Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

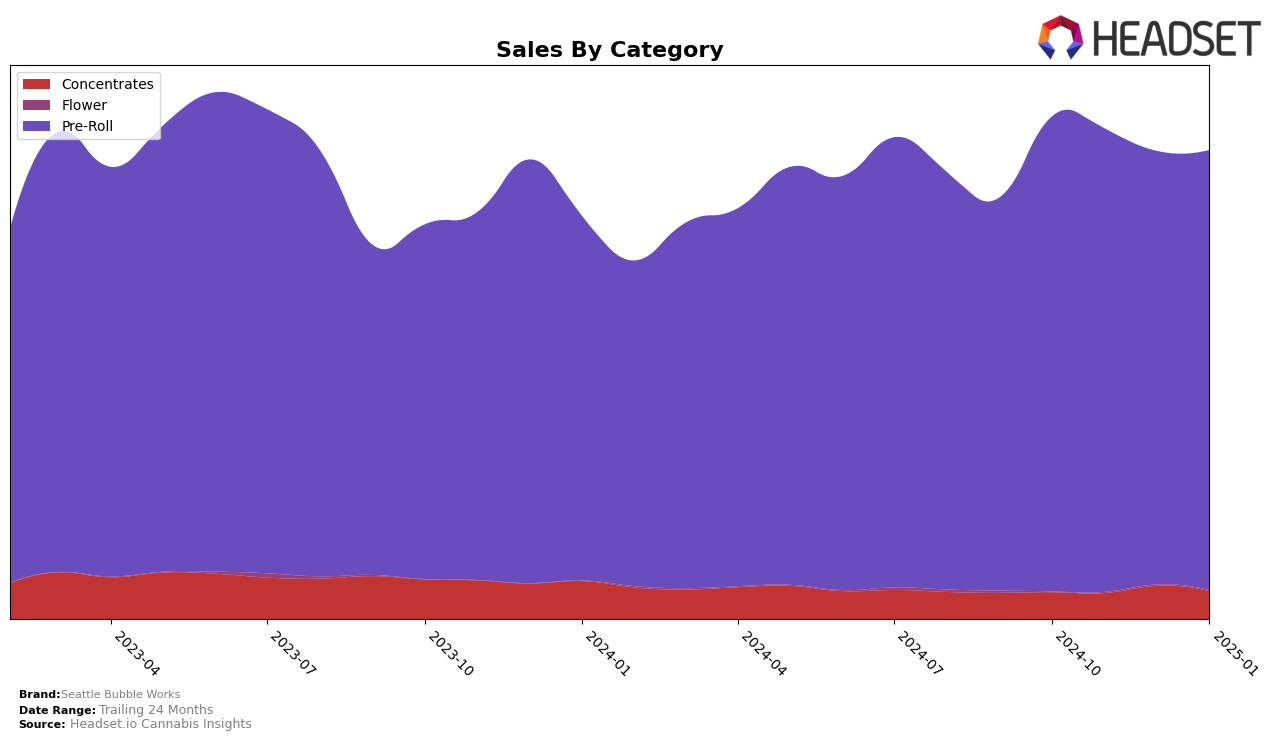

Seattle Bubble Works has shown notable improvements in the Concentrates category within Washington. Over the past few months, the brand has climbed from a ranking of 74 in October 2024 to 53 by January 2025, indicating a steady upward trajectory. This positive movement suggests an increasing consumer preference or effective strategic initiatives in this category. However, despite the upward trend, the brand has not yet broken into the top 30, which highlights the competitive nature of the Concentrates market in Washington.

In contrast, Seattle Bubble Works has maintained a strong presence in the Pre-Roll category in Washington. The brand consistently ranks within the top 10, holding positions like 9th in October 2024 and improving slightly to 7th by January 2025. This consistent high ranking underscores the brand's established reputation and consumer loyalty in the Pre-Roll segment. The stability in rankings, coupled with minor fluctuations in sales, illustrates a robust market position, which is crucial in maintaining a competitive edge amidst market dynamics.

Competitive Landscape

In the competitive landscape of Washington's Pre-Roll category, Seattle Bubble Works has demonstrated a consistent performance, maintaining a strong presence with ranks fluctuating between 7th and 9th place from October 2024 to January 2025. Notably, Seattle Bubble Works improved its rank from 9th in October 2024 to 7th in November 2024, indicating a positive trend in market positioning. However, they face stiff competition from brands like Lifted Cannabis Co and Mama J's, which consistently ranked higher, occupying the 5th and 6th positions. Despite this, Seattle Bubble Works managed to outperform The Happy Cannabis, which fluctuated between 7th and 10th place, and From the Soil, which ranked lower in the same period. The sales figures for Seattle Bubble Works show a slight decline from October to December 2024, followed by a modest increase in January 2025, suggesting a need for strategic initiatives to boost sales and further improve their competitive standing.

Notable Products

In January 2025, the top-performing product from Seattle Bubble Works was the Blue Dream Hash Infused Pre-Roll 10-Pack (5g), maintaining its rank at number 1 from November 2024, with sales reaching 1212 units. The Blue Dream Hash Infused Pre-Roll 2-Pack (1g) held steady in second place, showing consistent performance since December 2024. Bubba Kush Hash Infused Pre-Roll 10-Pack (5g) climbed to the third spot after not being ranked in December, indicating a resurgence in popularity. Funky Fresh Infused Pre-Roll 2-Pack (1g) slipped to fourth place from third in December, suggesting a slight decline in demand. Notably, the Super Lemon Haze Hash Infused Pre-Roll 2-Pack (1g) entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.