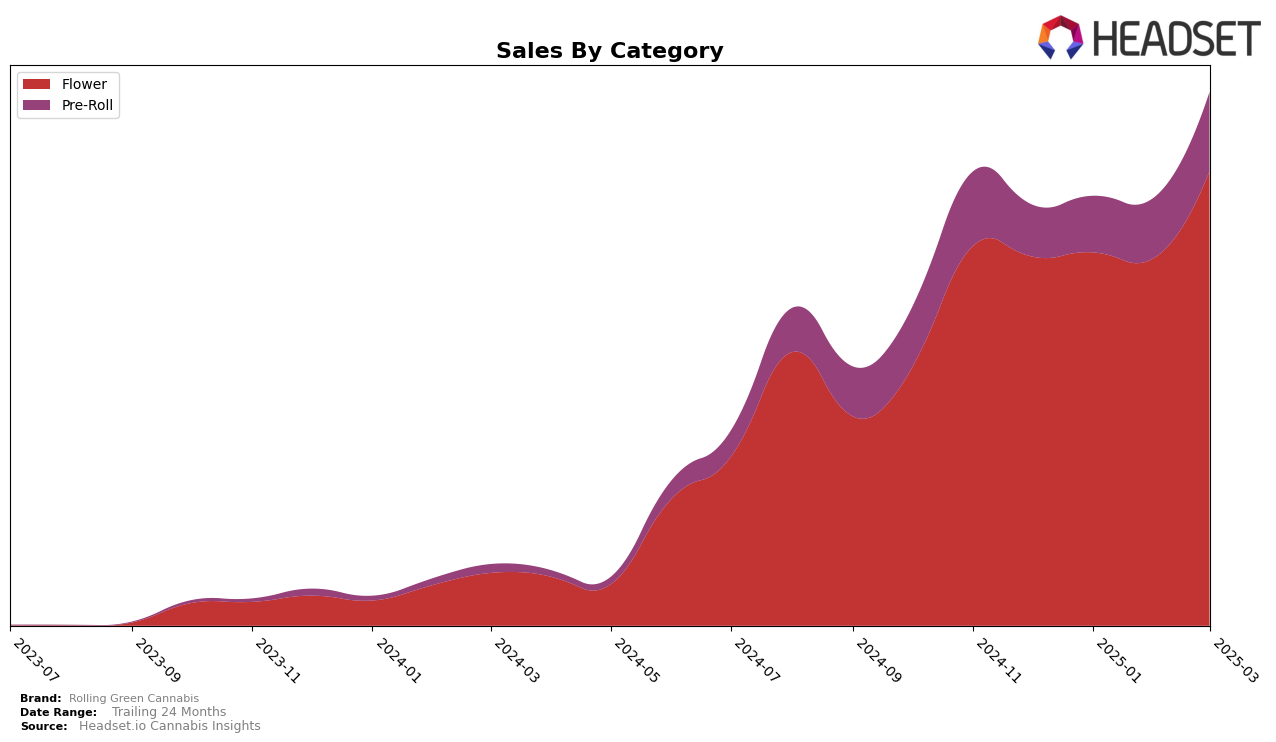

Rolling Green Cannabis has shown notable performance across different product categories in New York. In the Flower category, the brand has consistently improved its ranking, moving from 5th place in December 2024 to 3rd place by March 2025. This upward trend is supported by a significant increase in sales, with March 2025 sales reaching $1,635,370. Such growth indicates a strong consumer preference and effective market strategies in the Flower category. However, the Pre-Roll category tells a different story, where Rolling Green Cannabis started at 27th place in December 2024 but managed to climb to 15th place by March 2025. This improvement suggests a growing acceptance and popularity of their Pre-Roll products, although they still have room to strengthen their position further in this category.

Despite not being in the top 30 brands in some states and categories, the brand's performance in New York is promising, particularly when considering their advancement in rankings over just a few months. The Flower category, in particular, is a standout success, reflecting a strategic focus that has paid off. On the other hand, while the Pre-Roll category shows progress, the initial lower ranking indicates that there may have been challenges or a slower start in capturing market share. This mixed performance across categories highlights the importance of targeted strategies to capitalize on strengths while addressing weaker areas to ensure continued growth and competitiveness in the market.

Competitive Landscape

In the highly competitive New York flower category, Rolling Green Cannabis has demonstrated a promising upward trajectory in recent months. From December 2024 to March 2025, the brand improved its rank from 5th to 3rd, indicating a strengthening market position. This positive shift is particularly notable when compared to competitors such as Find., which fluctuated between 3rd and 5th place during the same period, and The Plug Pack, which made a remarkable leap from outside the top 20 in December to 5th place by March. Despite the dominance of Dank. By Definition consistently holding the top spot, Rolling Green Cannabis's sales growth, particularly in March 2025, suggests a robust demand for their products, positioning them well against established players like LivWell, which maintained a stable 2nd place ranking. This trend indicates that Rolling Green Cannabis is effectively capturing market share and could continue to climb the ranks if the momentum persists.

Notable Products

In March 2025, the top-performing product for Rolling Green Cannabis was Blue Dream Pre-Roll (1g), maintaining its number one rank from February, with impressive sales of 6154 units. Guava Jam Pre-Roll (1g) also retained its second-place position from the previous month, showcasing strong sales figures of 5914 units. White Wedding Pre-Roll (1g) climbed to third place, improving from its fourth-place rank in February, indicating a positive trend in its popularity. Black Amber (3.5g) entered the rankings at fourth place, showing a significant increase in sales compared to its previous appearance in January. Lemon Cherry Gelato (3.5g) debuted in the rankings, securing the fifth position, suggesting a growing interest in this new product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.