Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

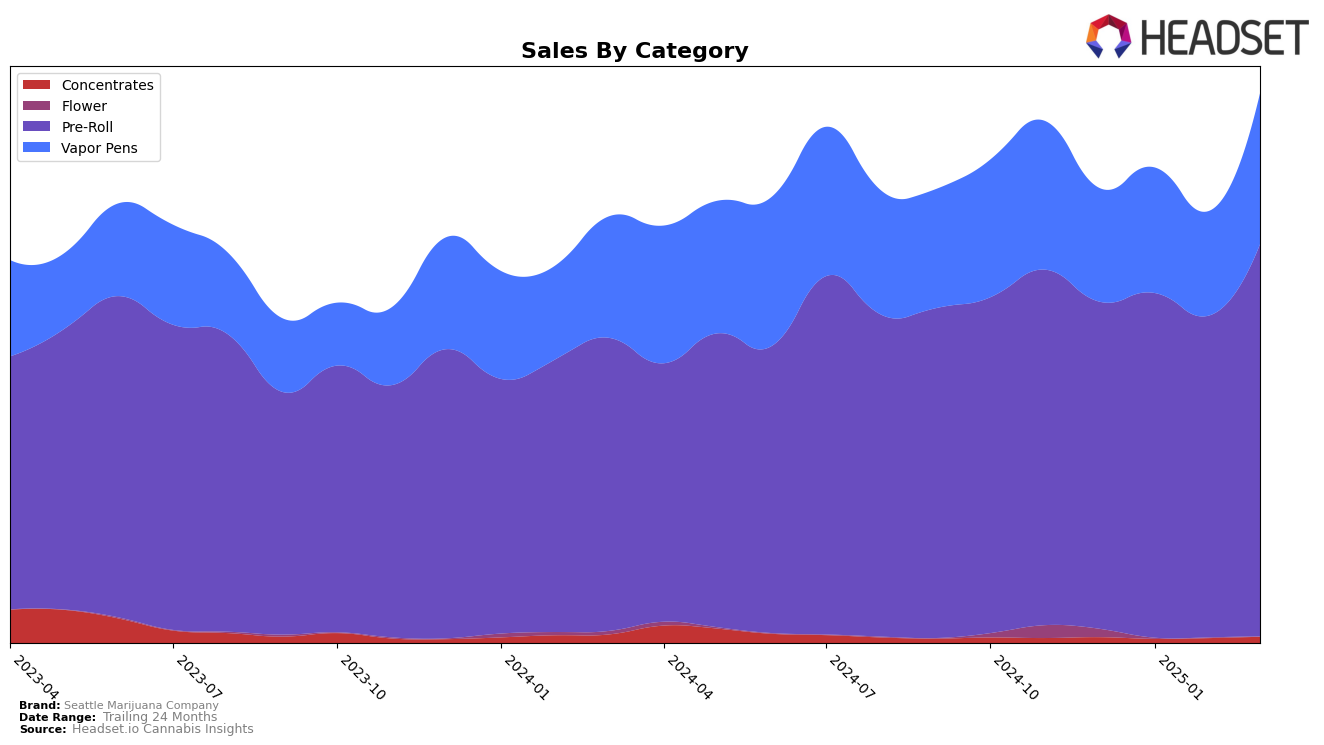

Seattle Marijuana Company has shown noteworthy progress in the Washington market, particularly in the Pre-Roll category. The brand has climbed from a rank of 35 in December 2024 to 27 by March 2025, indicating a consistent improvement in their market position. This upward trend is complemented by a notable increase in sales, with March 2025 figures reaching $154,473, suggesting a strong consumer demand and effective market strategies. However, the absence from the top 30 in December highlights areas for potential growth and the importance of maintaining momentum.

In contrast, the Vapor Pens category presents a different challenge for Seattle Marijuana Company. Despite an improvement from rank 85 in December 2024 to 67 in March 2025, the brand remains outside the top 30, suggesting fierce competition or a need for strategic adjustments in this segment. The fluctuation in sales figures, with a dip in February before climbing again in March, indicates potential volatility in consumer preferences or market dynamics. These insights point to the importance of targeted initiatives to strengthen their position in the Vapor Pens category, especially given the positive trajectory in the Pre-Roll segment.

Competitive Landscape

In the Washington Pre-Roll category, Seattle Marijuana Company has shown a steady improvement in its ranking from December 2024 to March 2025, moving from 35th to 27th place. This upward trend is indicative of a positive sales trajectory, especially when compared to competitors like Sky High Gardens, which fluctuated between 19th and 26th place during the same period. Notably, Fetti made a significant leap from 47th to 25th place, suggesting a more aggressive growth strategy. Meanwhile, Treats maintained a relatively stable position, hovering around the 26th to 29th range. The consistent improvement in Seattle Marijuana Company's rank, alongside its competitive pricing and product offerings, positions it favorably against these brands, although it faces a challenge from the rapid ascent of Fetti.

Notable Products

In March 2025, the top-performing product for Seattle Marijuana Company was the Cotton Candy Infused Blunt (1g) in the Pre-Roll category, maintaining its number one rank for the fourth consecutive month with sales of 2094 units. Following closely was the Blackberry Pie Infused Pre-Roll (1g), which also held its position at rank two, showing a steady increase in sales figures over the months. The Blueberry Infused Pre-Roll (1g) climbed back to the third position from fourth in February, demonstrating consistent growth. The Chocolate Covered Strawberry Infused Pre-Roll (1g) improved its ranking to fourth, recovering from a fifth-place ranking in the previous two months. Meanwhile, the Grape Infused Pre-Roll (1g) slipped to the fifth position, indicating a slight decline in its sales momentum compared to February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.