Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

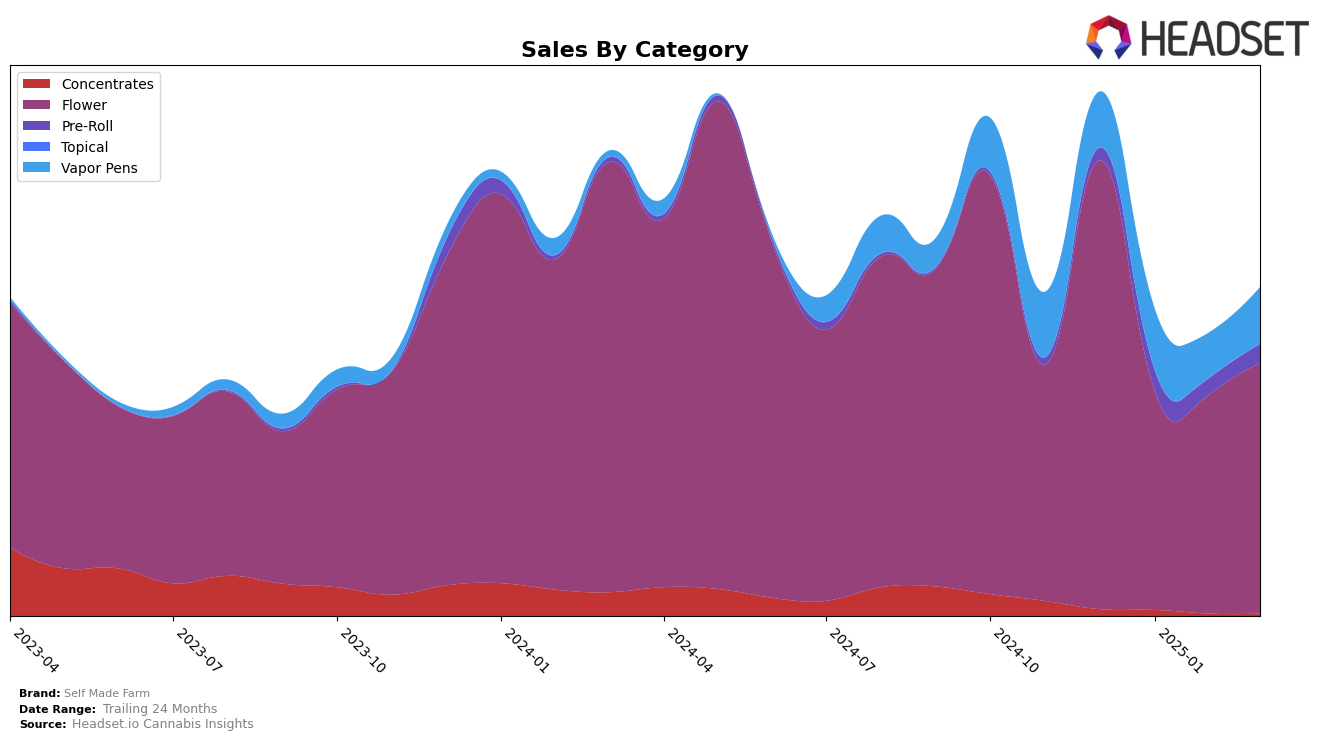

In Oregon, Self Made Farm has shown notable fluctuations across different cannabis categories over recent months. In the Flower category, the brand started strong with a rank of 6 in December 2024 but experienced a significant drop to rank 25 in January 2025. However, they managed to stabilize with a consistent rank of 21 in both February and March 2025. This suggests a potential recovery or adjustment in their market strategy. On the other hand, their presence in the Pre-Roll category has been less prominent, as they did not make it into the top 30, starting at rank 89 in December 2024 and gradually improving to rank 71 by March 2025. This indicates a slow but steady improvement in their market position within this category.

For Vapor Pens, Self Made Farm's performance in Oregon has been relatively stable, maintaining a rank just outside the top 45, fluctuating slightly between 46 and 49 from December 2024 to March 2025. This consistency suggests a stable consumer base for their products in this category. Despite not breaking into the top 30, the brand's sales figures in the Vapor Pens category have shown some positive direction, hinting at potential growth opportunities if they can capitalize on their existing market presence. Overall, while Self Made Farm faces challenges in climbing the ranks, their ability to maintain and slightly improve their positions in different categories indicates resilience and a potential for future growth in the competitive Oregon market.

Competitive Landscape

In the competitive landscape of the Oregon flower category, Self Made Farm experienced a notable shift in its market position from December 2024 to March 2025. Initially ranked 6th in December, Self Made Farm saw a significant drop to 25th in January, before recovering slightly to 21st in February and maintaining that position in March. This fluctuation in rank coincided with a decrease in sales from December to January, followed by a gradual recovery in the subsequent months. In contrast, Oregon Roots maintained a more stable presence, starting at 13th in December and only dropping to 22nd by February and March. Meanwhile, BJ's A-Grade made a remarkable leap from being outside the top 20 in December and January to securing the 20th position by March, reflecting a strong upward sales trend. Earl Baker also showed consistent improvement, moving from 24th in December to 19th by March. These dynamics suggest that while Self Made Farm faced challenges in maintaining its top-tier status, competitors like BJ's A-Grade and Earl Baker capitalized on market opportunities to enhance their standings.

Notable Products

In March 2025, the top-performing product from Self Made Farm was the Velveeta Breath Pre-Roll 2-Pack (1g) in the Pre-Roll category, achieving the number 1 rank with notable sales of 7419 units. Amnesia Glue Pre-Roll (1g) followed closely in second place, showing a slight drop from its top position in February 2025. Swiss Watch Pre-Roll (1g) ranked third, maintaining its presence in the top tier despite not being ranked in February 2025. Ice Cream Cake (3.5g) and Mike Gary (3.5g), both in the Flower category, secured the fourth and fifth positions, respectively, marking their entry into the top rankings. This shift indicates a dynamic change in consumer preferences, particularly within the Pre-Roll category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.