Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

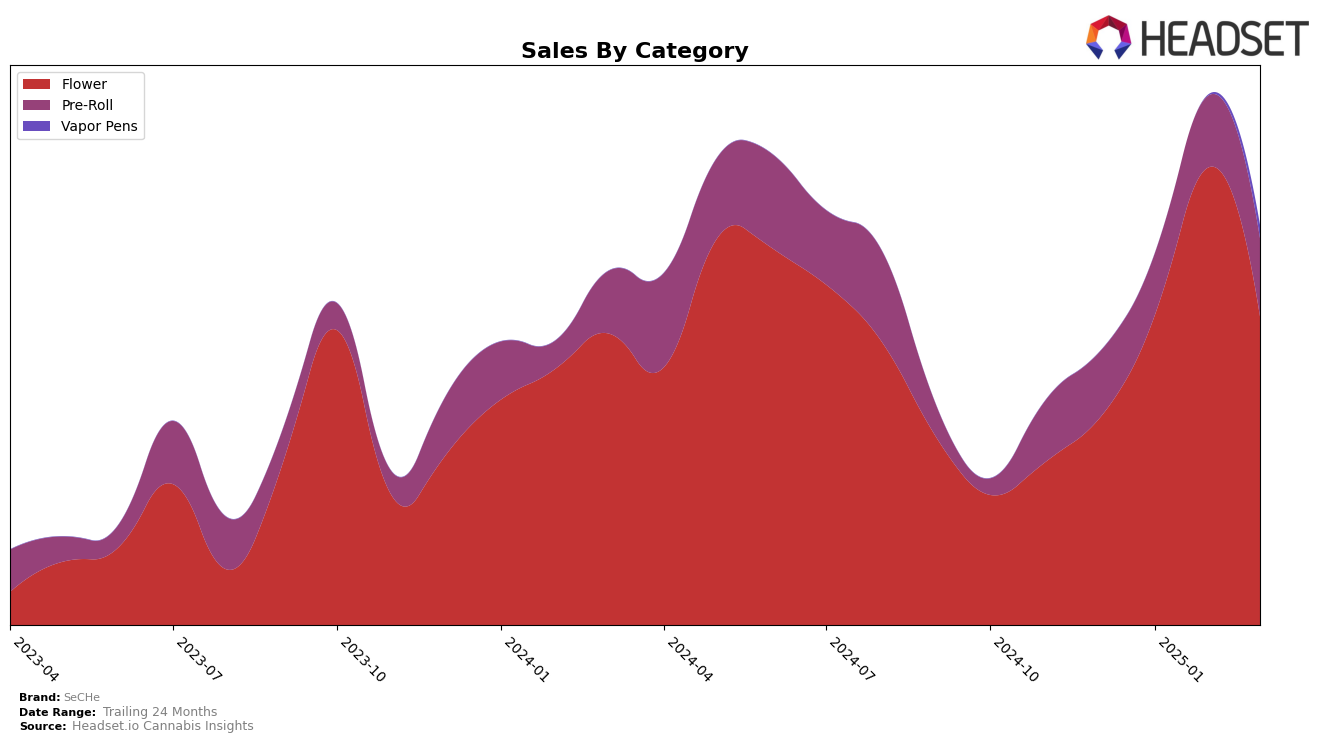

SeCHe has demonstrated varied performance across different states and product categories, marking some significant movements in rankings. In Massachusetts, the brand's journey in the Flower category is noteworthy, where it climbed from being ranked 100th in December 2024 to 47th by February 2025, before slipping back to 85th in March. This fluctuation suggests a volatile but initially promising growth trajectory in this category. Meanwhile, in the Pre-Roll category, SeCHe maintained a more stable presence, remaining within the 88th to 96th rank range. The steady sales figures in this category indicate a consistent consumer base, though not enough to break into the top 30, which could be seen as a limitation in their market penetration strategy.

In Nevada, SeCHe has shown a stronger foothold, particularly in the Flower category, maintaining a consistent position within the top 30 since February 2025. This sustained performance indicates a solid market presence and possibly a strong brand recognition among consumers in this state. Their ranking in the Pre-Roll category, however, fluctuated slightly, with a peak at 48th in February before settling at 53rd in March. Notably, SeCHe entered the Vapor Pens category in March, debuting at 52nd, which suggests potential for growth in this segment. The absence of earlier rankings in Vapor Pens may point to either a recent entry into the category or challenges in gaining initial traction. This mixed performance across categories and states highlights areas where SeCHe is excelling as well as opportunities for improvement.

Competitive Landscape

In the highly competitive Nevada flower market, SeCHe has shown a notable upward trajectory in its rankings from December 2024 to March 2025, moving from 39th to 29th place. This improvement is indicative of a positive trend in sales performance, with SeCHe's sales increasing consistently over the months. In contrast, Superior (NV) experienced a significant fluctuation, peaking at 12th place in January 2025 but dropping to 28th by March, despite having higher sales figures than SeCHe. Meanwhile, Greenway Medical and Kynd Cannabis Company both saw a decline in their rankings, with Greenway Medical falling out of the top 20 by March. BLVD, although starting behind SeCHe, managed to surpass it in March, reaching the 30th position. These dynamics suggest that while SeCHe is gaining momentum, it faces stiff competition from brands that have historically maintained stronger sales figures, necessitating strategic marketing efforts to sustain and enhance its market position.

Notable Products

In March 2025, La Kush Cake Pre-Roll (1g) emerged as the top-performing product for SeCHe, securing the number one rank with sales reaching 1,393 units. Valley Vixen (14g) followed closely in second place, while Gastro Pop (14g) took the third spot. Blueberry Muffin Pre-Roll (1g) ranked fourth, showing a strong presence in the Pre-Roll category. Grape Pie Pre-Roll (1g) maintained its fifth position from February 2025, despite a slight decline in sales. Notably, La Kush Cake Pre-Roll (1g) showed a significant jump to the top from an unranked position in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.