Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

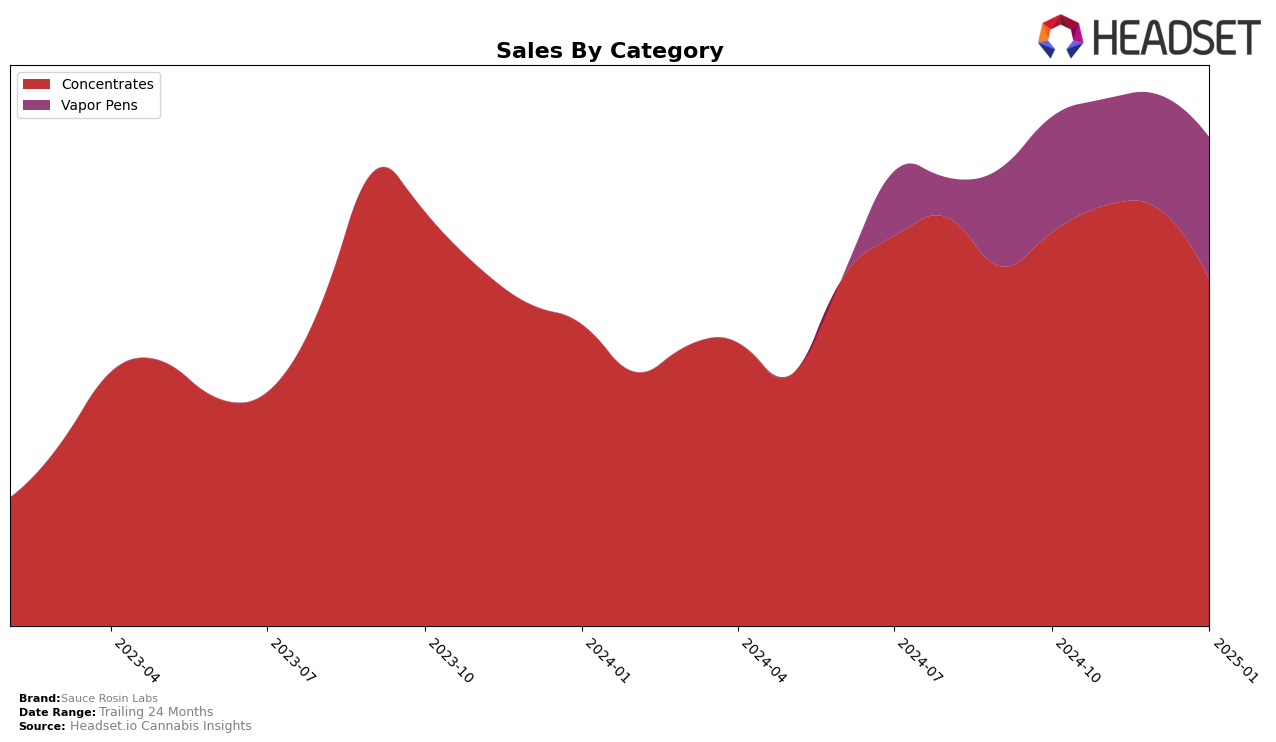

Sauce Rosin Labs has shown a consistent performance in the Concentrates category in Ontario. The brand maintained a stable presence within the top 30, with rankings hovering around the mid-20s from October 2024 to January 2025. This indicates a steady demand for their products in this category, although there was a slight dip in January 2025 when they moved from 23rd to 25th place. Despite the decrease in rank, the sales figures suggest a robust market presence, with a notable peak in December 2024 before a drop in January 2025. This fluctuation could be attributed to seasonal trends or competitive pressures within the market.

In contrast, Sauce Rosin Labs' performance in the Vapor Pens category in Ontario illustrates a different story. The brand was not ranked in the top 30 for November and December 2024, which could indicate challenges in maintaining a competitive edge in this segment. However, the brand made a significant comeback in January 2025, securing the 90th position. This improvement, alongside a notable increase in sales from October to January, suggests a potential strategic shift or product innovation that resonated with consumers. The absence from the rankings during the holiday months highlights a critical area for growth and focus for Sauce Rosin Labs moving forward.

Competitive Landscape

In the Ontario concentrates market, Sauce Rosin Labs has experienced notable fluctuations in its competitive positioning over the past few months. While the brand maintained a steady rank of 23rd in November and December 2024, it saw a slight dip to 25th in January 2025. This change in rank coincided with a decrease in sales from December's peak, suggesting potential challenges in maintaining momentum. In contrast, RAD (Really Awesome Dope) improved its rank from 26th in November to 21st in January, likely benefiting from a consistent upward trend in sales. Similarly, Ellevia showed a stable performance, maintaining a rank around 23rd and demonstrating robust sales figures. Meanwhile, Kolab and Chillum remained lower in the rankings, with Kolab showing a gradual improvement from 30th in October to 26th in January. These dynamics indicate that while Sauce Rosin Labs is a competitive player, it faces strong competition from brands like RAD and Ellevia, which are gaining traction in the market.

Notable Products

In January 2025, the top-performing product for Sauce Rosin Labs was the Hybrid Solventless Live Rosin Cartridge (0.5g) in the Vapor Pens category, reclaiming its top spot from October 2024 with sales reaching 636 units. The Seasonal Sweet Exotics Pack Live Rosin (1g) from the Concentrates category, which held the number one position in November and December 2024, ranked second in January 2025. The Grease Bucket Live Rosin Creme Brulee (1g) maintained a consistent third place throughout the previous months, showing steady sales figures. The Strawberry Diamond Live Rosin Jam (1g) remained in the fourth position, although its sales have decreased notably since October 2024. A new entry in January 2025, the Strawberry Guava Solventless Live Rosin Cartridge (0.5g), debuted in fifth place, indicating a growing interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.