Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

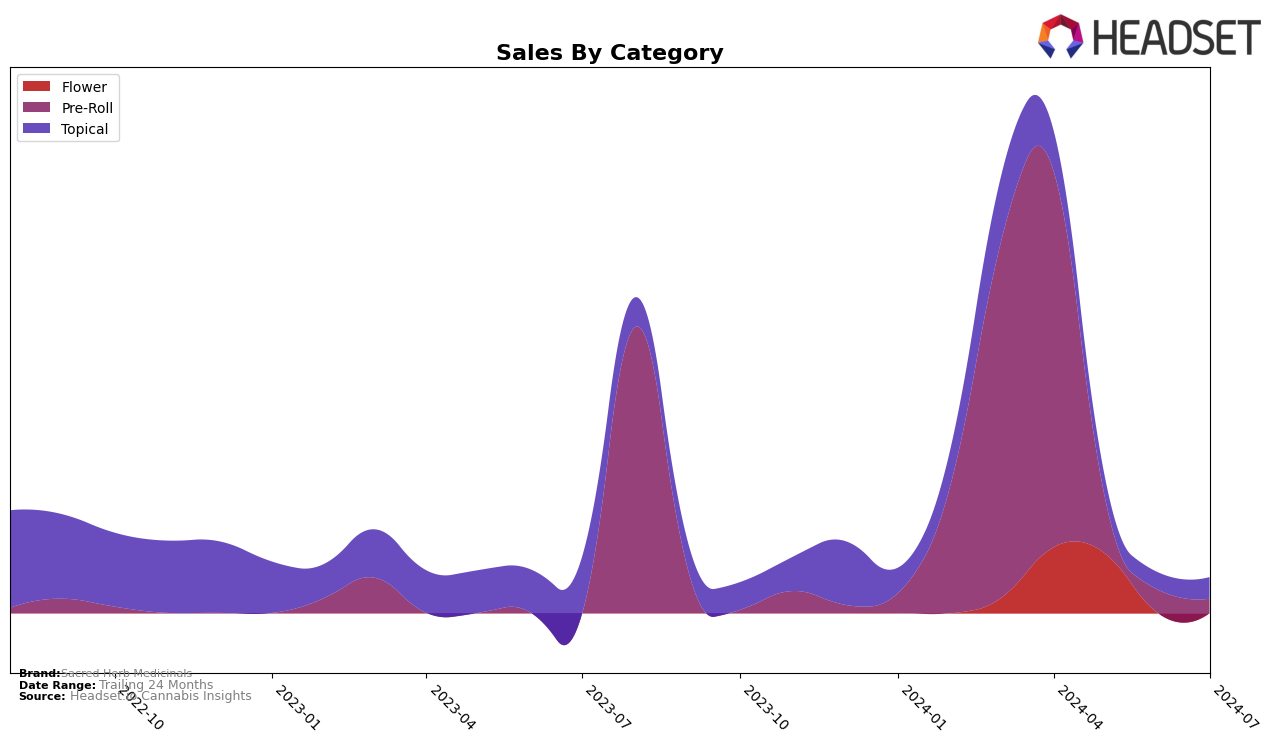

Sacred Herb Medicinals has shown a fluctuating performance across various categories and states, with notable shifts in their rankings. In Nevada, the brand saw a significant presence in the Pre-Roll category in April 2024 with a rank of 37, but unfortunately, they did not maintain a top 30 position in the subsequent months. This indicates a potential decline in market share or increased competition within the state. The absence of rankings in May, June, and July suggests that Sacred Herb Medicinals may need to reassess their strategy or product offerings to regain a competitive edge in Nevada.

On the other hand, the sales figures from April 2024 in Nevada show that Sacred Herb Medicinals had a decent market entry with $51,059 in sales for the Pre-Roll category. However, the lack of subsequent data implies that there might have been challenges in sustaining this momentum. This trend highlights the importance of continuous market analysis and adaptation to consumer preferences. While the detailed performance in other states and categories is not provided, it is crucial for Sacred Herb Medicinals to monitor their rankings closely and identify areas for improvement to enhance their market presence.

Competitive Landscape

In the competitive landscape of the Nevada pre-roll category, Sacred Herb Medicinals has shown a notable presence, particularly in April 2024, where it ranked 37th. This is a strong position compared to competitors such as INDO, which fluctuated between 45th and 56th place from April to June 2024, and Dutchie, which ranked 68th in April and dropped to 75th in May 2024. The absence of Sacred Herb Medicinals from the top 20 in subsequent months suggests a potential decline or increased competition, as brands like TWAX and Belushi's Farm entered the rankings in May 2024 at 77th and 72nd, respectively. This dynamic indicates that while Sacred Herb Medicinals had a strong start, maintaining or improving its rank will require strategic efforts to counter the rising competition and regain market share in the Nevada pre-roll market.

Notable Products

In Jul-2024, the top-performing product from Sacred Herb Medicinals was Scooby Snacks Pre-Roll (0.5g) in the Pre-Roll category, maintaining its first-place ranking from the previous month with notable sales of $85. The CBD/THC 1:1 Extra Strength Lotion (88.14mg CBD, 102.83mg THC, 4oz) in the Topical category emerged as the second-best seller, a new entry in the rankings. Kush Mints Pre-Roll (1g) held the third spot, reappearing in the rankings after being absent in the previous two months, with sales of $44. Devil Driver Pre-Roll (1g) dropped to fourth place from its second position in Jun-2024, showing a decline in sales. Nanaz Pre-Roll (1g) debuted at fifth place, contributing to the diversity of Sacred Herb Medicinals' top products for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.