Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

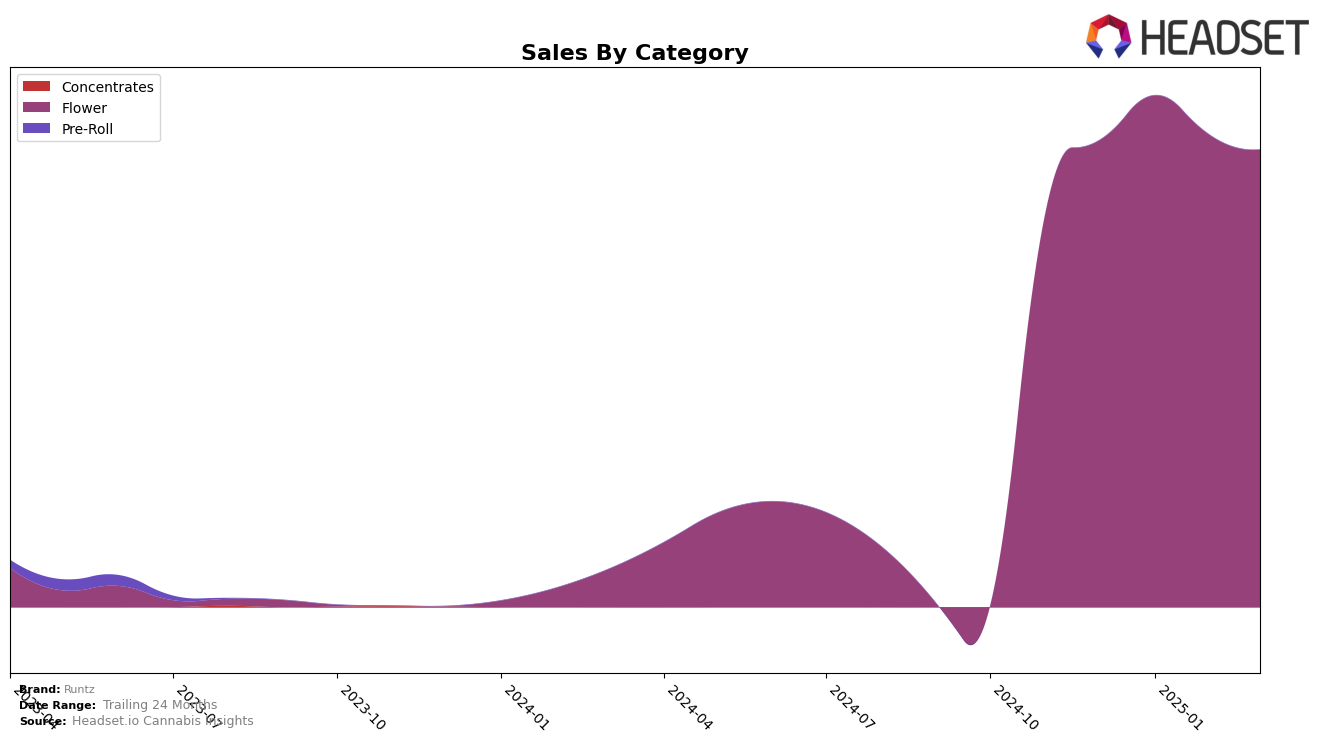

Runtz has shown varied performance across different categories and states, with notable fluctuations in its rankings over the first quarter of 2025. In the New York market, Runtz maintained a presence in the top 30 for the Flower category, starting at rank 19 in December 2024, climbing to 16 in January 2025, and then slipping back to 19 and 22 in February and March, respectively. This movement suggests a competitive market where Runtz is managing to hold its ground, albeit with some challenges in maintaining upward momentum. The brand's ability to stay within the top 30 throughout this period is a positive indicator of its resilience and market presence in New York.

While Runtz's performance in New York highlights its consistent presence, the absence of rankings in other states or categories indicates areas where the brand could potentially expand or improve. The lack of top 30 placements in other regions could be seen as a missed opportunity or a strategic focus on maintaining its stronghold in New York. This selective presence might suggest a targeted approach, but it also leaves room for growth in untapped markets. Understanding these dynamics can provide valuable insights into the brand's strategic priorities and potential areas for expansion.

Competitive Landscape

In the competitive landscape of the New York flower category, Runtz has experienced fluctuations in its market position, indicating a dynamic and challenging environment. Starting from December 2024, Runtz was ranked 19th, and despite a brief improvement to 16th in January 2025, it slipped back to 19th in February and further down to 22nd by March. This decline in rank suggests increasing competition and potential challenges in maintaining market share. Notably, Grassroots also faced a downward trend, moving from 14th to 21st over the same period, while FlowerHouse New York saw a significant drop from 9th to 23rd, highlighting a volatile market. Conversely, Florist Farms showed resilience, climbing from 21st to 20th by March, suggesting a strategic positioning that could be impacting Runtz's performance. These shifts underscore the importance of strategic marketing and product differentiation for Runtz to regain and improve its standing in the competitive New York flower market.

Notable Products

In March 2025, Runtz's top-performing product was Obama Runtz (3.5g) in the Flower category, maintaining its position as the number one seller for the third consecutive month, with sales figures reaching 1762 units. Pink Runtz (3.5g) rose to the second position, showing significant improvement from its fourth-place ranking in December 2024. Trump Runtz (3.5g) experienced a decline, moving from the top spot in December 2024 to third place in March 2025. White Cherry Runtz (3.5g) held steady in fourth place, while Lemon Candy Runtz (3.5g) slipped to fifth place despite its earlier fourth-place ranking in January and February 2025. This analysis highlights the dynamic shifts in product performance within the Flower category for Runtz over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.