Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

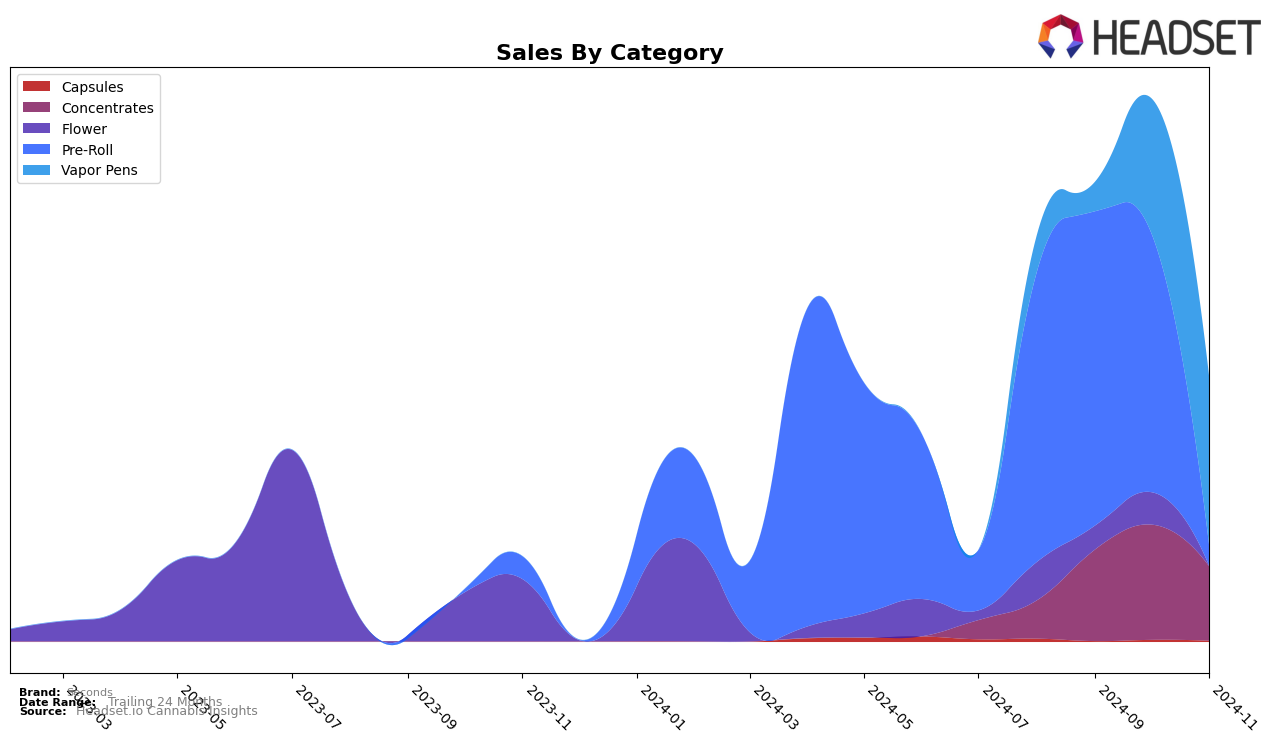

In Massachusetts, the cannabis brand Seconds has demonstrated varied performance across different product categories. In the Concentrates category, Seconds has been climbing the ranks, moving from outside the top 30 in August to 43rd in September, although it slightly dipped to 46th in November. This indicates a fluctuating but generally positive trend in this segment. On the other hand, their performance in the Pre-Roll category has not been as strong, with the brand consistently missing the top 30 rankings from August through November. This could suggest a need for strategic adjustments in their Pre-Roll offerings to boost their market presence.

Seconds has shown some promise in the Vapor Pens category in Massachusetts, where they were ranked 87th in October and improved to 84th in November. This upward movement may signal increasing consumer interest or effective marketing strategies in this category. Despite not being in the top 30, the brand's progression suggests potential for future growth. It's worth noting that the brand's sales figures for Vapor Pens in November were higher compared to October, indicating a positive reception in the market. However, without consistent top rankings, Seconds will need to continue innovating and refining their product offerings to maintain and enhance their competitive edge.

Competitive Landscape

In the Massachusetts Vapor Pens category, Seconds has shown a promising upward trajectory in recent months. After not being in the top 20 for August and September 2024, Seconds made a notable entry at rank 87 in October and improved slightly to rank 84 in November. This upward movement is indicative of a positive trend in sales, suggesting growing consumer interest and market penetration. In contrast, Standard Farms experienced a decline, dropping from rank 76 in October to 90 in November, which might indicate a shift in consumer preferences or competitive pressures. Meanwhile, Ocean Breeze maintained a steady position at rank 79 from October to November, showing stability in their sales performance. Rave also saw an improvement, moving from rank 97 in October to 86 in November, suggesting a competitive push in the market. The re-entry and improvement of Seconds in the rankings highlight its potential to capture more market share, especially as it competes with brands like Coast Cannabis Co., which reappeared at rank 78 in November after being absent in the previous months. This dynamic landscape underscores the importance of strategic marketing and product differentiation for Seconds to continue its upward momentum.

Notable Products

In November 2024, the top-performing product from Seconds was the Kahlua Oasis Pre-Roll (1g) in the Pre-Roll category, maintaining its first-place ranking from October with sales of 826 units. The Sativa Blend Hash Rosin Cartridge (1g) in the Vapor Pens category climbed to the second position, improving from its fifth-place rank in October, with notable sales figures of 634 units. The Indica Blend Hash Rosin Cartridge (1g) also made a significant move, securing the third spot in November, up from not being ranked in October. The Sativa RSO Dart (1g) maintained a steady fourth position in the Concentrates category, while the Indica RSO Dart (1g) held its fifth-place ranking. Overall, the Vapor Pens category showed a strong performance with noticeable upward movement in rankings for key products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.