Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

Rooted (MO) has demonstrated notable performance in the Arizona market, particularly in the Flower category. Despite not breaking into the top 30 brands initially, Rooted (MO) made significant strides from December 2024 to March 2025, improving its rank from 66th to 43rd. This upward trajectory is underscored by a substantial increase in sales, which more than doubled from December to January. Such progress signifies a strengthening presence in the Arizona Flower category, although there remains room for further growth to secure a top 30 position.

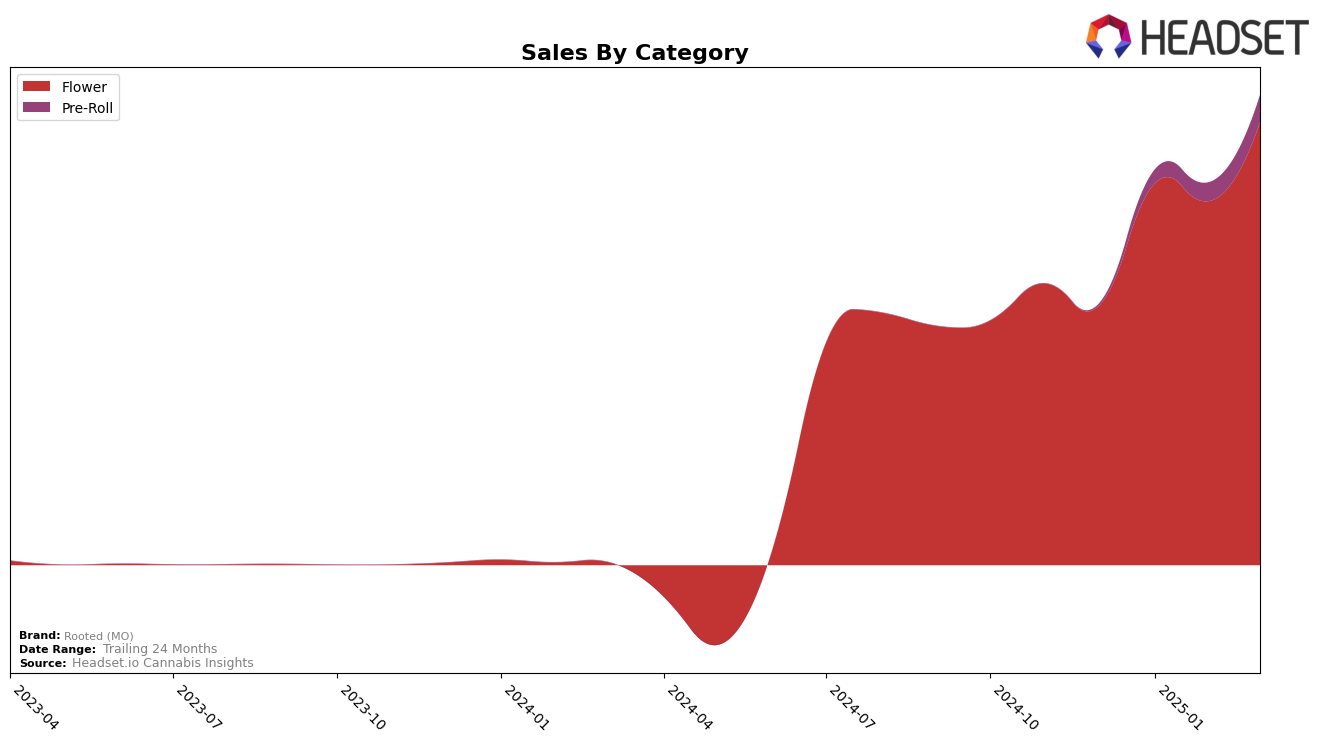

In Missouri, Rooted (MO) has established a strong foothold in both the Flower and Pre-Roll categories. The brand consistently held a top 20 position in the Flower category, climbing from 19th to 11th place by March 2025. This ascent is reflected in their sales, which saw a notable increase in March compared to previous months. In the Pre-Roll category, Rooted (MO) entered the rankings in January 2025 at 47th and improved to 37th by March. While their position in the Pre-Roll category indicates potential, the brand's robust performance in the Flower category highlights its primary strength in the Missouri market.

Competitive Landscape

In the competitive landscape of the Missouri Flower category, Rooted (MO) has demonstrated a promising upward trajectory in terms of rank and sales from December 2024 to March 2025. Initially ranked 19th in December 2024, Rooted (MO) climbed to the 11th position by March 2025, showcasing a significant improvement in its market standing. This upward movement is particularly notable when compared to brands like Local Cannabis Co., which fluctuated between 9th and 11th place, and Elevate (Elevate Missouri), which saw a decline in rank, dropping out of the top 20 in February before recovering to 12th in March. Meanwhile, Greenlight and Daybreak Cannabis maintained relatively stable positions, with Daybreak Cannabis consistently ranking 9th. Rooted (MO)'s sales growth aligns with its rank improvement, indicating a robust market performance that positions it favorably against its competitors in the Missouri Flower market.

Notable Products

In March 2025, Wedding Cake (3.5g) maintained its position as the top-performing product for Rooted (MO), with sales reaching 5,577 units, marking a consistent lead since January 2025. Do Si Dos (3.5g) held steady in the second position, showing an upward trend from its third rank in January 2025. Ozark Hash (3.5g) improved its rank to third from fourth in February 2025, indicating a positive sales trajectory. Dark Starz (3.5g) experienced a slight decline, dropping to fourth place from its previous third position in February 2025. Acid Dough (3.5g) made its debut in the rankings at the fifth position, highlighting its entry into the top-performing products for the first time.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.