Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

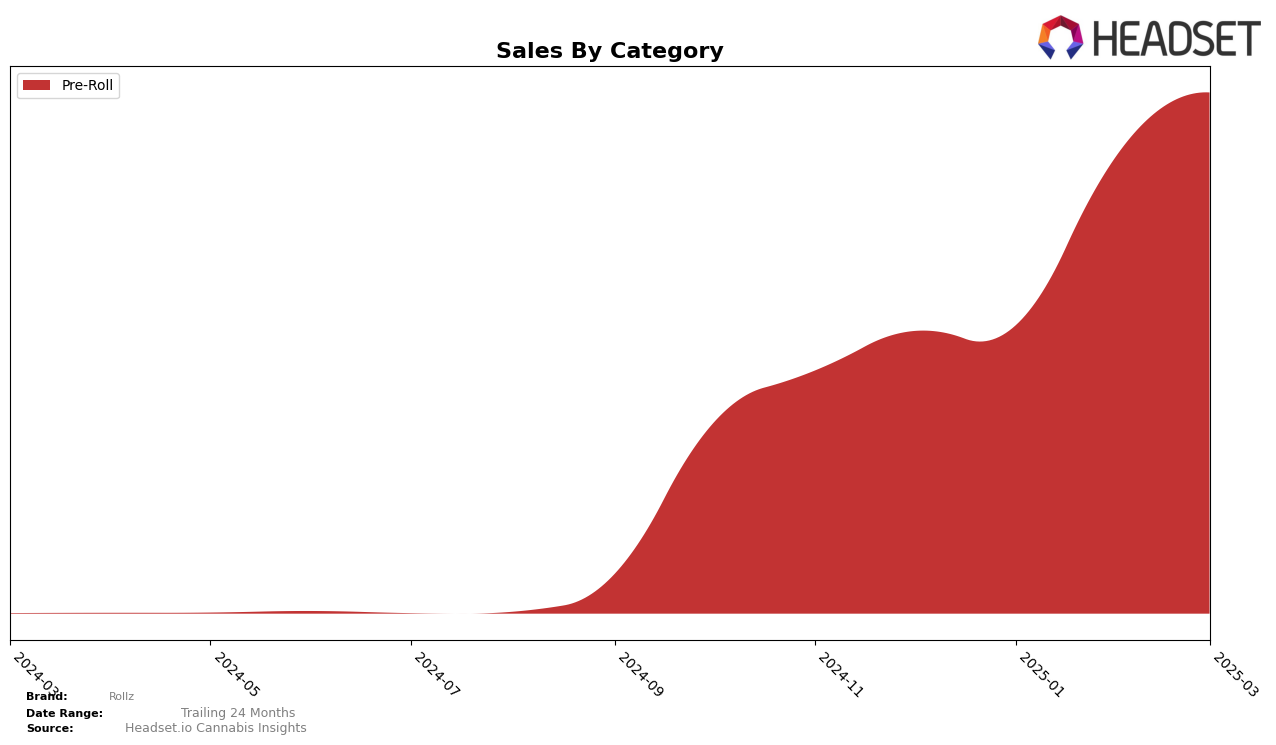

Rollz has demonstrated a notable performance in the Pre-Roll category within the state of Michigan. Over the first quarter of 2025, the brand showed a consistent upward trend, moving from a rank of 16 in December 2024 to 11 by March 2025. This steady climb in the rankings indicates a strengthening market presence and suggests that Rollz is effectively capturing consumer interest in Michigan's competitive pre-roll segment. The sales figures corroborate this positive trajectory with a significant increase from January to March, highlighting a successful strategy in this particular market.

However, it's important to note that Rollz's absence from the top 30 rankings in other states or categories suggests that their current market penetration might be limited geographically or by product line. This could be seen as a potential area for growth, but also a challenge if they aim to expand their footprint beyond Michigan. The focus on Michigan's pre-roll market could be a strategic choice, allowing Rollz to consolidate its position before exploring other opportunities. Understanding the factors driving their success in Michigan might provide valuable insights for replicating this performance in other regions.

Competitive Landscape

In the competitive landscape of the pre-roll category in Michigan, Rollz has shown a dynamic performance in recent months. Starting from December 2024, Rollz was ranked 16th, and by February 2025, it had climbed to the 10th position, showcasing a significant improvement in its market standing. However, in March 2025, Rollz experienced a slight dip, moving to the 11th position. This fluctuation in rank is mirrored in its sales performance, which saw a notable increase from January to February 2025, followed by a stabilization in March. Competitors such as Pro Gro and Muha Meds have also been active, with Pro Gro advancing from 19th to 10th place over the same period, indicating a robust upward trajectory. Meanwhile, Rare Michigan Genetics made a remarkable leap from 35th in December 2024 to 13th by March 2025, suggesting an aggressive market penetration strategy. Consistent performers like HY-R maintained their 9th position throughout, highlighting their steady market presence. For Rollz, maintaining its competitive edge will require strategic initiatives to counter the rapid advancements of its competitors and capitalize on its recent sales momentum.

Notable Products

In March 2025, Pineapple Express Infused Pre-Roll (1g) emerged as the top-performing product for Rollz, with sales reaching 24,832 units. Ice Cream Cookies Infused Pre-Roll (1g) climbed to the second position from third in February, indicating a consistent upward trend in its popularity. Boomstick - Sour Mango Diamond Infused Pre-Roll (1g) secured the third spot, having dropped from its second position in January. Strawberry Cough Diamond Infused Pre-Roll (1g) maintained its fourth position from February, showcasing stable demand. Blue Widow Infused Pre-Roll (1g) experienced a drop from first in February to fifth in March, suggesting a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.