Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

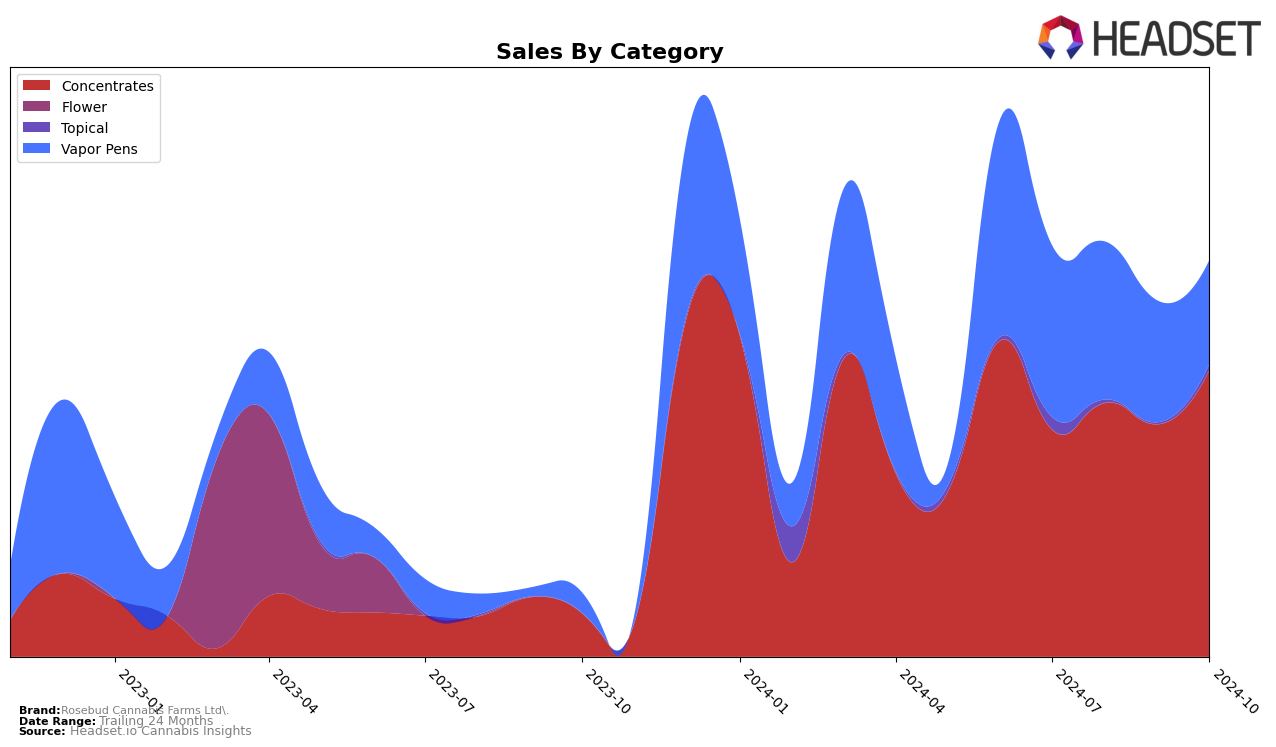

Rosebud Cannabis Farms Ltd. has shown a promising upward trajectory in the Concentrates category in British Columbia. Starting from a rank of 29 in July 2024, the brand climbed to 22 by October 2024, indicating a consistent improvement in its market positioning. This positive movement is underscored by a notable increase in sales, peaking at 28,829 units in October. However, the brand's absence from the top 30 in other states for this category suggests room for growth and expansion beyond British Columbia.

In contrast, Rosebud Cannabis Farms Ltd.'s performance in the Vapor Pens category in British Columbia did not reflect the same momentum. The brand did not break into the top 30, maintaining a rank around the mid-50s throughout the observed months. This stagnation is accompanied by a downward trend in sales, which decreased from 17,502 in July to 10,587 in October. The brand's inability to secure a top 30 spot in this category highlights a potential area for strategic improvement and market penetration.

Competitive Landscape

In the competitive landscape of the British Columbia concentrates market, Rosebud Cannabis Farms Ltd. has shown a notable upward trajectory in rankings over the past few months, moving from 29th in July 2024 to 22nd by October 2024. This improvement in rank is accompanied by a steady increase in sales, indicating a positive reception in the market. In contrast, Good Buds has also improved its position, climbing from 27th to 21st, suggesting strong competition. Meanwhile, Tremblant Cannabis has experienced a decline, dropping from 9th to 20th, which could present an opportunity for Rosebud to capture more market share. Herbal Dispatch Craft has seen fluctuating ranks, ending at 25th in October, which may indicate instability that Rosebud could leverage. Notably, EarthWolf Farms entered the top 20 in October, highlighting emerging competition. Overall, Rosebud's consistent sales growth and improved ranking suggest a strengthening position in the competitive landscape.

Notable Products

In October 2024, the top-performing product from Rosebud Cannabis Farms Ltd. was BC Garlic Papaya Live Rosin (1g) in the Concentrates category, maintaining its number one rank for four consecutive months with a notable sales figure of 470 units. BC Garlic Papaya Live Rosin Cartridge (1g) in the Vapor Pens category climbed to the second position, improving from third place in September. BC Guava Gas Live Rosin (1g) remained consistent in the Concentrates category, holding the third rank. The BC Guava Gas Full Melt Live Bubble Hash (1g) showed a steady improvement, moving up to fourth place from fifth. Meanwhile, BC Guava Gas Live Rosin Cartridge (1g) experienced a drop, falling to fifth place from second in the prior month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.