Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

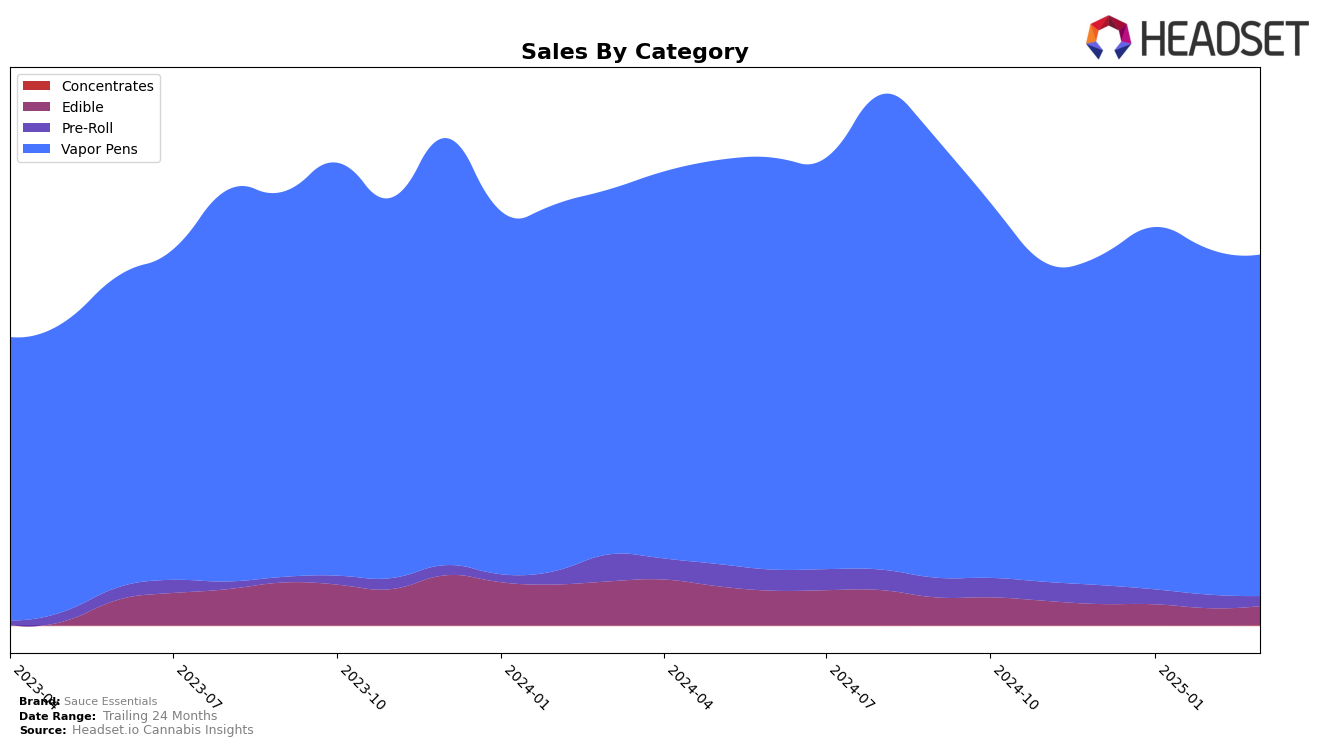

Sauce Essentials has demonstrated varied performance across different states and categories, with notable shifts in rankings that warrant attention. In Arizona, the brand's presence in the Vapor Pens category showed some fluctuations, moving from 29th in December 2024 to 34th by March 2025, indicating a challenge in maintaining a top 30 position consistently. Conversely, in California, Sauce Essentials has maintained a stronger foothold, consistently ranking around the 20th position in the Vapor Pens category, with a peak at 21st in March 2025, suggesting a stable market presence. Meanwhile, in Colorado, the brand has shown a positive trajectory, climbing from 34th in December 2024 to 22nd by March 2025, highlighting a growing acceptance and popularity in this region.

In Michigan, Sauce Essentials experienced mixed results across different product categories. While the Vapor Pens category saw consistent rankings around the 12th to 15th positions, the Edible category showed a slight improvement from 41st to 37th, suggesting potential for growth. However, their performance in the Pre-Roll category was less promising, as they failed to secure a position within the top 30 by March 2025, indicating a need for strategic adjustments. In Nevada, the brand maintained a strong position, consistently ranking within the top 6 for Vapor Pens, reflecting a solid market presence. The situation in Ohio was stable, with a slight improvement in ranking from 13th to 12th, while in Oregon, the brand faced a decline from 19th to 23rd, indicating potential challenges in maintaining market share.

Competitive Landscape

In the competitive landscape of California's Vapor Pens category, Sauce Essentials has shown notable fluctuations in its ranking and sales performance over recent months. Starting from a rank of 30 in December 2024, Sauce Essentials made a significant leap to 21 in January 2025, indicating a strong upward momentum. This improvement was maintained in February 2025 with a rank of 20, although it slightly dipped back to 21 in March 2025. This fluctuation suggests a competitive environment where brands like ABX / AbsoluteXtracts and Kurvana consistently remain in the top 20, with ABX / AbsoluteXtracts maintaining a stable position around rank 18-19. Meanwhile, UP! has shown a remarkable rise from rank 37 in December 2024 to 22 by March 2025, potentially challenging Sauce Essentials' position. Despite these challenges, Sauce Essentials' sales figures reveal a strong performance in January and February 2025, although there was a noticeable decline in March 2025, which could be attributed to intensified competition or market dynamics. Overall, while Sauce Essentials has demonstrated resilience and growth, maintaining its competitive edge will require strategic efforts to navigate the evolving market landscape.

Notable Products

In March 2025, the top-performing product for Sauce Essentials was White Widow Live Resin Disposable (1g) in the Vapor Pens category, maintaining its number one rank from previous months with sales of 8083 units. Aloha Express Live Resin Disposable (1g) held steady at the second position, showing a significant increase in sales compared to February. Blueberry Kush Live Resin Disposable (1g) improved its rank to third place, up from fifth in February. Ghost Train Haze Live Resin Disposable (1g) slipped to fourth place after being second in February, indicating a slight decrease in sales momentum. Strawberry Cough Live Resin Distillate Disposable (1g) maintained its fifth-place position, showing consistent performance across the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.