Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

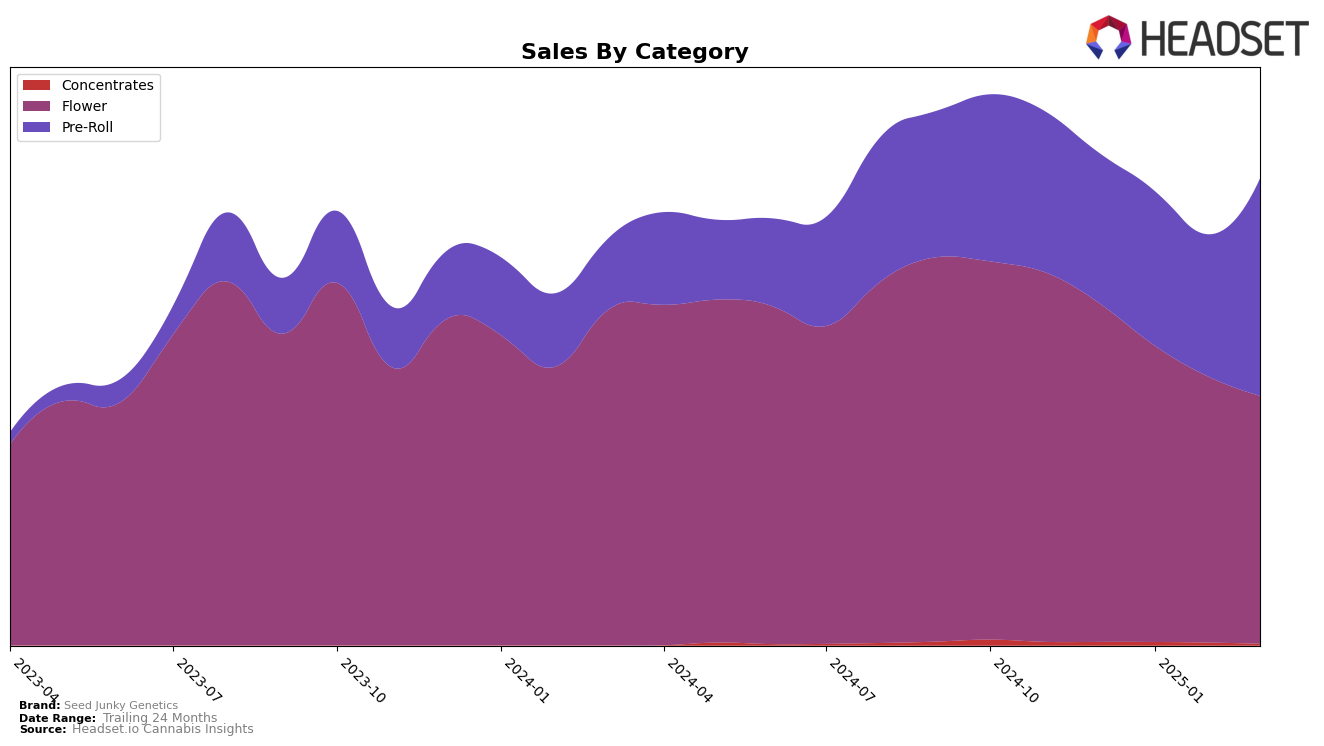

Seed Junky Genetics has shown varied performance across different categories and states, with notable activity in both the Flower and Pre-Roll segments. In California, the brand's Flower category rankings have remained outside the top 30, consistently hovering in the 70s range from December 2024 to March 2025. This indicates a struggle to break into the higher echelons of the market despite maintaining a steady sales volume, which slightly rebounded in March after a dip in January and February. In the Pre-Roll category, Seed Junky Genetics also did not make it into the top 30, though it showed some positive movement, improving its rank from 79 in January to 73 in February and March, suggesting a potential area for growth if this trend continues.

In contrast, Michigan presents a more dynamic picture for Seed Junky Genetics. The Flower category saw a significant decline in rankings from 48 in December 2024 to 74 by March 2025, accompanied by a downward trend in sales. This decline might be concerning, as it indicates a possible loss of market share. However, the Pre-Roll category tells a different story, where the brand improved its rank, climbing from 22 to 15 over the same period. This upward trend in Pre-Roll rankings is bolstered by a notable increase in sales in March, suggesting that Seed Junky Genetics could be capitalizing on a growing demand for Pre-Rolls in Michigan. This dual performance highlights the brand's potential to leverage its strengths in specific product categories while addressing challenges in others.

Competitive Landscape

In the competitive landscape of the Michigan pre-roll category, Seed Junky Genetics has shown a notable upward trajectory in rankings from December 2024 to March 2025. Initially ranked at 22 in December 2024 and January 2025, Seed Junky Genetics improved to rank 21 in February 2025 and further climbed to rank 15 by March 2025. This positive trend is indicative of a strategic positioning that has allowed Seed Junky Genetics to surpass competitors like Doobies, which fell from rank 9 to 17 over the same period. Meanwhile, Rare Michigan Genetics consistently improved its rank, reaching 13 by March 2025, suggesting a close competition with Seed Junky Genetics. Additionally, Galactic maintained a stable presence, hovering around rank 12 to 14, while Swisher made a significant leap from rank 49 in December 2024 to 16 in March 2025. These shifts highlight the dynamic nature of the market and the importance of strategic marketing and product differentiation for Seed Junky Genetics to maintain its upward momentum and capture a larger market share.

Notable Products

In March 2025, Malibu Pre-Roll (1g) emerged as the top-performing product for Seed Junky Genetics, ascending from a previous rank of 4 in January to 1, with notable sales of 6238 units. Bubblegum Sherb Pre-Roll (1g) maintained a strong position, consistently holding the second rank from January through March. Purple Push Pop Pre-Roll (1g) improved its standing, moving from fourth in February to third in March. Magic Shotz Pre-Roll (1g) entered the rankings for the first time in March, securing the fourth spot. Meanwhile, Gello Shotz Pre-Roll (1g) saw a decline, dropping from the top position in January and February to fifth in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.