Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

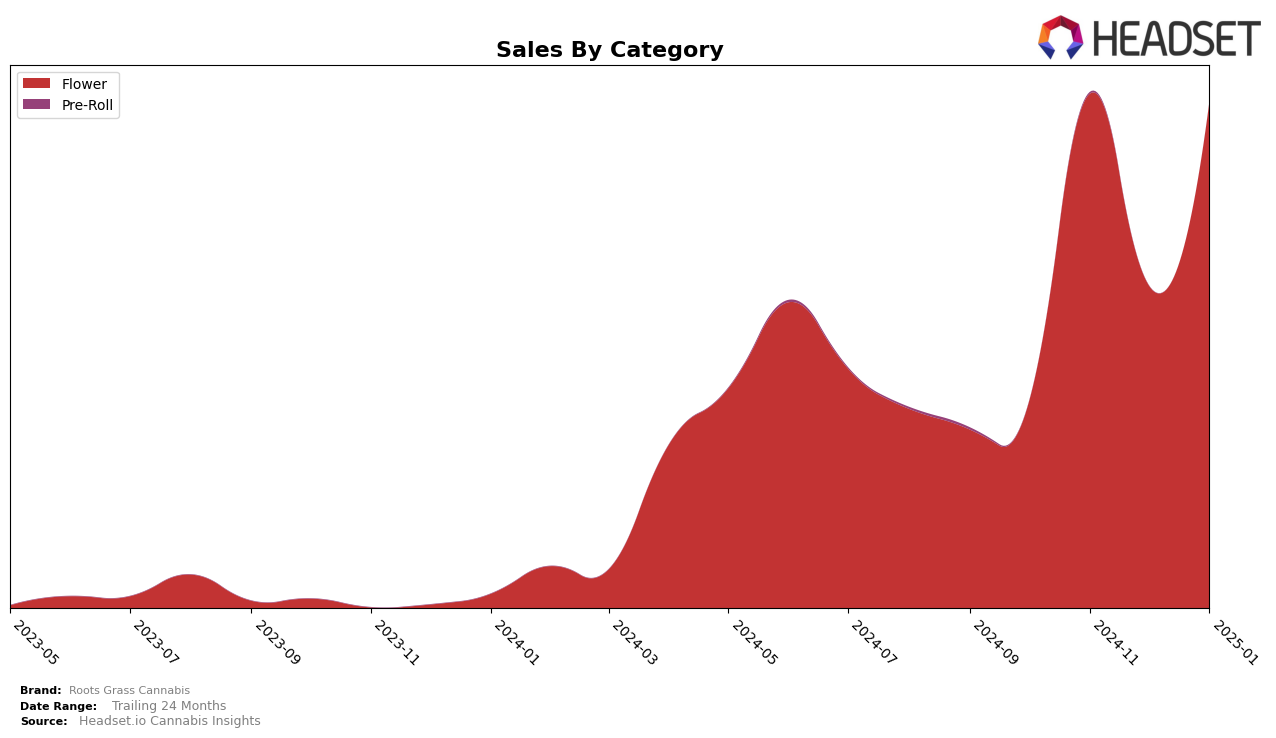

Roots Grass Cannabis has shown a notable performance in the Oregon market, particularly in the Flower category. In October 2024, the brand was ranked 66th, but by November, it had climbed to 24th place, indicating a significant upward trajectory. This rise in ranking suggests a strong market presence and growing consumer preference. However, December saw a slight dip to 41st place, but the brand quickly rebounded in January 2025, achieving a 26th place ranking. This fluctuation highlights the competitive nature of the market and the brand's resilience in maintaining a strong position despite challenges.

It is worth noting that the brand did not appear in the top 30 rankings in October 2024, which could be seen as a setback. However, the subsequent months demonstrated a positive trend with substantial sales growth, especially from October to November. The sales figures reflect a dynamic market strategy that could be driving consumer engagement and brand loyalty. While the exact strategies behind these movements are not detailed here, the data suggests that Roots Grass Cannabis is making strategic moves to enhance its market share in Oregon. This provides a glimpse into the shifting landscape of the cannabis market and the potential for brands to capitalize on emerging opportunities.

Competitive Landscape

In the competitive landscape of the Flower category in Oregon, Roots Grass Cannabis has demonstrated notable fluctuations in rank over recent months. Starting from a rank of 66 in October 2024, Roots Grass Cannabis made a significant leap to 24 in November 2024, indicating a strong surge in market presence and sales performance. However, this momentum was not sustained as the brand's rank slipped to 41 in December 2024 before recovering slightly to 26 in January 2025. This volatility contrasts with competitors like Earl Baker, which showed a more stable performance, peaking at rank 19 in December 2024. Meanwhile, Growing Up also displayed a significant rank improvement from being outside the top 20 to reaching 24 in January 2025. The fluctuation in Roots Grass Cannabis's rank suggests a competitive market environment, where maintaining a consistent upward trajectory is challenging, yet the brand's ability to rebound in January 2025 indicates potential resilience and adaptability in its strategies.

Notable Products

In January 2025, Northern Lights (Bulk) from Roots Grass Cannabis emerged as the top-performing product with impressive sales of 10,103 units, climbing from its previous rank of 4 in December 2024. Caffeine (Bulk) secured the second position, marking its first appearance in the rankings. Area 41 (Bulk) moved up to third place from being unranked in previous months. Kush Mintz (Bulk) entered the rankings at fourth place, while Area 41 (1g) dropped to fifth from its previous rank of second in October 2024. This shift highlights a strong performance in bulk flower products for the brand.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.