Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

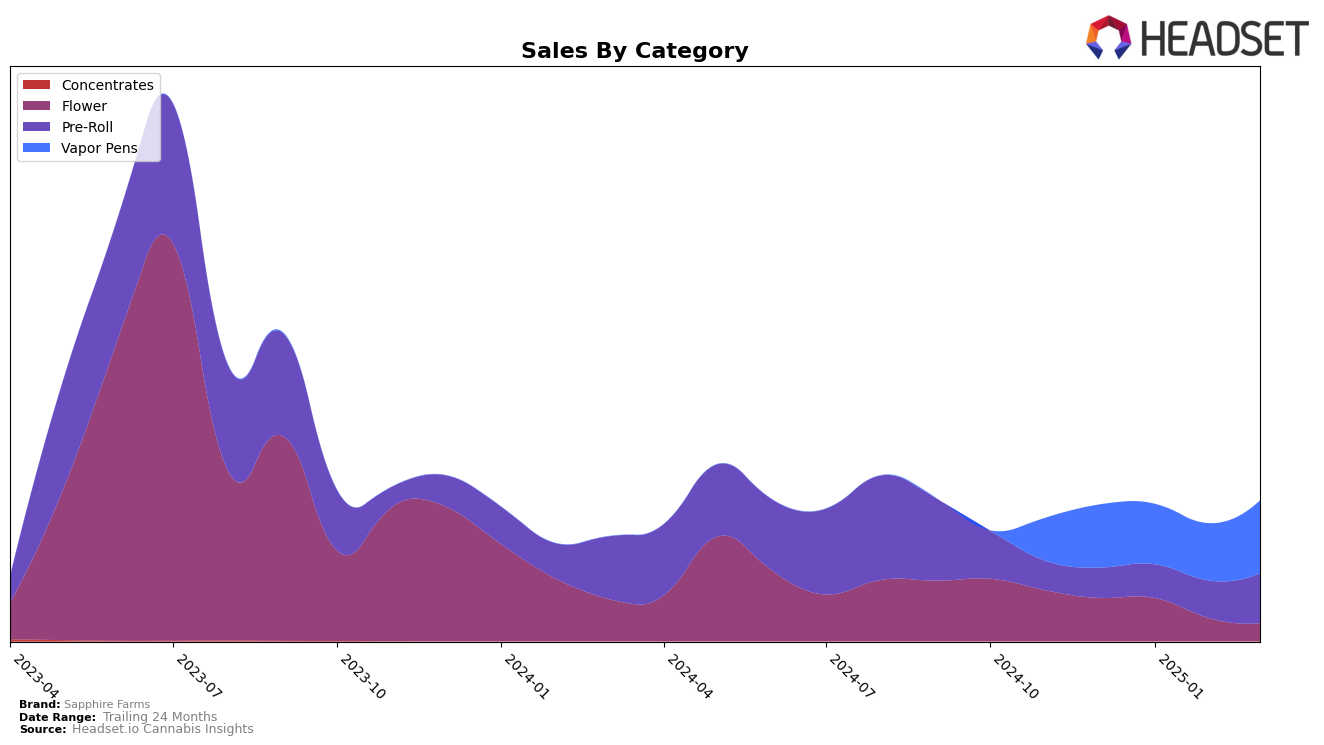

In the state of Michigan, Sapphire Farms has shown varied performance across different cannabis categories. In the Flower category, the brand was not ranked in the top 30 from December 2024 to March 2025, indicating a potential area for improvement or increased competition in this segment. However, the Pre-Roll category tells a different story, with Sapphire Farms climbing from 46th in December 2024 to an impressive 26th by March 2025. This positive trajectory is accompanied by a notable increase in sales, suggesting a growing consumer preference for their pre-roll products in Michigan.

Meanwhile, in New York, Sapphire Farms has maintained a relatively stable presence in the Vapor Pens category. Despite a slight dip in February 2025, where they ranked 23rd, the brand rebounded to secure 18th place by March 2025. This fluctuation in rankings is mirrored by their sales performance, which saw a decline followed by a significant recovery in March. The ability to regain and improve their position indicates a strong market resilience and adaptability in New York's competitive vapor pen market. Further insights into their strategies and consumer engagement could provide a deeper understanding of their success in this category.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Sapphire Farms has shown a notable improvement in its market position from December 2024 to March 2025. Initially ranked 21st in December 2024, Sapphire Farms climbed to 18th by March 2025, indicating a positive trend in market penetration and consumer acceptance. This upward movement is particularly significant considering the performance of competitors like Eureka, which saw a decline from 13th to 20th over the same period, and ghost., which experienced a volatile ranking but ultimately ended March 2025 just one spot below Sapphire Farms. Meanwhile, Turn maintained a steady position around the 16th rank, and Florist Farms showed a similar upward trajectory, moving from 19th to 17th. The sales figures reflect these trends, with Sapphire Farms' sales increasing in March 2025, surpassing those of Eureka and closely trailing behind Florist Farms. This competitive analysis underscores Sapphire Farms' potential to further enhance its market share amidst a dynamic and shifting competitive environment.

Notable Products

In March 2025, Sapphire Farms' top-performing product was Lemon Berry Crisp Pre-Roll (1g) in the Pre-Roll category, which soared to the number one rank from being unranked in the previous months, achieving a notable sales figure of 33,555. Kush Cake Pre-Roll (1g) maintained its strong performance, holding the second position consistently after dropping from the top spot in February. Bubba Berry Pre-Roll (1g) showed impressive growth, moving up to the third position from fifth in February. Cherry Skunk Pre-Roll (1g) experienced a slight decline, dropping to fourth place after previously ranking third. Stank Breath Pre-Roll (1g) entered the rankings for the first time, securing the fifth spot with a solid sales performance.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.