Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

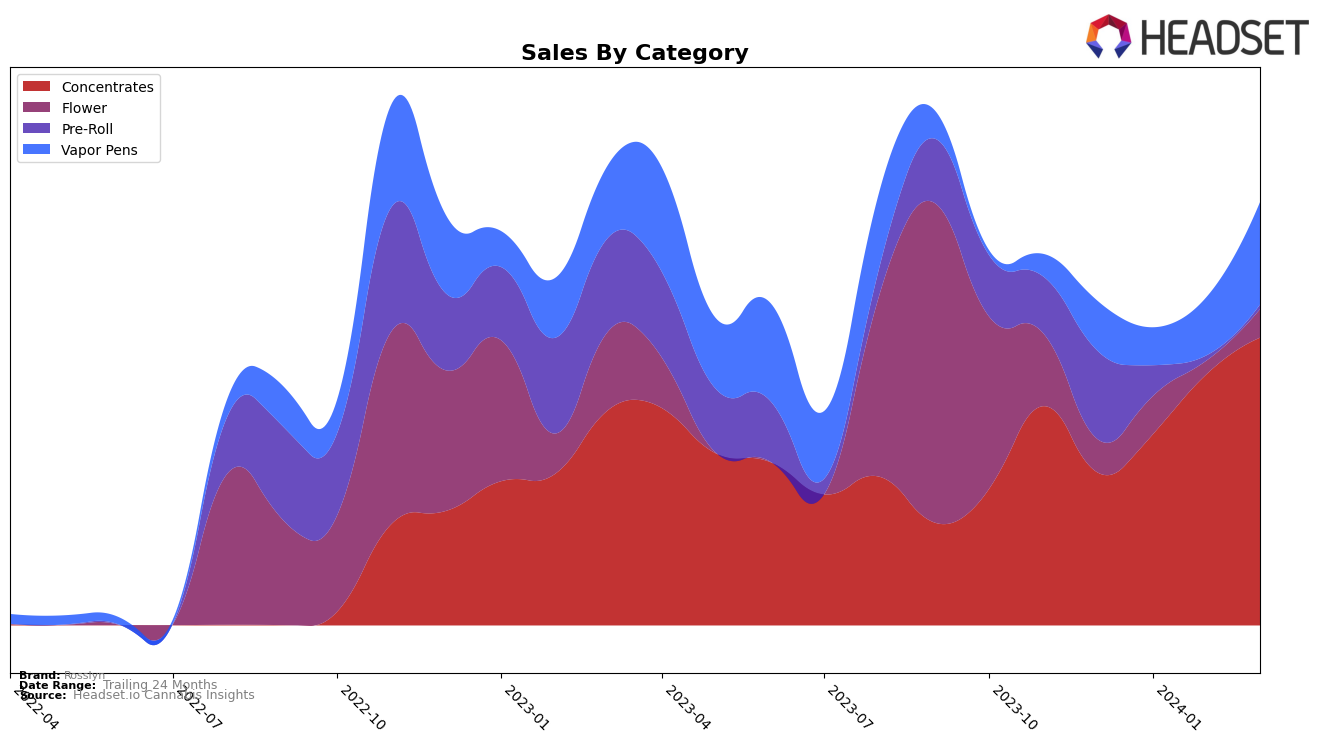

In the Michigan market, Rosslyn has shown a notable performance across different cannabis categories, with a particularly strong presence in Concentrates. Over the recent months, the brand climbed from a rank of 38 in December 2023 to a consistent 20th position in both February and March 2024, indicating a solid upward trajectory. This improvement in ranking is mirrored by a significant increase in sales, starting from $140,429 in December 2023 and reaching $264,364 by March 2024. However, it's worth noting that Rosslyn's performance in the Pre-Roll category tells a different story. After being ranked 90th in December 2023, the brand disappeared from the top 30 rankings in the subsequent months, suggesting a decline or a strategic shift away from this category within the Michigan market.

Furthermore, Rosslyn's engagement in the Vapor Pens category within Michigan showcases a gradual but promising improvement. Initially ranked at 96 in December 2023, the brand made a significant leap to 73rd place by March 2024. This progress is accompanied by a remarkable increase in sales, starting from $45,721 in December 2023 and surging to $93,915 by March 2024. The consistent upward movement in rankings and sales across these months highlights Rosslyn's growing influence and consumer acceptance in the Vapor Pens category. Despite the challenges in the Pre-Roll segment, Rosslyn's overall performance in Michigan, especially in Concentrates and Vapor Pens, underscores its potential and adaptability in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the concentrates category in Michigan, Rosslyn has shown a notable upward trajectory in both rank and sales from December 2023 to March 2024, moving from a position outside the top 20 to firmly securing the 20th spot by March. This improvement is significant when compared to competitors like Pleasantrees, which fluctuated within the top 20 but ended up at the 18th position in March, and Humblebee, which saw a decline from the 10th to the 19th position in the same period. Interestingly, Ozone and Fruit & Fuel also experienced volatility, with Ozone not breaking into the top 20 until February and Fruit & Fuel making a surprising leap to the 22nd position in March after not ranking in February. Rosslyn's consistent growth in sales and improvement in rank, despite the absence from the top 20 in December, underscores its potential to challenge and possibly outperform its competitors in the concentrates market in Michigan over time.

Notable Products

tags, the analysis would be presented in a clean and organized format, enhancing readability and making it more accessible for online viewers. These insights would provide a comprehensive overview of the top-performing products for a specified month, offering valuable information for data analysts and other stakeholders interested in product sales trends.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.