Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

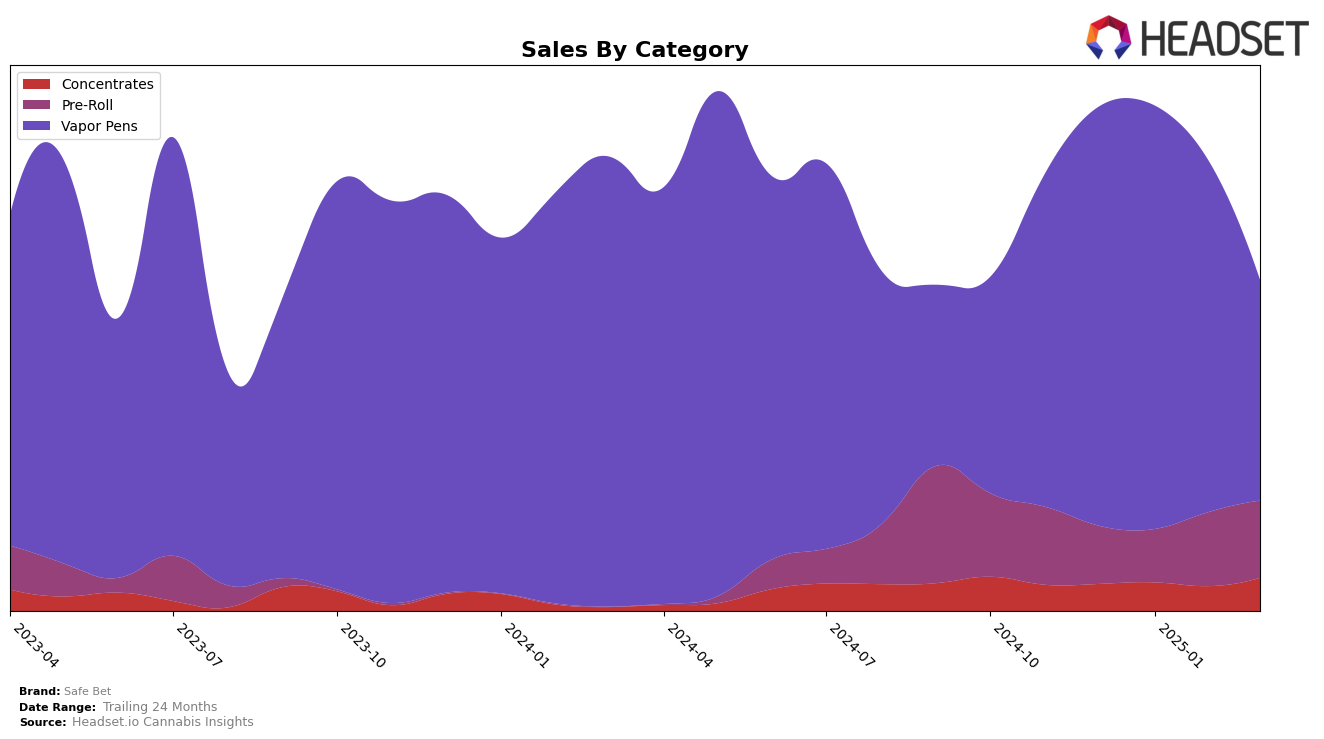

Safe Bet has demonstrated a varied performance across different product categories in Missouri. In the Concentrates category, Safe Bet has seen a steady upward movement from December 2024 to March 2025, improving its ranking from 27th to 23rd. This ascent is a positive indication of increasing consumer preference or successful market strategies. However, the Pre-Roll category tells a slightly different story. Although Safe Bet managed to climb to the 20th position in February 2025, it slipped back to 23rd in March, suggesting potential volatility or increased competition in this segment. The Vapor Pens category showed a notable decline, with the brand dropping from 12th place in January to 22nd by March, which could indicate a shift in consumer preferences or challenges in maintaining market share.

Interestingly, Safe Bet's sales figures in the Concentrates category saw a significant jump in March 2025, with sales increasing from $55,317 in February to $72,729 in March. This contrasts with the Vapor Pens category, where sales have been on a downward trajectory, potentially signaling a need for strategic adjustments. The Pre-Roll segment, despite its fluctuating rank, has shown consistent sales growth, reaching $165,121 in March, which might suggest a loyal customer base or effective promotions. Overall, Safe Bet's performance across these categories in Missouri highlights both opportunities for growth and areas that may require strategic attention to sustain or improve its market position.

Competitive Landscape

In the competitive landscape of vapor pens in Missouri, Safe Bet has experienced notable fluctuations in its market position over recent months. Starting from a rank of 17th in December 2024, Safe Bet climbed to 12th in January 2025, indicating a strong performance boost. However, this momentum was not sustained, as the brand slipped to 16th in February and further down to 22nd in March 2025, suggesting challenges in maintaining its competitive edge. In contrast, Select has consistently hovered around the 19th to 21st positions, while CODES improved its rank to 20th in March. Meanwhile, Pinchy's and Clouds Vapes have shown more stable rankings, with Pinchy's maintaining a 24th position since January and Clouds Vapes experiencing minor fluctuations. These dynamics highlight the volatility in the market and underscore the need for Safe Bet to strategize effectively to regain and stabilize its rank amidst fierce competition.

Notable Products

In March 2025, the top-performing product for Safe Bet was the Indica CBN FECO Syringe (1g) in the Concentrates category, achieving the number one rank with sales of 1989 units. This product showed a significant rise from its previous ranks of fifth in December 2024 and third in January 2025. The Lilly Haze Distillate Cartridge (1g) made a strong debut in March, securing the second position among Vapor Pens. Conversely, the Green Crack Distillate Cartridge (1g), which held the top rank in both January and February, dropped to third place in March. Meanwhile, the Trainwreck Distillate Cartridge (1g) entered the rankings in fourth place, followed by the Sweet Tooth Distillate Cartridge (1g) in fifth, both making notable entries in the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.